USDX Resurgence: Gold and Silver Don't Let It Catch You Flat-Footed! / Commodities / Gold and Silver 2021

With its negative correlation to themetals, the USDX rally weighed heavily on gold, silver and stocks. Stop and think: what would be if it continued?

While the overwhelming majority ofinvestors entered 2021 with a bearish outlook for the U.S. dollar, our optimismhas proved quite prescient. The USDX bottomed at the beginning of the year.With the USD Index hitting a new 2021high last week – combined with the EUR/USD, the GDX ETF, the GDXJ ETF, andthe price of silver (in terms of the closing prices) hitting new 2021 lows –the ‘pain trade’ has caught many market participants flat-footed. Even silverstocks (the SIL ETF) closed at new yearly lows.

Moreover, after the USD Index surgedabove the neckline of its inverse(bullish) head & shoulders pattern and confirmed the breakout above itscup and handle pattern, the combination of new daily and weekly highs is quitea bullish cocktail. Given all that, even if a short-term pullback materializes,the USDX remains poised to challenge ~97.5 - 98 over the medium term — perhaps even over the short term (nextseveral weeks).

Please see below:

Furthermore, as the USD Index seekshigher ground, the euro has fallen off a cliff. For context, the EUR/USDaccounts for nearly 58% of the movement of the USD Index, and that’s why thecurrency pair’s performance is so important. If you analyze the chart below,you can see that the Euro Index hasconfirmed the breakdown below its bearish head& shoulders pattern, and the ominous event was further validated afterthe back-test of the breakdown failed and the Euro Index hit a new 2021 low.

Please see below:

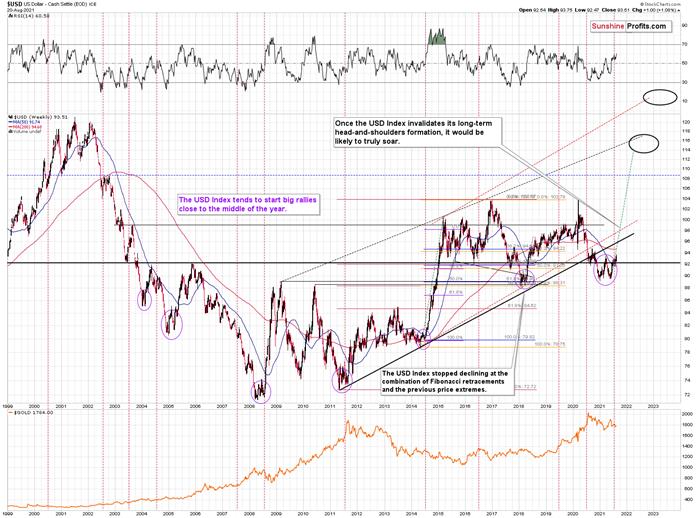

EyeIn the Sky Doesn’t Lie

What is signaling trouble for dollarbears as well, the USD Index often sizzles in the summer sun and major USDX ralliesoften start during the middle of the year. Summertime spikes have beenmainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011,2014 and 2018 a retest of the lows (or close to them) occurred before the USDIndex began its upward flights (which is exactly what’s happened this timearound).

What’s more, profound rallies (marked bythe red vertical dashed lines below) followed in 2008, 2011 and 2014. With the current situationmirroring the latter, a small consolidation on the long-term chart is exactlywhat occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its50-week moving average; an identical development occurred in 2014. Moreimportantly, though, with bottoms in the precious metals market often occurringwhen goldtrades in unison with the USD Index (after ceasing to respond to the USD’srallies with declines), we’re still far away from that milestone in terms ofboth price and duration.

Justas the USD Index took a breather before its massive rally in 2014, it seemsthat we saw the same recently. This means that predictinghigher gold prices here is likely not a good idea.

Ok,but didn’t we just see strength in gold – the one that you just wrote about?The USD Index soared last week by a full index point, and yet gold didn’tdecline…

That’s a good question, but the context is very important when analyzing specific price moves and their relativestrengths. As I wrote earlier, we saw new yearly lows in practically everyother important asset used for determining next moves in the precious metalssector: the EUR/USD, silver, and mining stocks (including practically all noteworthyETFs and indices). So, did gold really show strength by not declining despite the USD’s strength, or was gold’sperformance just a small, local deviation from the ongoing trend? Sincepractically everything else points to lower PM prices in the next weeks, thelatter is more probable.

Besides, there are both: technical andfundamental reasons for gold to behave in this way right now.

The technical reason comes from thelooming triangle-vertex-based turning point in gold, which is due today.

The rising black support line starts atthe 2020 low, which is not visible on the chart.

Since these points work on a near-tobasis, we might see a turnaround today or within the next few days.

SeenAnything on the News Recently?

Fundamentally, did anything importantfrom the geopolitical point of view happen recently? Like, for example, theU.S. withdrawing from Afghanistan? Exactly…

Geopolitical events tend to impact goldmuch more than they impact other parts of the precious metals sector, whichserves as a perfect explanation of why gold didn’t decline along with the restof the PMs. As a reminder, geopoliticalevents usually have a visible but temporary impact on the gold price. They change its short-term price moves, but they don’t changethe forecastfor gold in general.

Consequently,it was not really the strength in gold vs. the USD Index that took place lastweek. It was a mix of the above and gold’s weakness relative to what happenedin a geopolitical arena sprinkled with technicals. All in all, it’s not bullishfor the PMs.

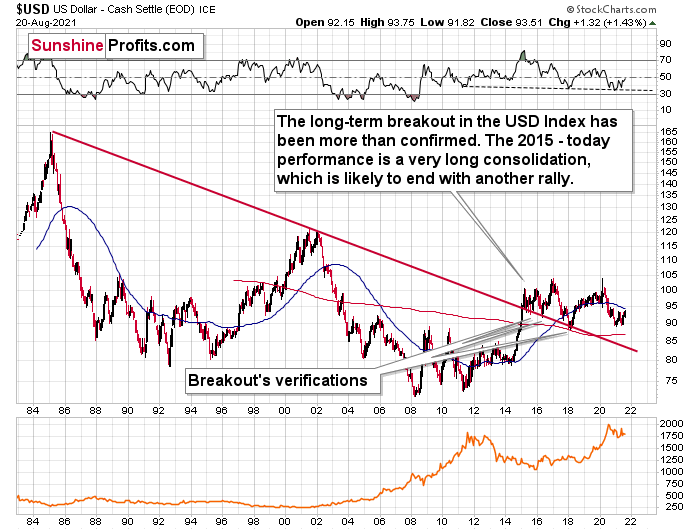

On top of that, the eye in the skydoesn’t lie. And with the USDX’s long-term breakout clearly visible, the smartmoney is already backing the greenback.

Please see below:

Finally, while short covering helpedpropel the USD Index higher last week, speculators’ positioning still has roomto run. For example, while the latest Commitments of Traders (COT)report shows that net-positioning (long 19,211 contracts) by non-commercial(speculative) futures traders is near its 2021 highs, enthusiasm for the U.S.dollar is still well below the highs witnessed in previous years.

Source:COT

The bottom line?

Once the momentum unfolds, ~94.5 is likely the USD Index’s first stop, ~98 is likely the nextstop, and the USDX will likely exceed 100 at some point over the medium or longterm. Keep in mind though: we’re not bullish on the greenback because of theU.S.’ absolute outperformance. It’s because the region is fundamentallyoutperforming the Eurozone, the EUR/USD accounts for nearly 58% of the movementof the USD Index, and the relative performance is what really matters.

In conclusion, the U.S. dollar’sresurgence has weighed heavily on gold, silver and mining stocks. And with the technicals, fundamentals and shifting sentimentsupporting a higher USD Index over the medium term, the metals’ strong negativecorrelation with the U.S. dollar should give investors a cause for pause. Tothat point, while we’re bullish on gold, silver and mining stocks’ long-termprospects, sharp declines will likely materialize over the medium term beforethey continue their secular uptrends.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.