Why is it worth investing in

your property?

Michael Kosowan:

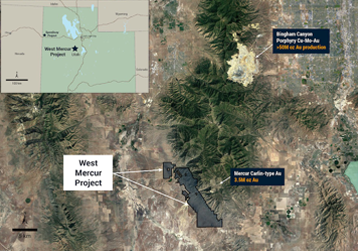

It's worth investing in our company because we are on the hunt for new gold. We have recently made two key acquisitions in Utah, Speedway Gold and West Mercur, and on these properties we are seeing Carlin-style mineralization, not dissimilar from the style of geology that's been mined for years in Nevada. Nevada is home to the second largest gold resource on the planet – which gives you an indication of the kind of potential we think could exist one state over. The difference is – Utah hasn't been explored to nearly the same degree as Nevada, but as far as we know, mineralization trends don't obey by state lines.

To give you an even better idea of the kind of territory we're in – Newmont's Long Canyon mine is about 50 km to the west of our Speedway project. Long Canyon was acquired by Newmont in 2011 for 2.3 billion dollars. We now have two of the Newmont geologists who completed the mapping and structural contouring for Long Canyon working on Speedway, and they have already been able to recognize similarities between the two.

To give you an even better idea of the kind of territory we're in – Newmont's Long Canyon mine is about 50 km to the west of our Speedway project. Long Canyon was acquired by Newmont in 2011 for 2.3 billion dollars. We now have two of the Newmont geologists who completed the mapping and structural contouring for Long Canyon working on Speedway, and they have already been able to recognize similarities between the two.

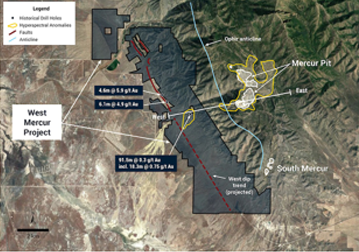

Our other Utah property, West Mercur, is analogous to the Mercur mine, where Barrick got it's start. Barrick did drill holes on the West Mercur property, including 90 metres of 0.3 g/t in 1986, but the company was focusing it's efforts in Nevada at the time and did not explore further and to the west.

Utah - West Mercur Location

We acquired West Mercur from a private company that is headed by the former VP of Exploration for Barrick during those years, and he is now working with us in the effort of providing a more thorough geological investigation.

We acquired West Mercur from a private company that is headed by the former VP of Exploration for Barrick during those years, and he is now working with us in the effort of providing a more thorough geological investigation.

To say he knows the rocks well in the area is clearly an understatement. His deep technical and historical knowledge of the region will help us fast track our exploration efforts.

West Mercur - Structures

As for Newfoundland, home to our other major asset, it represents the Canadian frontier; a safe and underexplored region that is now generating excitement. There's been a resurgence of exploration in the province. Companies are moving in and developing the area.

As for Newfoundland, home to our other major asset, it represents the Canadian frontier; a safe and underexplored region that is now generating excitement. There's been a resurgence of exploration in the province. Companies are moving in and developing the area.

Marathon Gold, which is contiguous to one of our tenements is putting Newfoundland back on the map as it uncovers multi-million-ounce style gold deposits.

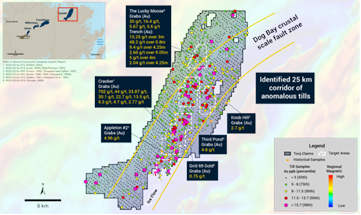

Our Gander Gold Project, as indicated in the following figure, shows a strong structural break, which is indicated by the two curved yellow lines running down the centre of the sampled area. This structural fault is known as the Dog Bay Crustal Fault Zone.

If you look to the right of that, you'll see orange triangles. The one at the top is called Knob Hill. The other one is called Third Pond. These multi-gram types of grabs are what were historically found at surface.

If you look to the right of that, you'll see orange triangles. The one at the top is called Knob Hill. The other one is called Third Pond. These multi-gram types of grabs are what were historically found at surface.

Unlike in the past, we now have the technology, the capital, and the wherewithal to follow closer to the structural interlay that likely exists here.

The red and purple dots are where our till samples really light up, in other words, they indicate where the better ‘prospectivity' exists for gold. Gold is typically controlled by some kind of structural feature. In the middle of those two yellow lines is this big ripping fault. This is where we're hunting; where's there's opportunity.

Interestingly, the massive structural feature that rips through this part of Newfoundland is a major suture that extends across the Atlantic Ocean, right up through Northern Ireland towards Dalradian's deposit. This is because Pangea, the supercontinent, split apart more than 300 million years ago creating two geologically similar land masses. Our property is a Canadian Dalradian-style system, which means very high-grade gold – exactly what this market is looking for. As we develop this prospect, and have the success we anticipate, then ‘bar the doors,' as this could be a significant new Canadian discovery.

What is Torq Resources

Financial position?

Michael Kosowan:

We are in an enviable position. We have solid financial backing and extensive networks. We have a treasury of over $13 million. This provides us a long runway to operate while retail interest returns and markets improve, which we are confident of in the near future. Our stock is trading at $.50. with no dilutive financings in sight.

Our robust treasury allows us to take advantage of these weak markets and be accretive. Torq is on the hunt for projects to acquire. It's good timing because everything's on sale. The Boxing Day, Door Crasher sale is now on! We are one of the few teams out there with previous success in similar market conditions. Just look at Cayden. It was one of the only companies to be sold in all of 2014. Investors should know we are laser focused on monetizing returns.

Lastly, management is aggressively buying Torq stock. The company is 30% owned internally, and we are buyers. Investors should take this as a clear indication of our confidence and excitement in what lies ahead for Torq. They can easily check insider buying to see our recent activity.

What are the potential Catalysts

for Torq Resources?

Michael Kosowan:

Acquisitions. Torq's technical team has been working very hard scouring North and South America for overlooked, undervalued projects. Investors can expect this to be the next catalyst that propels the company forward. In the short term, Utah and Newfoundland are the big drivers. In Utah, we're mapping, increasing our footprint, and aggressively defining targets. As for Newfoundland, investors can anticipate results from our biogeochem sampling program, which is now complete. This will be followed by trenching later this summer.

What are the risks going forward?

Macro Risks:

Michael Kosowan:

The macro risk is the gold space itself, but I think that the economic fundamentals are there to push the gold price up, whether it's inflation, or political uncertainties. Even the U.S. dollar is really starting to degrade and go down. I think a combination of these elements, not to mention geopolitical risk, could spark that rise.

It's what's required to get renewed interest in gold and gold equities. Higher prices will increase the margins of the major gold producers that will in turn, get Main Street, Wall Street, and Bay Street's attention. The majors are currently trading near their N.A.V. level, whereas historically they've always traded at some kind of multiple to N.A.V.

The great sums of money currently being managed or set into passive investment strategies make it difficult to foresee active participation in the junior mining space. In this sense it remains difficult to rationalize full-scale investment into the gold mining space. However, we remain confident that the speculative capital will return to this sector with the advent of exploration success.

Micro Risks:

Michael Kosowan:

On the 'micro' side, I'd say speculative capital is currently distracted by what are being perceived as more 'exciting' investment choices. However -- speculative capital will come back, when there's a good reason. We need to see discoveries. We haven't seen discoveries in a long time because there hasn't been enough capital going into real exploration.

Contrarian & smart investors will know that now is actually the time to buy, and to buy companies like Torq, where we have the financial and technical resources to follow-up with aggressive exploration. So if we start hitting in Utah, for instance, you can be sure we're going to follow it up with a thorough $2 million exploration program.. Our mandate is to advance these types of prospects, so we can act quickly.

The lack of good exploration targets coming to the majors is working to our advantage. It's why we've been able to attract attention from the corporate side, which realistically, in this market, and over the last three or four years, has been the only game in town from a financing perspective. Senior gold companies are also more likely to take an interest in Torq because our technical team is made up of their former colleagues and they have been trained to produce along the same lines of professionalism and completeness in practice. Operating technically at these high levels gives confidence to our future corporate partners in our results and conclusions. In effect, we look to accept the role of the subcontracting detail of the exploration. Our sister company, Auryn Resources, exemplifies this type of corporate synergy. They have received a $35 million investment from Goldcorp to follow-up on our exploration projects and programs. Given the state of the current mining cycle, my suspicion is that something similar to this action may be in the cards for Torq as well.

As for now -- we've got the right kind of shareholders. As described, we're owner operators, so both my directors and myself are buying, and we're deploying the capital to best serve our long-term prospects, which most importantly, is in the best service of our shareholders.

Canadian Mining Report will be staying in touch with Michael Kosowan and Torq Resources to keep you up to date with their progress. To learn more about the company, call 1 800 863 8655, or visit Torq's website at www.torqresources.com

Company Press Releases

VANCOUVER, BC / ACCESSWIRE / May 3, 2023 / Torq Resources Inc. (TSXV:TORQ)(OTCQX:TRBMF) ("Torq" or the "Company") is pleased to announce the results of its 85% completed soil survey from the Santa Cecilia gold - copper project located in the world-class Maricunga belt in...

Torq Provides Update on Inaugural Program Underway at its Santa Cecilia Gold-Copper Project in Chile

VANCOUVER, BC / ACCESSWIRE / April 25, 2023 / Torq Resources Inc. (TSXV:TORQ)(OTCQX:TRBMF) ("Torq" or the "Company") is pleased to provide an exploration update on the Santa Cecilia gold - copper project located in the world-class Maricunga belt in northern Chile, approxi...

VANCOUVER, BC / ACCESSWIRE / April 5, 2023 / Torq Resources Inc. (TSX-V:TORQ)(OTCQX:TRBMF) ("Torq" or the "Company") is pleased to announce the results of its recently completed soil geochemical survey focused on identifying new gold and gold-copper targets at Torq's Marg...

Company News

See TORQ RESOURCES INC (TORQ.V) stock analyst estimates, including earnings and revenue, EPS, upgrades and downgrades.

Get the annual and quarterly balance sheet of TORQ RESOURCES INC (TORQ.V) including details of assets, liabilities and shareholders' equity.

Torq Resources is a junior mining exploration company focused on delivering shareholder value through project acquisition and development.

TORQ Resources Corporate Presentation

TORQ Resources Stock Chart

Company Videos

Looking to explore investment opportunities with TORQ?

Location: Canada & British Columbia Vancouver,

Address: 1199 West Hastings Street, Suite 600

Telephone: +1 778 729-0500