Western Magnesium Corporation (TSXV: WMG; Frankfurt-M1V; OTCQB: MLYF): Bringing Magnesium Production Back into the USA; Interview with Sam Ataya, Executive President, CEO and Paul Sauve, VP of Operations

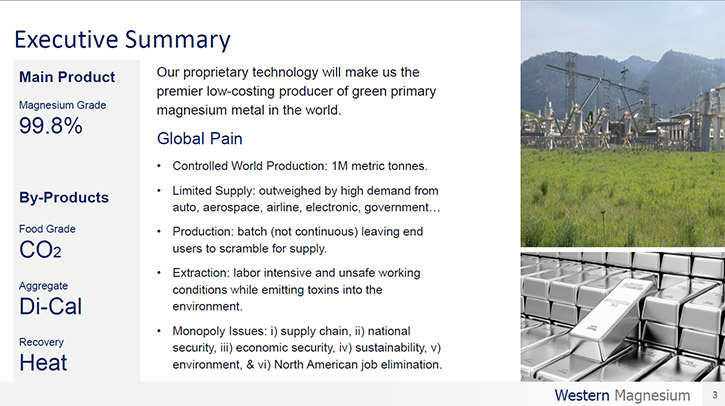

Western Magnesium, and from Paul Sauve, the Company's Vice President of Operations that the Company's focus is bringing magnesium production back into the United States, targeting industries, such as the auto, aerospace, airline, electric car batteries, US government and the DOD. We learned from Mr. Ataya and Mr. Sauve that their proprietary technology is scalable, and price competitive with the world's largest magnesium producer, China. Currently,  Sam Ataya, CEOWestern Magnesium Corporation and also Paul Sauve, who's Vice President of Operations of

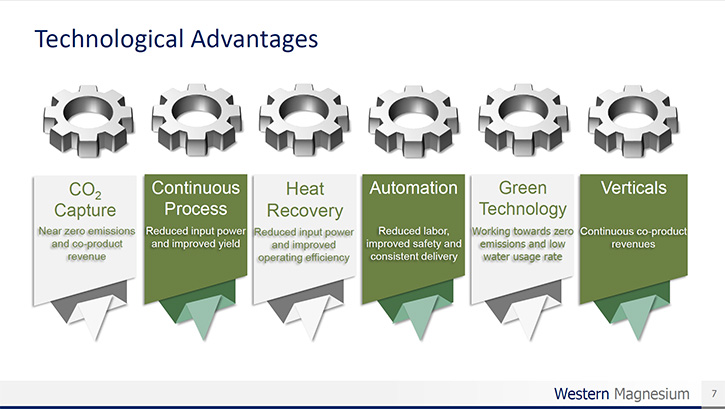

Sam Ataya, CEOWestern Magnesium Corporation and also Paul Sauve, who's Vice President of Operations of  There are one million metric tons of magnesium metal being produced per year. That's it! 85% or 850,000 metric tons are produced by the Chinese. And so we felt that we had to be price competitive with the largest producer, which I'm happy to say that we are. Number two, the technology had to be scalable, and today the technology is not scalable. So you either build a bigger plant, or you don't. For us, we're able to build a small plant in a rural area or a big commercialized plant in the middle of a downtown like Detroit, for example, servicing the auto industry. And third, and this is the most important, because of EPA requirements, not only in North America, the United States, Canada, or Europe, or even globally, EPA standards have really been a focus for us because that third area that we really had to prove concept in, was we want it to be zero waste and close to if not zero toxicity in our process.And I'm very proud to say that we are, and we've been able to prove concept on that as well. Those were the three conditions we had to meet, and two and a half, almost three years ago, we proved concept on those three issues and we went from an R&D state, into an operational state. Since that time, we've been growing, not only our technological side and our development there, but also our corporate side. We are the only publicly traded company in North America, and there's really only two publicly traded companies in the world, excluding ones that are Chinese that might be state owned. If we're talking about free market, then there's really only two, but in North America, there's only us. And that's something that we're very focused on because transparency is very important, especially in dealing with big industry, and I think big industry really likes that when it comes to us. I hope that gives you an overview of where we've been.

There are one million metric tons of magnesium metal being produced per year. That's it! 85% or 850,000 metric tons are produced by the Chinese. And so we felt that we had to be price competitive with the largest producer, which I'm happy to say that we are. Number two, the technology had to be scalable, and today the technology is not scalable. So you either build a bigger plant, or you don't. For us, we're able to build a small plant in a rural area or a big commercialized plant in the middle of a downtown like Detroit, for example, servicing the auto industry. And third, and this is the most important, because of EPA requirements, not only in North America, the United States, Canada, or Europe, or even globally, EPA standards have really been a focus for us because that third area that we really had to prove concept in, was we want it to be zero waste and close to if not zero toxicity in our process.And I'm very proud to say that we are, and we've been able to prove concept on that as well. Those were the three conditions we had to meet, and two and a half, almost three years ago, we proved concept on those three issues and we went from an R&D state, into an operational state. Since that time, we've been growing, not only our technological side and our development there, but also our corporate side. We are the only publicly traded company in North America, and there's really only two publicly traded companies in the world, excluding ones that are Chinese that might be state owned. If we're talking about free market, then there's really only two, but in North America, there's only us. And that's something that we're very focused on because transparency is very important, especially in dealing with big industry, and I think big industry really likes that when it comes to us. I hope that gives you an overview of where we've been. It's also being used in structural building materials, not so much in North America at this time, but that could change if a Company like ours comes online and produces magnesium at a consistent and stable rate, within North America. But in other parts of the world, primarily China, they're starting to use magnesium alloys in replacement of structural steel. The lighter a material is, the taller you can build it. So it has a lot of opportunities to replace more friatec metals that are heavier just due to their properties. That's the benefit of magnesium. The difficulty was the processing techniques were not there that made it attractive to produce, in modern ways, under modern EPA rules. And that's where we come in.

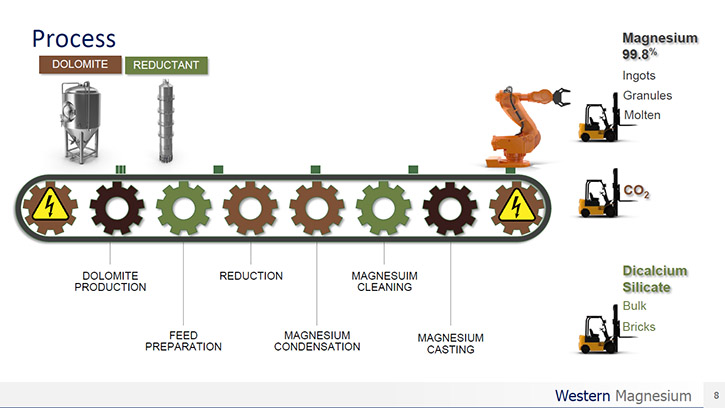

It's also being used in structural building materials, not so much in North America at this time, but that could change if a Company like ours comes online and produces magnesium at a consistent and stable rate, within North America. But in other parts of the world, primarily China, they're starting to use magnesium alloys in replacement of structural steel. The lighter a material is, the taller you can build it. So it has a lot of opportunities to replace more friatec metals that are heavier just due to their properties. That's the benefit of magnesium. The difficulty was the processing techniques were not there that made it attractive to produce, in modern ways, under modern EPA rules. And that's where we come in. Dr. Allen Alper:Now, what kind of feed materials would you be thinking of using?Paul Sauv?(C):At this time we're focusing on dolomite.Dr. Allen Alper: That sounds very good. Could you tell us what develop stage you are in? Have you completed the lab stage? Are you at a pilot plant stage?Paul Sauv?(C):Certainly. The lab stage ended at least three years ago, and an initial pilot plant has already run once. Now we're building a much more advanced commercial pilot plant that is currently under construction, engineering is almost complete and we will start building very soon. That will be in British Columbia.Dr. Allen Alper:That sounds very good. Maybe I'll go back to Sam for a moment. Sam, could you tell our readers/investors a little bit about your plans for the remainder of 2020, going into 2021?Sam Ataya:Absolutely. For now, we are in phase two of operations. We're focusing on three areas in phase two. Number one, Paul referred to the commercialized pilot plant being built. That is very important for us for the data and analytics that it will give us to move on to build the bigger commercialized plants, which will all be in the United States. So that commercialized pilot plant will be completed by the end of 2020, and we plan on producing metal by first quarter of 2021. That is a big part of phase two and that's what we're working on right now. The other thing is that we are going to become S-1 reporting because on our corporate side, we re-domiciled the Company from Canada, and we are now a US domiciled corporation out of Delaware.

Dr. Allen Alper:Now, what kind of feed materials would you be thinking of using?Paul Sauv?(C):At this time we're focusing on dolomite.Dr. Allen Alper: That sounds very good. Could you tell us what develop stage you are in? Have you completed the lab stage? Are you at a pilot plant stage?Paul Sauv?(C):Certainly. The lab stage ended at least three years ago, and an initial pilot plant has already run once. Now we're building a much more advanced commercial pilot plant that is currently under construction, engineering is almost complete and we will start building very soon. That will be in British Columbia.Dr. Allen Alper:That sounds very good. Maybe I'll go back to Sam for a moment. Sam, could you tell our readers/investors a little bit about your plans for the remainder of 2020, going into 2021?Sam Ataya:Absolutely. For now, we are in phase two of operations. We're focusing on three areas in phase two. Number one, Paul referred to the commercialized pilot plant being built. That is very important for us for the data and analytics that it will give us to move on to build the bigger commercialized plants, which will all be in the United States. So that commercialized pilot plant will be completed by the end of 2020, and we plan on producing metal by first quarter of 2021. That is a big part of phase two and that's what we're working on right now. The other thing is that we are going to become S-1 reporting because on our corporate side, we re-domiciled the Company from Canada, and we are now a US domiciled corporation out of Delaware. Western Magnesium?Sam Ataya:I think there are two very, very important reasons that this is the right time. The first one is that our Company's undervalued at this time. Part of the problem comes down to education. If more people become aware of the benefits of magnesium metal and what it can do, then the call to action is going to be there and we're going to have a lot of investors come on board, and a lot of shareholders wanting to come into it, and that is going to drive the stock up. I think that's starting to change significantly because government, especially in the United States, understands. In the US an executive order has been issued that put magnesium metal, for national security interests, on the 32 most protected metals list, and also put a 114% tariff on any magnesium metal coming into the United States from anywhere around the world.So the United States is really going after the build-out and production of metals again in the United States. And that's driving a considerable amount of value for what we're trying to do. So I feel that for shareholders coming on board right now, the heavy lifting has been done. We're six months away from producing metal and we're about to get started. So this is the right time, the Company's still undervalued and there's a great upside to it. That's a big one for me. We have not yet made the move to a major board, which makes it also the right time. So there's a lot of benefit buying into the Company today, because there's nothing but upside, especially when it comes to the valuation of the technology after the commercialized pilot plant is built. That will bring considerable value to our stock as well.Western Magnesium. Is there anything else you'd like to add, Sam?Sam Ataya:We really believe in our Company that we want to be part of the tip of the spear to bring attention to the fact that in our countries, in North America, we need to bring back production, manufacturing and control of our own resources. We've given that up, we've given it away and now we're scrambling to control it. The COVID pandemic has brought light to something that we've been talking about for many years now, which is that we have to be in control of our own resources. Just as we need to be able to produce our own food and our own medicine. We need to regain the ability to produce and manufacture competitively, using the latest technology.Globalization only works when all countries are honest and fair, but it's difficult to do when one country is beholding to another; one is manufacturing, producing and sending products to another country that cannot compete in that space. That is no longer globalization. That is simply beholding to another country. Fair play means that we have to be in control of production, manufacturing, and resources, within our own borders, and then go out in the world and compete and be the best we can be, and develop our industries. That's what we used to do. That's what made us number one in the past, and we've moved away from that. We moved away from that and it's cost us dearly. It took something like a pandemic to bring that to light with governments, to bring that to light with industry, to bring that to light within the general public. We need to be in control of resources, manufacturing and production. We're not looking at going global, we're interested in making this happen for the industries in the United States and within North America. That's our interest. Right now there're one million metric tons being produced globally, yet the demand in the United States alone, within the different industries, like the auto, aerospace, airline, eco-friendly technologies, government, and the military, is between 20 and 30 million metric tons or 20 to 30 times the world's supply. That's a very dangerous place to be in, but it's a great upside for our Company, and yet another reason why you should be investing in our Company.Dr. Allen Alper:That sounds excellent! We'll publish your press releases as they come out so our readers/investors can follow your progress.

Western Magnesium?Sam Ataya:I think there are two very, very important reasons that this is the right time. The first one is that our Company's undervalued at this time. Part of the problem comes down to education. If more people become aware of the benefits of magnesium metal and what it can do, then the call to action is going to be there and we're going to have a lot of investors come on board, and a lot of shareholders wanting to come into it, and that is going to drive the stock up. I think that's starting to change significantly because government, especially in the United States, understands. In the US an executive order has been issued that put magnesium metal, for national security interests, on the 32 most protected metals list, and also put a 114% tariff on any magnesium metal coming into the United States from anywhere around the world.So the United States is really going after the build-out and production of metals again in the United States. And that's driving a considerable amount of value for what we're trying to do. So I feel that for shareholders coming on board right now, the heavy lifting has been done. We're six months away from producing metal and we're about to get started. So this is the right time, the Company's still undervalued and there's a great upside to it. That's a big one for me. We have not yet made the move to a major board, which makes it also the right time. So there's a lot of benefit buying into the Company today, because there's nothing but upside, especially when it comes to the valuation of the technology after the commercialized pilot plant is built. That will bring considerable value to our stock as well.Western Magnesium. Is there anything else you'd like to add, Sam?Sam Ataya:We really believe in our Company that we want to be part of the tip of the spear to bring attention to the fact that in our countries, in North America, we need to bring back production, manufacturing and control of our own resources. We've given that up, we've given it away and now we're scrambling to control it. The COVID pandemic has brought light to something that we've been talking about for many years now, which is that we have to be in control of our own resources. Just as we need to be able to produce our own food and our own medicine. We need to regain the ability to produce and manufacture competitively, using the latest technology.Globalization only works when all countries are honest and fair, but it's difficult to do when one country is beholding to another; one is manufacturing, producing and sending products to another country that cannot compete in that space. That is no longer globalization. That is simply beholding to another country. Fair play means that we have to be in control of production, manufacturing, and resources, within our own borders, and then go out in the world and compete and be the best we can be, and develop our industries. That's what we used to do. That's what made us number one in the past, and we've moved away from that. We moved away from that and it's cost us dearly. It took something like a pandemic to bring that to light with governments, to bring that to light with industry, to bring that to light within the general public. We need to be in control of resources, manufacturing and production. We're not looking at going global, we're interested in making this happen for the industries in the United States and within North America. That's our interest. Right now there're one million metric tons being produced globally, yet the demand in the United States alone, within the different industries, like the auto, aerospace, airline, eco-friendly technologies, government, and the military, is between 20 and 30 million metric tons or 20 to 30 times the world's supply. That's a very dangerous place to be in, but it's a great upside for our Company, and yet another reason why you should be investing in our Company.Dr. Allen Alper:That sounds excellent! We'll publish your press releases as they come out so our readers/investors can follow your progress.