"Strength" in the Gold Miners? / Commodities / Gold and Silver Stocks 2018

Goldmoved visibly higher during the first session of the year and thistime mining stocks accompanied it. In fact, it seems that they are back on thetrack after a short pause. What’s the likely reason behind this year’s rallyand what does it imply going forward?

Goldmoved visibly higher during the first session of the year and thistime mining stocks accompanied it. In fact, it seems that they are back on thetrack after a short pause. What’s the likely reason behind this year’s rallyand what does it imply going forward?

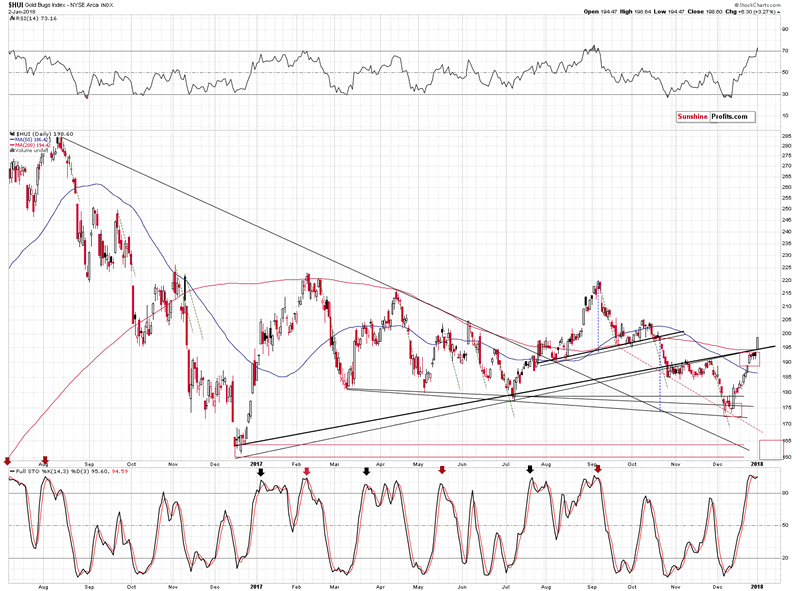

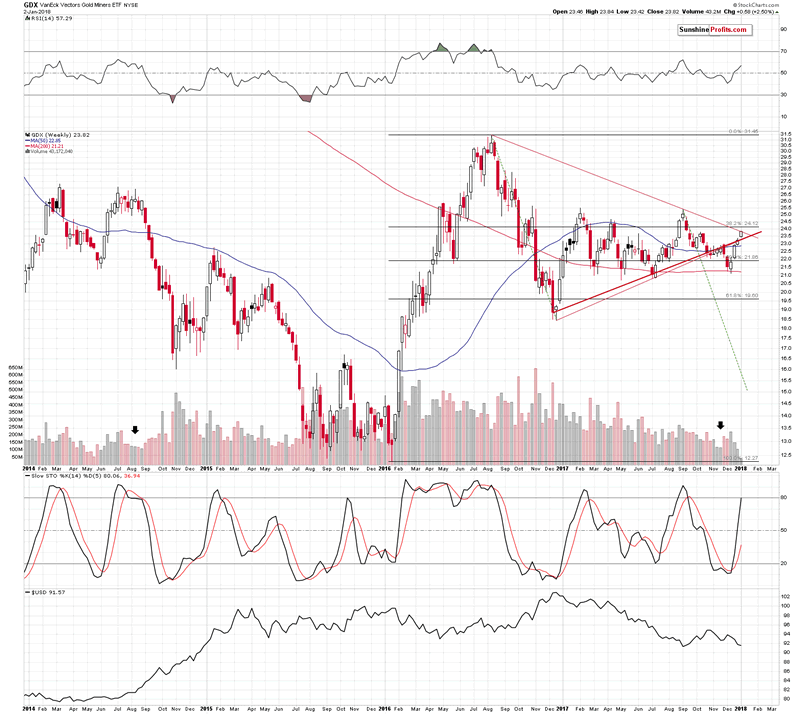

Let’s jump right into the mining stock charts (chart courtesyof http://stockcharts.com).

Gold stocks indeed broke abovethe rising support lines, but since that was only one close above them, thebreakout is unconfirmed. There are several reasons to think that it will not beconfirmed without even considering the apex-based reversal or gold’s cyclicalturning point.

Thetwo things that we would like to discuss with regard to the above chart are:the 200-day moving average, and the RSI above the 70 level.

Theformer was broken rather insignificantly and this doesn’t invalidate thebearish analogy to the previous similar patterns. For instance, in February,the day when the HUI Index closed above the200-day MA was the day of the final top. In fact, higher HUI values have never beenseen since that time. The June rally also ended above the MA, but the follow-upaction was very bearish.

Asfar as the second factor is concerned, there was only one case in the previousmonths, when the RSI indicator moved as high as it did yesterday - in earlySeptember. Mining stocks started an almost 50-index point-decline shortlythereafter.

Moreover,the moments when the RSI moved only to 70 level, without breaking above it,were almost always times when it was a good idea to be short the preciousmetals market. July 2016, February 2017, and the August-September 2017 top wereall confirmed by the RSI at or above the 70 level. Naturally, the implicationsare bearish.

Plus,while the rising support line was broken (again, the breakout was notconfirmed), the declining, even more long-term line, held. So, did we reallysaw a major breakout yesterday that changed the outlook? Not necessarily.

Thekey reason why we shouldn’t trust yesterday’s move is not visible on the abovecharts.

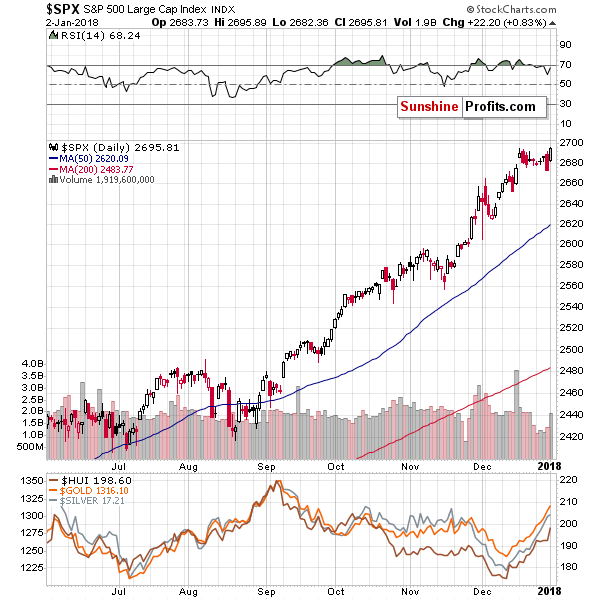

It’spartially visible on the general stock market chart. In fact, it’s the likelyreason that all stocks soared yesterday, not just miners. The reason is sellingduring the year or at its end due to tax reasons and then buying back at thebeginning of the year. In this way, investors are able to book the losses,which often leads to a decrease in one’s taxes on investments. Those who wantto keep the exposure to a given stock, often buy back in the first day of thefollowing year.

Consequently,yesterday’s “strength” in mining stocks is likely no strength at all – it’slikely just a result of applying one of the tax-optimizing investmentideas.

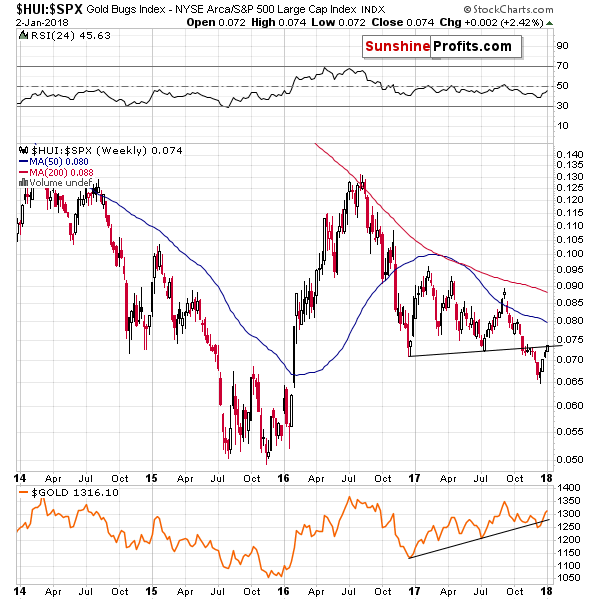

Theabove chart showing the golds stock ratio to the general stock market showsthat there was no major breakout yesterday. Why? Because by looking at theratio, we’re looking at the chart that “takes out” the factors that impact theentire stock market in the same way. In math, when we do the samemultiplication for the numerator and the denominator of a faction, we are leftwith the same fraction. So, since there was no major move in the ratio, itseems that the same thing caused the rally in both markets and thus, what wesaw yesterday was not a sign of strength in the precious metals sector.

If you enjoyed the above analysis and would like toreceive free follow-ups, we encourage you to sign up for our gold newsletter –it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. Ifyou sign up today, you’ll also get 7 days of free access to our premium dailyGold & Silver Trading Alerts. Signup now.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.