What Does this Valuable Gold Miners Indicator Say Now? / Commodities / Gold & Silver 2020

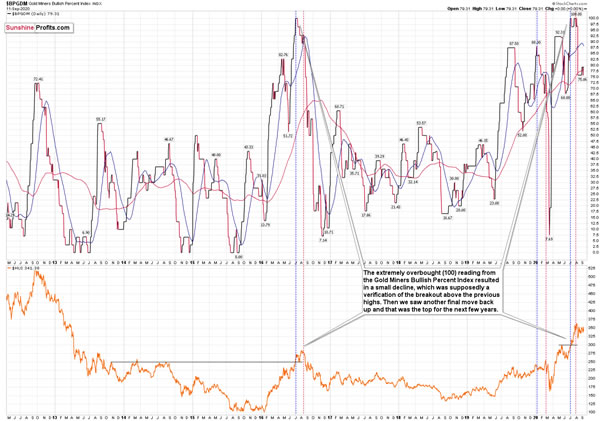

Someswear by price action, many others rely on indicators. There are actually manygold trading tips built around these techniques. Gold Miners Bullish PercentIndex, is one of the rare ones that don't issue signals all that often. And itshowed the highest possible overbought reading recently.

Theexcessive bullishness was present at the 2016 top as well and it didn’t causethe situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-termoutlook really is. Then, they correct. If the upswing was significant, thecorrection is also quite often significant.

Pleasenote that back in 2016, there was an additional quick upswing before the slideand this additional upswing has caused the GoldMiners Bullish Percent Index to move up once again for a few days.It then declined once again. We saw something similar also this time. In thiscase, this move up took the index once again to the 100 level, while in 2016this wasn’t the case. But still, the similarity remains present.

Backin 2016, when we saw this phenomenon, it was already after the top, and rightbefore the big decline. Given the situation in the USD Index, it seems thatwe’re seeing the same thing also this time.

Pleasenote that back in 2016, after the top, the buying opportunity didn’t presentitself until the Gold Miners Bullish Percent Index was below 10. It’s currentlyabove 70, so it seems that miners have a long way to go before they bottom.

Three weeks ago, we commented on the above chart in the following way:

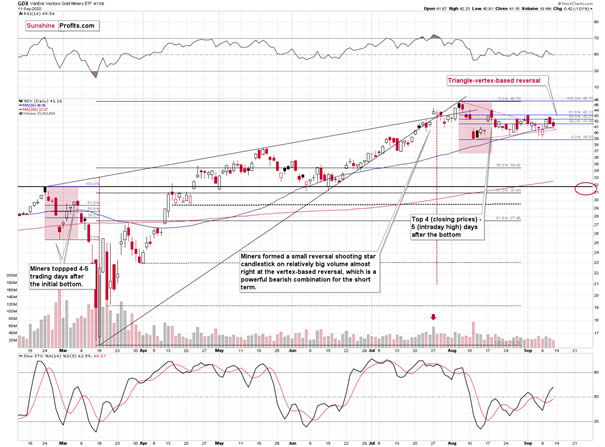

Now,since the general stock market moved above the previous highs and continues torally, we might or might not see a sizable decline early this week. Back inMarch, the slide in miners corresponded to the decline in the general stockmarket, and this could be repeated, or we could see some sideways trading afterthe slide resumes, once stocks finally decline.

That’sexactly what happened. The general stock market continued to move higher, andmining stocks have been trading sideways instead of declining – or rallying.Before miners’ pause (and S&P’s breakout) miners were repeating their late-February and early-Marchperformance. The implications of the self-similar pattern were bearish, andthey continue to be bearish, only the timing changed.

TheGDX ETF didn’t manage to break below the lower border of the triangle patternyet, but given the situation in the USD Index and what we’re about to show inyou case of gold, it’s likely that it will move lower shortly.

Basedon the triangle (marked with red, dashed lines), we get a vertex. Thismeans that it wouldn’t be surprising to see an intraday rallythat is followed by a decline later today or tomorrow.

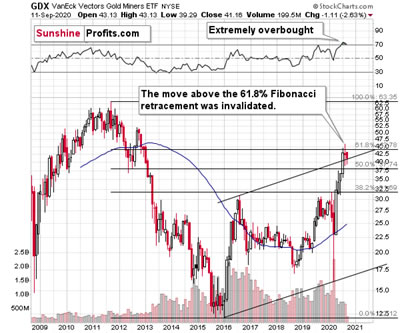

Also,let’s not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracementbased on the 2011 – 2016 decline.

WhenGDX approached its 38.2% Fibonacci retracement, it declined sharply – it was rightafter the 2016 top. Are we seeing the 2020 top right now? This is quitepossible – PMs are likely to decline after the sharp upswing, and since thereare only several months left before the year ends, it might be the case thatthey move north of the recent highs only in 2021.

Eitherway, miners’ inability to move above the 61.8% Fibonacciretracement level and their invalidation of the tiny breakout is abearish sign.

Everyone and their brother appear to be bullishon the precious metals sector right now, but if everyone is on the same side ofthe trade, it’s usually a good idea to be on the other side. There are quite afew factors pointing to lower precious metals prices on the horizon, and thesituation in the mining stocks is one of them.

Thank you for reading today’s free analysis. Itsfull version includes detailed upside targets for our long positions in miningstocks that we entered in the last 25 minutes of Friday’s session (based onyesterday’s closing prices the UNLEVERAGED positions in GDX and GDXJ are about 50%profitable). We currently offer 10% discount for the first subscription period(even for the yearly subscriptions). Given how volatile the markets are, howprofitable our trades just were and currently are, and how much is likelyaround the corner, the time to subscribe was never better – subscribeat a discount today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.