Was That the Top in Gold? / Commodities / Gold & Silver 2020

It could have been. But what is more likely, itcould have been the final pre-plunge top in case of the mining stocks. Why?Because the history tends to rhyme, and the verses appear more similar to whatwe already “read” in the mining stocks than they what we can see on the goldmarket.

Before digging into details, we would like to quotewhat we wrote on mining stocks on Monday:

Backin March, gold moved back to its previous highs (in fact it moved slightlyabove it) before topping and right now, it’s consolidating lower. Still, weshould keep in mind that there’s also the possibility that gold won’t repeatthe March performance to the letter and history will rhyme instead.

Consequently,it might be more useful to monitor the market for signs of weakness andto pay extra attention to the time factor.

Afterall, time is more important than price; when the time is right, the price willreverse.

Backin February, it took 4 days after the top for the miners to form their initialbottom and we saw the same thing also this time.

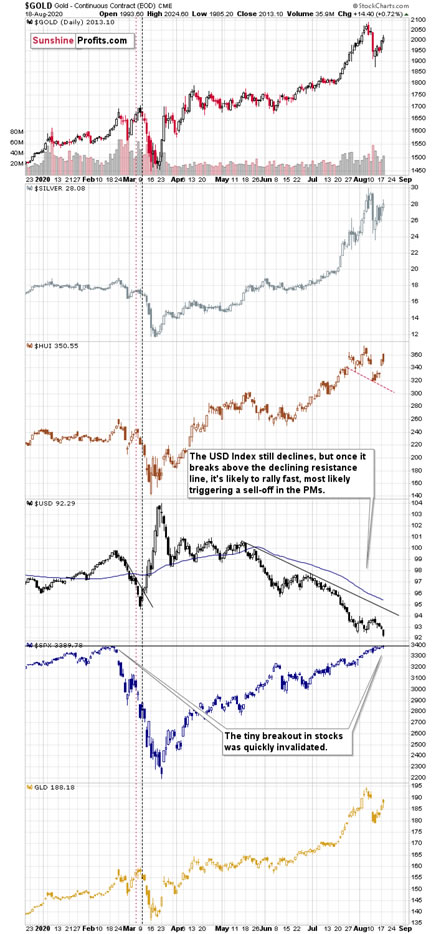

Backthen, it then took 4 (closing prices) or 5 (intraday extremes) trading days for the miners to top.Today will be the 4th trading day after the bottom, so if thehistory is to repeat itself with regard to time, miners might form the finaltop today or tomorrow. This would be in tune with where the general stock market is trading right now. It’s so close toits previous high that it could easily break to new highs and then invalidatethis breakout today or tomorrow.

Ifgold does indeed rally to the previous highs or even moves slightly above them,we don’t expect miners to do the same thing. In fact, we think that they wouldbe likely to top close to the 61.8% Fibonacci retracement level (at most) – atabout $43.

Yesterday,we clarified the “close to” part: “close” means that miners could move a bitabove it, just like they did in March. Gold minersmoved to exactly $43 on Monday and closed at $42.96, so if gold movedsignificantly higher from here (say, $100), miners would also be likely to movehigher temporarily.

Sinceminers already reached the $43 level on Monday, yesterday we wrote that wewouldn’t be surprised to see GDX at $44 or even $45 at the top.

Inshort, miners – and the general stock market – did exactly what we haveoutlined above.

TheGDX ETF moved to $44.09 yesterday, but then declined on an intraday basis, and endedthe session lower, despite gold’s daily gain.

Thismeans that at the same time, we saw:

Miners’ extreme weakness relative to gold and general stockmarket, which serves as the perfect “sign of weakness” that we previously wroteaboutSmall breakout to new highs in the S&P 500 Index (and inthe most popular ETF on it: SPY) that was then invalidated in case of theintraday termsMiners’ had formed a top in terms of the daily closingprices 4 days after the recent bottom, and they formed a top in intraday terms5 days after the recent bottom – exactly the same thing that we saw in March,right before THE slideThe shape of yesterday’s candlestick in the mining stocks isvery similar to what we saw on March 6 – right before THE slide.Theabove is a profoundly bearish combination for the next few days – weeks.

Wait– didn’t you say that gold could rally more?

Yes,we did. And gold could move higher while at the same time miners might not.That’s exactly what happened in March. Please take a look at the chart belowfor details.

Thevertical, black line shows the day right after the top (we didn’t want the lineto cover the daily performance at the top), and it clearly shows that whilegold was one day after the top, miners were already 2 days after the top.

Thetop in the mining stocks (in terms of the daily closing prices) took place onMarch 5, which we marked with red, vertical line.

OnMarch 5, gold was still below its initial February high and the USD Index wasjust starting to move lower after briefly pausing. In other words, miners declinestarted earlier than what we saw in gold or the USD Index.

Onecould say that the reason for it is was the situation in the general stockmarket. Indeed, the latter was already declining in early March. However, thefact that miners declined yesterday despite a daily rally in stocksmakes the current case even more bearish for the miners. Besides, theinvalidation of the intraday breakout in stocks is a sign that miners arelikely to get a bearish push from other stocks.

Whatdoes that all lead to? To the likelihood that we saw the final top in themining stocks, which might be the right shoulder of a head-and-shoulderstop pattern (the red line on the HUIchart would be the neck thereof). At the same time, it could be the case thatgold will make another attempt to rally above the previous 2020 highs. They keyword here is “could” – it’s not something that is carved in stone. In fact,back in March, silver was weaker, and gold was stronger. We’re seeing theopposite right now – overall, the situation is already similar to what happenedwhen the PMs were topping in March. Therefore, if gold moves slightly theprevious highs – just like it did in 2011 – it could trigger the sell-off, butat the same time we would like to stress that this kind of move is not requiredfor the sell-off to start. Especially in case of the mining stocks.

Naturally,the sell-off would be a temporary event and PMs and miners would be likely tosoar in the following months.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – ju7stdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.