Stocks and Silver Have Something to Say about Gold / Commodities / Gold & Silver 2023

Silver just shot up, and given whatthe stock market is doing, it makes perfect sense.

Namely, it’s most likely the final partof the rally in them both, and the same is the case for gold and mining stocks.

Echoing Early 2022

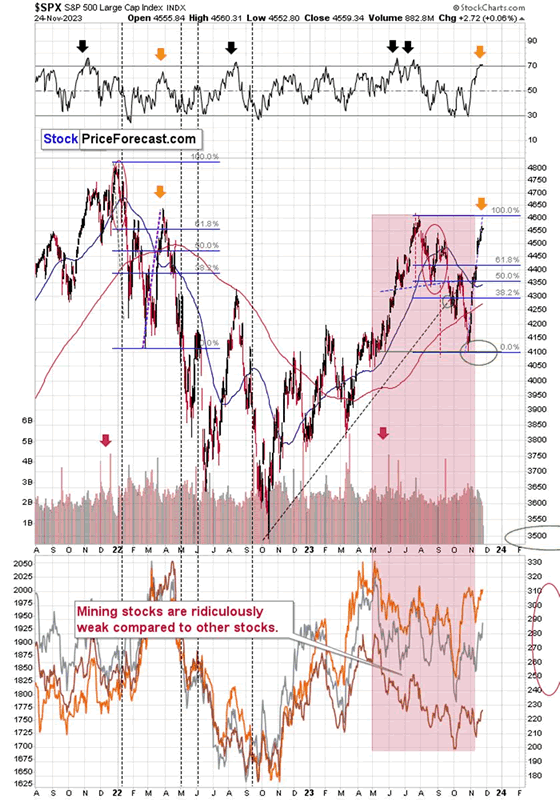

Starting with the stock market, it’sstill the case that the shares are following their early-2022 path.

What I wrote about it previously, remainsup-to-date:

Stockssoared recently. It is usually the case that people associate rallies withbullishness and declines with be arishness. Incorrectly so – bullish and bearish areterms that are about the future and forecasts, whereas a rally or a decline are termsthat refer to the past – something that already happened.

Doesthe fact that a price moved higher make it likely to go higher in the future?No.

Infact, a price can’t form a top, without a prior rally.

Whatdoes matter is an entire set if indications and context in which a given rallyor a decline took place.

Inthe current situation, the rally in stocks is very much aligned with the samekind of action that we saw in early 2022, which also took place right after theconcern about the military conflict peaked. Both rallies were sharp. In fact,they are almost identical in terms of sharpness. Imarked the 2022 rally with a purple, dashed line, and I copied it into thecurrent situation. It turns out that the moves are extremely similar.

Inrelative terms, the current move up is bigger, but in absolute terms, thecurrent move is smaller. It’s a tough call to say which analogy is moreimportant, so overall, we can say that it seems that stocks have either ralliedas much (approximately) as they did in 2022, or they are about to top.

Interestingly,if the 2022 rally is repeated to the letter, the S&P 500 Index would belikely to top at its previous 2023 top. Either way, the top seems to be eitherin or at hand.

Andyou know what happened to the prices of mining stocks when stocks rallied backclose to their yearly highs?

Almostnothing.

Miningstocks almost completely ignored stocks’ rally! This is particularly visiblewhen you focus on the shaded area. At the same time stocks ralliedsubstantially, while miners plunged.

Thisextreme weakness is a bearish sign for the miners on their own, but it’s also asign that when stocks finally do decline (again, any day now), then miners are likely to magnify those declinesand decline in a truly profound manner.

Bearish Outlook Remains

As stocks moved higher exactly as theydid in 2022, the bearish implications of the analogy remain intact. A confirmed breakout to new yearly highswould make things bullish for stocks, but that simply wasn’t the case.

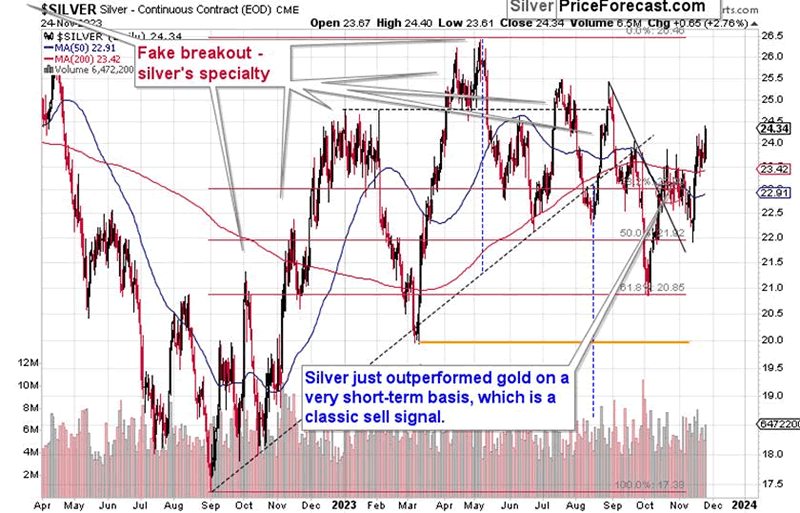

Moving to silver, those who have beenfollowing my analyses and/or the precious metals for some time know that whensilver soars relative to gold, it’s likely time to buckle up and prepare for aprice drop. That’s simply what the silver market does.

The silver market is considerably smallerthan the gold market, and it’s more popular among individual investors(compared to the interest from institutions), which means that as investmentpublic gets excited, it’s likely to push the silver market more than the goldmarket. And when does the investment public get particularly excited? That’sright – at the tops or very close to them.

That’s exactly what we saw. Silver movedabove its recent highs even though gold didn’t.

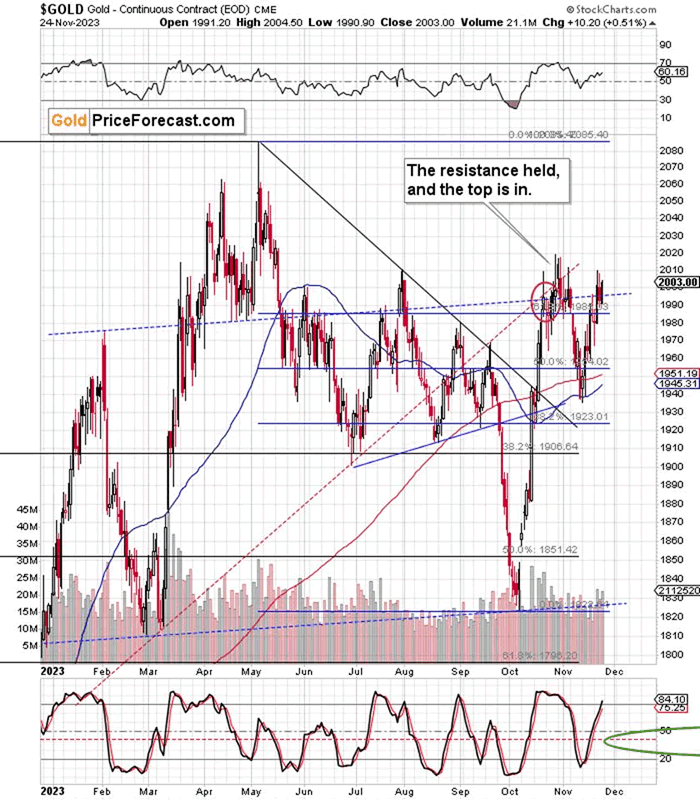

In gold’s case, it’s just another attemptto move above the rising, dashed resistance line that’s parallel to the oneconnecting the March and October bottoms. The previous attempt to break abovethis line was invalidated, so it’s likely that it will also fail this time.

Consequently, it doesn’t seem to be agood idea to blindly follow the latest immediate-term move in gold and silver.Those moves higher are likely tricky, just like silver’s sudden upswingsusually are.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.