When Gold Price Rises, Will Bitcoin Fall? / Commodities / Gold and Silver 2021

What do the portents say? Well, we’vebeen looking for connections between gold and bitcoin, and we see a chance tofatten the coffers. Read on.

But first, let’s talk about gold and theminers. Yesterday’s session provided us with a perfect confirmation of thebearish case in the precious metals sector for the short term.

The reason is that what happened wasbearish in two ways:

ShortTerm: Miners Still Looking Weak

First, the decline in mining stocks. Aprice action following a confirmed breakdown was exactly what I expected tohappen to both junior miners and senior miners.

Senior miners – the GDX ETF – declinedafter verifying the breakdown below the neck level of the head and shoulderspattern.

Junior miners – the GDXJ ETF – declinedafter verifying the breakdown to new yearly lows.

Both are very bearish on their own as theconfirmed breakdowns imply that another – bigger – short-term slide is about tostart.

But they are even more bearish whencompared to what happened in gold.

Nothing happened in the case of the goldprice, which means that miners had no good reason to decline yesterday.Well, except for the reason that they have been in a medium-term downtrend anddue to myriads of technical reasons that Idiscussed previously. However, on a day-to-day basis, since gold didn’tmove, miners shouldn’t have moved either, if their outlook was at leastneutral.

Their outlook, however, is not neutral.It’s clearly bearish as they showed weaknessrelative to gold. What just happened is the exact opposite of what one should see at or after animportant bottom – at that time gold stocks should outperform gold.

Consequently, the precious metals sectoris likely to slide shortly, and profits from our short positions in the juniorminers are likely to increase sooner rather than later.

That’s as far as the short-termimplications are concerned.

Goldand Bitcoin: What’s in It for Me?

There is something else that I’d like toshare with you today, though. I previously wrote that there’s a tendency forgold and bitcoin to move in the opposite directions in the short run, despitethat they both moved higher in the long term – since 2014. I wrote that I’llget back to this topic at some later date – and that day is today.

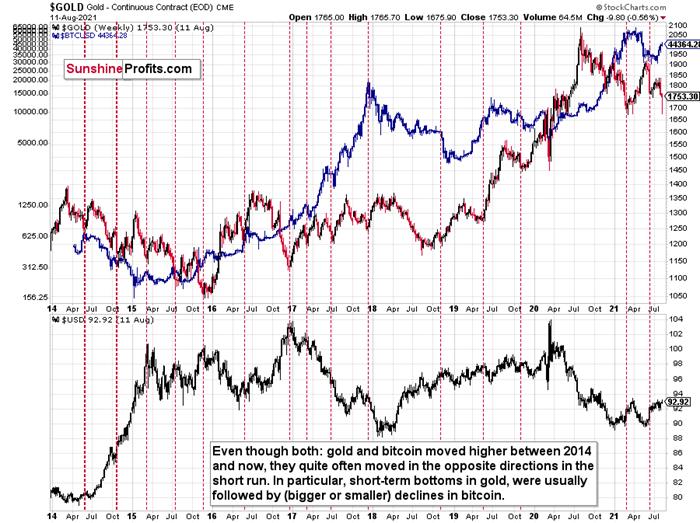

The upper part of the above chartfeatures gold (regular colors) and bitcoin (blue), and the lower part of thechart features the USD Index.

At first glance, the performance of goldand bitcoin doesn’t seem to be that connected, besides the fact that they bothmoved higher in recent years. However, taking a closer look reveals that thelink between them is not only present, but it’s actually quite strong.

I used the vertical, dashed lines to markthe moments when gold formed short-term bottoms and when bitcoin responded withdeclines. There were multiple cases like that! What’s remarkable is that evenif bitcoin was soaring, it managed to correct a bit when gold was regainingstrength. There were also some cases when bitcoin did nothing after gold’sbottom, but the moments when bitcoin ignored gold’s bottom and just continuedto rally were rare.

I marked the first two (2014) cases withbold lines as that’s when the USD Index had been rallying particularlystrongly. Since it seems that the USDX is starting a sizable upswing, theseanalogies might be most important.

Bitcoin declined in 2014 and the declinetook the form of two smaller declines. One of them started close to the middleof the year (practically right at the vertical line) and the second started inthe final few months of the year. What is most interesting, is that bothbitcoin declines started when gold was forming short-term bottoms.

Bitcoin has been on the rise in the lastseveral days, and given what we saw in gold – and in light of theabove-discussed link – it’s perfectly normal, since gold has been declining(the recent pause seems too small to trigger any price moves). But most importantly,it tells us that when gold rebounds, it could be bitcoin’s chance to slide.

The 2014 decline might not seem like abig deal on the above chart, but that is only due to the perspective. When youlook at the prices (the axis on the left side of the chart), you’ll see thatbitcoin actually declined from about $600 to about $150. In other words, itsprice was reduced fourfold. That’s a huge decline. And a huge opportunity forthose who are able to see it in advance.

This might or might not provide us with agreat shorting opportunity in case of bitcoin, when gold rebounds (likely closeto the previous 2021 lows), increasing this year’s profits, but it’s too earlyto say so with certainty at this time. I’ll keep looking for confirmations andI’ll report accordingly.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.