The Key USDX Sign for Gold and Silver / Commodities / Gold & Silver 2020

Yesterday’s session was indeed volatile around theFOMC, just like we warned,and gold even moved to its previous high, likely forming a double-top pattern.Even though gold moved higher on an intraday basis, it didn’t invalidate itsprevious breakdown, which was a bearish sign. Gold was likely to decline, andit is declining so far in today’s pre-market trading.

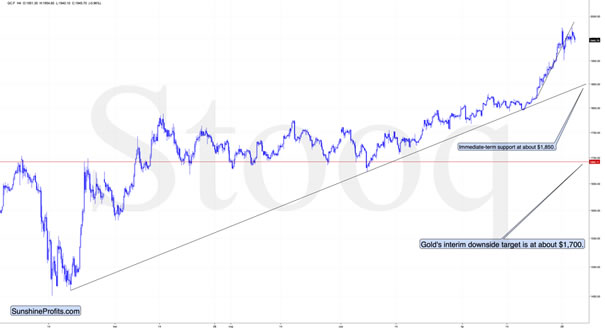

The above chart shows just how preciselyyesterday’s upswing ended at the previous support line, verifying it (mostlikely finally) as resistance. The implications are bearish.

The next short-term support is at about $1,850, butwe don’t think that the decline will completely stop there. Instead, after apause or corrective upswing, a move to about $1,700 – or even lower is likelyin the cards. Naturally, this is based on the information that we haveavailable at the moment of writing these words, and the outlook could change inthe future.

Why? Because of the confirmations from othermarkets, including silver and – perhaps most importantly at this time – the USDIndex.

Just like gold, silver moved back to its previoussupport line and verified it as resistance. It seems that both markets arewaiting for USD’s rally (which is likely to arrive shortly) to plunge.

And what did the USD Index do recently?

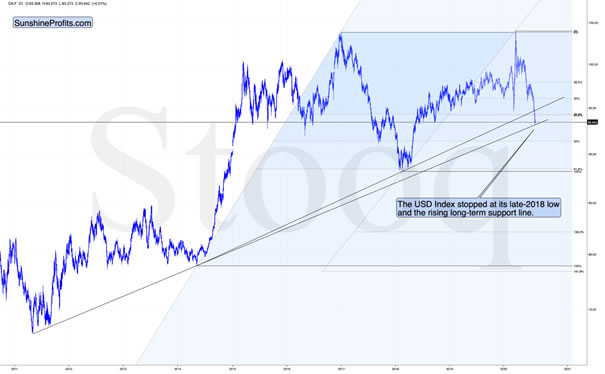

While gold didn’t move back above its risingsupport / resistance line, let alone the previous high, the USD Index did movebelow its previous low.

This means that after a powerful short-term rally,gold is refusing to react to additional bullish indications. This is a stronglybearish sign. Naturally, gold’s verification of its breakdown is bearish aswell.

The USD Index itself is also very important,because while the move to new lows is not encouraging, it’s worth keeping inmind that the early March bottom was actually a series of tiny bottoms, whenthe initial bottom was broken by just a little right before the USD soared.

Consequently, the loss of USD’s bearish momentummight be the thing that one should focus on at the current juncture, and viewthe breakdown as bearish only if it is confirmed. At the moment of writingthese words, the USD Index is already back above its Monday’s intraday low.

At the same time, the USD Index is attempting tomove back above its declining short-term resistance line. It seems that thisattempt might finally succeed. Let’s keep in mind that breaking above theanalogous line in early March was the start of USD’s powerful upswing.

Zooming out shows that there’s a very good reasonfor the USD Index to rally here.

The USD Index just moved to the early-2018 lows,which were also the mid-2015 and 2016 lows (approximately). Additionally, theUSDX moved to the rising long-term support line based on the 2011 and 2014bottoms. And it all happened relatively shortly after the USDX moved below twoimportant Fibonacci retracement levels: 61.8% retracement based on the 2018 –2020 rally, and the 38.2% retracement based on the 2014 – 2020 rally.

All the above-mentioned factors suggest that theUSD Index is going to rally in the very near future. Gold has been magnifyingUSD’s tiny shows of strength, which suggests that any really visible rally inthe USDX is likely to trigger a big sell-off in gold.

And a big sell-off in gold is likely to translateinto an even bigger plunge in the goldstocks.

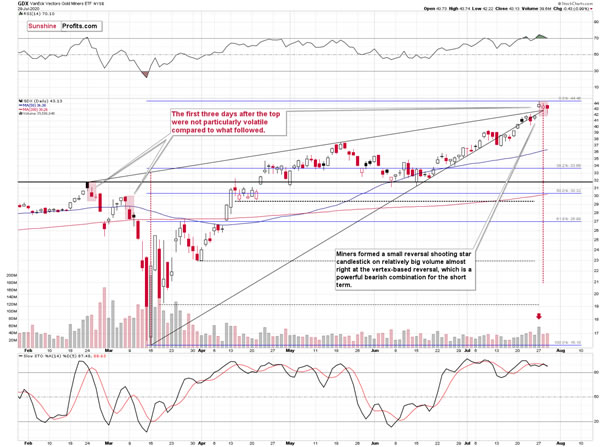

DuringMonday’s session, miners reversed on big volume and it happened almost right atthe vertex-based reversal. Gold stocks then continued to decline on volume thatwas not minor.

Sofar, the decline was relatively calm, but let’s keep in mind that the same wasthe case during the first three trading days of both early-2020 declines. TheGDX ETF declined rather insignificantly in late February, and the same was thecase in the early March.

Theimportant detail is that while gold moved to the precious high duringyesterday’s session, gold miners didn’t. Their underperformance relative togold along with the RSI above 70, and the recent reversal make the outlook verybearish for gold and silvermining stocks.

Summing up, it seems that gold has formed adouble-top pattern, just as the USD Index seems to have finally bottomed. Goldand silver have both reacted very strongly to the USDX developments, which hasvery bearish implications for the following days. The verifications of the veryshort-term breakdowns in gold and silver serve as bearish confirmations.

The miners have reversed this week on strong volumeand practically right at the vertex-based reversal, and it all happened afterthey had flashed the extremely overbought signal through the Gold MinersBullish Percent Index.

The implications arevery bearish for the next several days – weeks.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.