The US Dollar is the Driver of the Gold & Silver Sectors / Commodities / Gold and Silver 2021

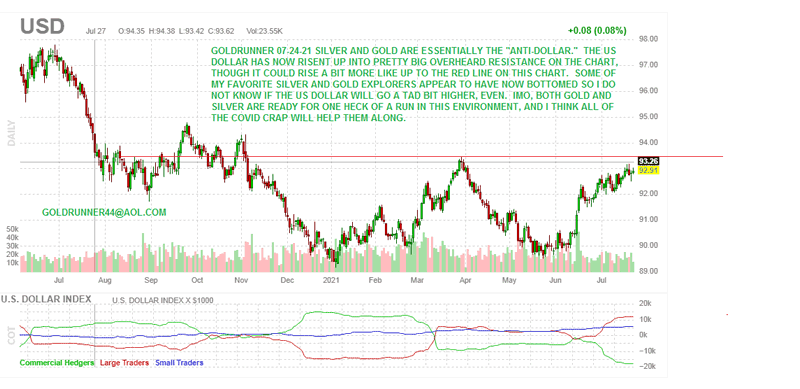

The U.S. dollar, as the world reserve currency, is still the driver of silver, gold, and inflation pricing and the charts below show that they should now be ready to run based on the USD topping and then dropping in “price”.

At this point the U.S. Dollar has corrected upward but has now either entered its next top, or is very close to that overhead resistance. Thus, we appear to be at the point where the USD will very soon start to move lower causing Precious Metals pricing across the board to start to move up aggressively, once again. In fact, I suspect that we saw a glimpse of exactly that into the close last week. All USD comments are on the chart.

GOLDRUNNER

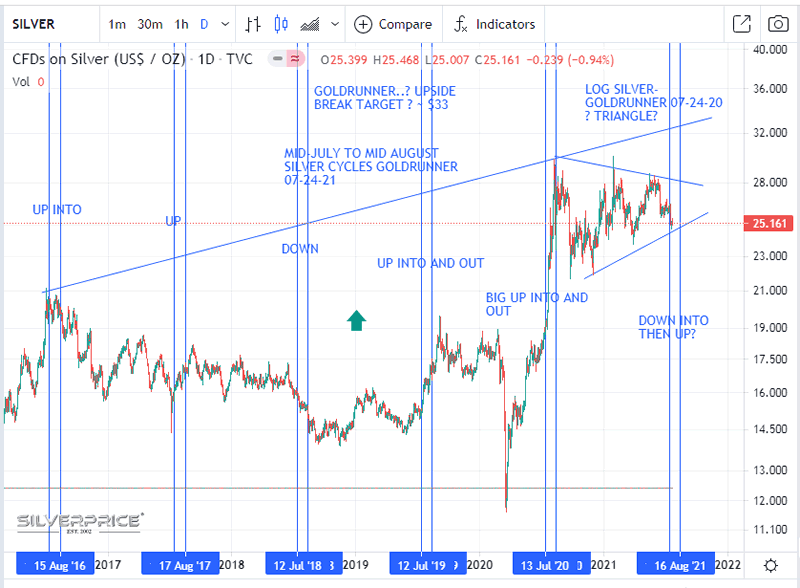

SILVER- READY TO RUN?

The second chart shows the Silver price cycles from July into August in the Silver bull market. At this point in time Silver appears to be mired in a large triangle correction that appears ready to end. With Dollar weakness most likely to be the driver of higher Silver and Gold pricing, soon we can see the probability for Silver to bottom in the triangle very soon. Thus, the set-up for Silver (and Gold) to take off to higher prices appears to match the USD’s terminal run on the chart above.

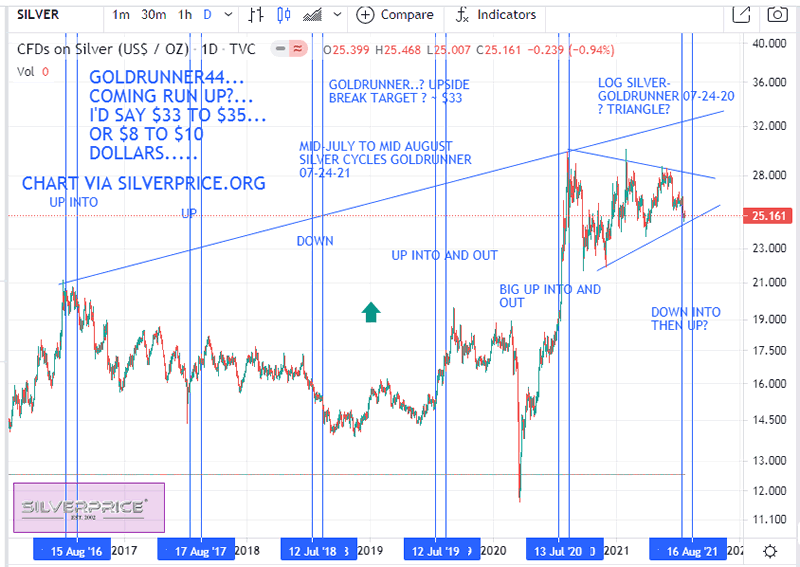

POTENTIAL UPSIDE SILVER TARGETS

The final chart of logarithmic Silver shows Silver currently sitting around the bottom of a huge triangle yet, with the USD now appearing to be topping at this time, the odds are very good that Silver will be climbing aggressively in price. The potential for Silver to start a run higher out of its triangle is very good as the USD tops. Thus, the potential for Silver to bust upward out of the triangle for a coming $8 to $10 run-up to $33 to $35. Such a run would likely cause the Silver stocks to surge.

GOLD

If the USD starts its next decline very soon, then Gold would obviously very likely make a big run higher, also. Such a run would likely take Gold up to its old highs, and then higher although we will leave that chart for another day.

THE BOTTOM LINE

The bottom line is that “everything real” should now be ready to run based on the USD topping and then dropping in “price”.

By Goldrunner, a frequent contributor to munKNEE.com – Your KEY To Making Money!

LorimerWilson is editor of www.munKNEE.com (Your Key to Making Money!), publisher of a daily FREE Financial Intelligence Report which can be subscribed to here anda frequent guest contributor to www.PreciousMetalsWarrants.com whichalso offers a FREE newsletter(sign up here) and a subscription service (see details here).

Disclaimer:Please understand that the above is just the opinion of a small fish in a largesea. None of the above is intended asinvestment advice, but merely an opinion of the potential of what mightbe. Simply put:

The above is a matter of opinion and is notintended as investment advice. Information and analysis above are derived fromsources and utilizing methods believed reliable, but we cannot acceptresponsibility for any trading losses you may incur as a result of thisanalysis. Comments within the text should not be construed as specificrecommendations to buy or sell securities. Individuals should consult withtheir broker and personal financial advisors before engaging in any tradingactivities. Do your own due diligence regarding personal investment decisions.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.