Yield-Curve Collapses As Inflation/Biden Spark Policy-Error Anxiety

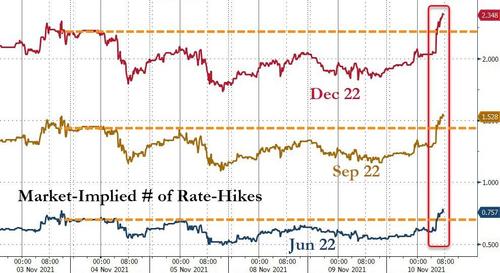

The market's rate-hike expectations are surging higher this morning following the way hotter than expected CPI print. Additionally, perpelxing double-speak from Biden is not helping as he reflects on The Fed's "independence" while implying the need to 'do something about inflation!!!!':

"And I want to reemphasize my commitment to the independence of the federal reserve to monitor inflation, and take steps necessary to combat it."

Having desperately jaw-boned down the market's hawkish expectations in the week since the FOMC statement, today's data has sent rate-hike expectations to cycle highs..

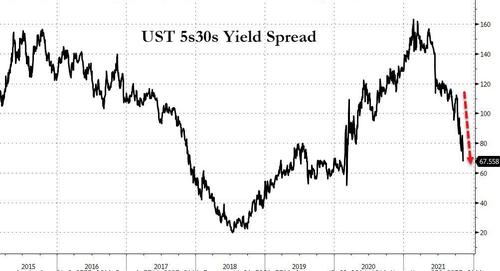

That has sparked serious weakness in the belly of the yield curve (5Y +10bps) relative to the long-end...

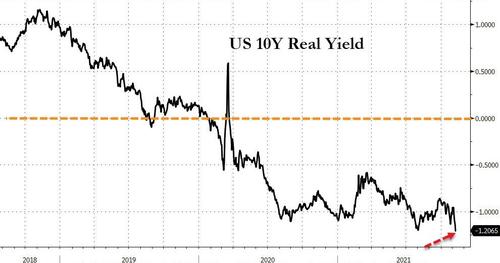

Real yields continue to hit record (negative) lows...

And that has pushed the yield curve (5s30s) to its flattest since pre-COVID...

As traders position for a more aggressive-than-they'd-like Fed coming to the rescue sooner than expected and then having to back-pedal rapidly as the Oz-ian world in which we live falls apart.