Why The Coming Silver Rally Might Be The Greatest / Commodities / Gold & Silver 2019

In the last one hundred years there havebeen some great silver rallies. Some have been greater than others though.

In the last one hundred years there havebeen some great silver rallies. Some have been greater than others though.

The economic conditions underlying thedifferent silver rallies were not all the same. Obviously those that occurredduring conditions most conducive to silver rallies were the great performers.

The coming silver rally could be thegreatest especially since it potentially has most conditions in common with thegreat silver rallies.

Gold/Silver Ratio (GSR)

The most ideal time for a silver rally relative to theGold/Silver ratio is after a major peak in the GSR and as close to the all-timehigh as possible. This is because the Gold/Silver ratio is to silver ralliesmuch like cycling down a hill is compared to cycling up a hill is to a cyclist.

In other words, when you cycle down thehill you can go much faster; just like silver can go much higher when the GSRis in decline.

Note that it is important to understandthat it is underlying economic conditions that manifest in the form thateconomic indicators (like the GSR, for example) eventually take. So, for thesake of simplicity, I refer to the economic indicator as the conditions.

Below is a image (from macrotrends.net) ofa Gold/Silver Ratio chart (above) and a Silver chart (below):

The red lines mark the beginning of theimportant silver rallies, and the green the end. The rally that started in 1941started at an ideal time relative to the GSR. The current silver rallypotentially has this in common with the 1941 silver rally. Note that that the otherrallies started at less than ideal times – they had hills to climb.

The fact that debt-levels are currently atan extreme, and that we are likely to have major stress in the credit marketsmake this possibility very likely. It is therefore, no coincidence thatinterest rates bottomed close to the start of the 1941 rally as well as thecurrent rally.

Dow

The most ideal time for a silver rallyrelative to the Dow is to start after the Dow peak and as close to the high aspossible. Again, one can use the cycling downhill analogy. Also, the Dow needsto trend down during the whole period of the silver rally.

Below is an image (both frommacrotrends.net) of a Dow chart (above) and a Silver chart (below):

The red lines mark the beginning of the importantsilver rallies, and the green the end. The silver rally that started in 1971began at the ideal time relative to the Dow. The current silver rally alsopotentially has this in common with the rally of 1971, which would give it anadvantage over the 1941 silver rally.

If the expected credit distress plays out,it could potentially cause the Dow to decline significantly over the comingyears. This could give the current silver rally an edge over the one of 1971,since the Dow did not not have much of a net decline over the entire period ofthe silver rally.

Either way, it already has an edge over the1971 rally due to it starting ideally relative to the GSR.

Interest Rates

The most ideal time for a silver rally relative tointerest rates is to start after a major interest peak and as close to the lowas possible. Also, it is ideal if the entire rally exists during an interestrate uptrend.

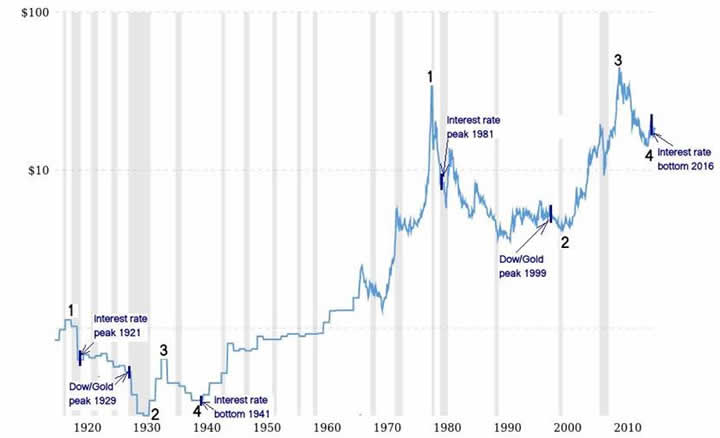

Below, is a long-term silver chart withmajor interest rate peaks and bottoms indicated:

Again, the 1941 silver rally started at anideal time relative to interest rates. The current silver rally potentially hasthis in common with the 1941 silver rally. However, the interest rate bottom of2016 is lower than the 1941 bottom, and is the all-time low of at least thelast one hundred years – again, giving the current rally a potential edge.

Conclusion

The current silver rally has the bestingredients to be the most explosive silver rally for the last 100 years.

For more on this, andsimilar analysis you are welcome to subscribe to my premium service. Ihave also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report.

Warm regards,

Hubert

“And it shall come to pass, that whosoevershall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2019 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.