What a Breakdown in Silver Mining Stocks! What an Opportunity! / Commodities / Gold & Silver Stocks 2024

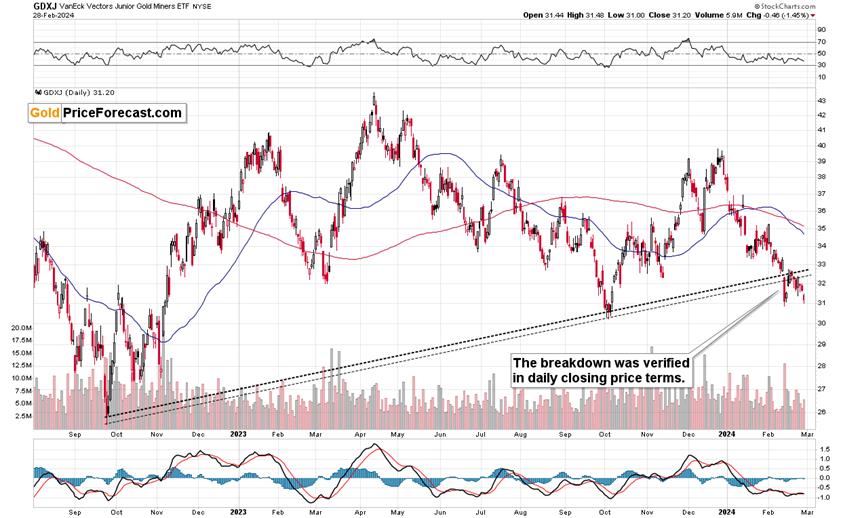

GDXJ declined once again yesterday,but the situation in silver juniors is even worse!

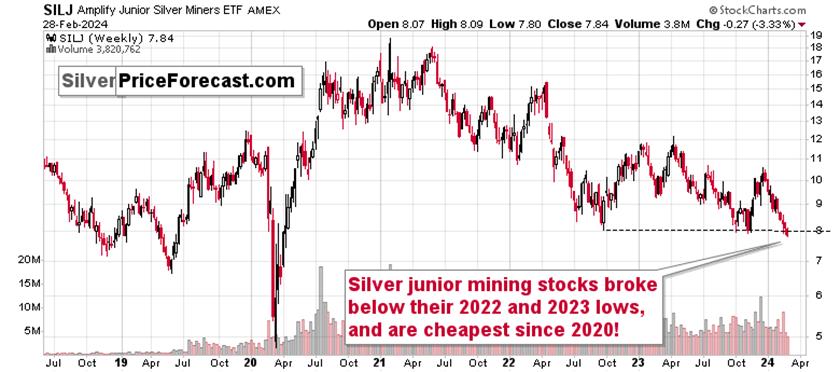

Silver Juniors inTrouble

Yes, it is possible for a market to bein an even worse position than gold junior mining stocks – that’s the case withsilver juniors.

To be precise, the GDXJ aims to beexposed to about 80% gold juniors and 20% of silver juniors, but the SILJ ETFaims to be exposed to just silver miners, with the focus on junior miners.

The ETF just broke below its 2022 and2023 lows!

The 2022 level held up well not once buttwice in 2023. This time, junior miners moved below it, which is a veryimportant sign for the entire sector.

Why? Because this tells us that this time IS different. It’s not anexpectation or assumption – it’s a fact.

The next strong support in SILJ’s case isall the way down at its 2020 lows. Will it move there? That’s likely. Will itmove there right away without periodic corrections? That’s unlikely.

Once caveat here – if the stock marketplunges, silver juniors could plunge too, and reach their 2020 lows withoutbigger pullbacks.

The silver juniors and their breakdownserve as a canary in the gold and silver mine. Breakdowns are about to happen,even if they don’t happen immediately.

The GDXJ ETF didn’t move to their 2023,let alone 2022 lows, but it just moved very close to its 2024 lows. In fact,yesterday’s close was the second-lowest close of this year.

Given the recent weakness in juniorminers, the fact that the RSI is not at 30 just yet, and given that strongersupport levels (like the 2023 low) are below the current prices, it seems thatminers’ decline is going to continue. We’ve been shorting this sector for awhile now, and the profits on this trade are quite nice, to say the least.

Now, as I mentioned before what happenson the stock market might impact mining stocks, but the dynamic of this link isvery specific – and one that contributes to the current awesome opportunity inthis sector.

The thing is that if stocks move higher,juniors pretty much ignore this move. But if stocks decline, juniors declineeven more.

Combining this with stock market’s veryvulnerable position creates a tremendous risk (for those thinking that preciousmetals and mining stocks can only go up) and a tremendous opportunity (forthose knowing that slides like the one in 2020 and 2008 can repeat).

Why would the stock market be in avulnerable position? I don’t think anyone needs to see stocks’ long-term chart– everyone knows that stocks are after a big, medium-term upswing that tookthem above 5,000. There are analogies to 1929 and there is a very short-termindication that perhaps the final top just formed.

The S&P 500 Index futures moved belowtheir initial lows, which could have been the first of many breakdowns. Rightnow, stocks are testing their breakout above the mid-Feb. highs. If theyinvalidate this breakout, the follow-up could be bearish, then very bearish,and then extremely bearish (I mean the subsequent waves down that could get bigger in each case).

Gold's Response

How would gold deal with this kind of moves in stocks? It would be likely to decline, and it’salready doing so based on its own technical reasons.

Gold price recently verified itsshort-term breakdown and now is breaking below another – lower – support line.

The 61.8% Fibonacci retracement levelsurely did its job well by stopping and ending gold’s short-term correction.

No wonder that gold is moving lower today– the USD Index – one of its key fundamental drivers – just broke higher.

After the initial move above thedeclining red line, the USD Index moved down once again, but not below it. It seems that theUSDX can move up quite substantially from here,at least in the short term.

All in all, it looks like mining stocksare in the perfect hell right now – rallies are brief, and declines last. Butso do profits if one is positioned to take advantage of this trend. We mightsee a short-term turnaround soon – even today – but we’re not there yet.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.