Sprott Physical Gold Trust: The Best Gold Bullion Fund To Put Into Your Portfolio

Gold is historically the best way to protect your wealth, and it is better to think of gold in that capacity rather than as an investment.

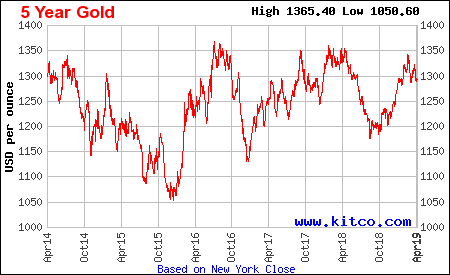

Gold prices have been essentially flat for five years, in stark contrast to just about everything else.

Central banks around the world are ramping up their purchases of gold, creating pressure on the demand side.

PHYS is fully convertible to physical gold and has none of the problems with unallocated storage that the ETFs have.

PHYS trades at a slight discount to NAV, essentially allowing you to obtain the gold owned by the fund for less than it is actually worth.

Gold is one of those investments that occasionally causes some controversy. For example, Warren Buffett has characterized it as a "barbarous relic," while others like Peter Schiff have recommended having 5-10% of your portfolio invested in the yellow metal. Personally, I do think that a good argument can be made for owning gold as a store of wealth since it cannot be printed out of thin air like fiat currency and as such it can serve as something of a hedge for the exposure that you would otherwise have by sitting in cash. A popular method to obtain this exposure is purchasing a fund like the SPDR Gold Shares ETF (GLD), although some have expressed concern that ETFs like this may not have the actual physical gold that they claim to. Therefore, in this article, I will present a better way to invest in gold while still having the liquidity and convenience of an exchange-traded fund. That way is the Sprott Physical Gold Trust (PHYS).

About The Trust

Unlike the other gold funds such as GLD, the Sprott Physical Gold Trust is structured as a closed-end fund. This gives it a major advantage over the exchange-traded fund structure in that it does not have to constantly buy and sell gold to ensure that there is always the correct amount of gold for the number of shares outstanding. This is something that may sometimes present a problem, and it is one reason why some gold bugs have concern that the ETFs may not actually have all of the gold that they claim. PHYS's closed-end structure meanwhile means that the trust was able to simply take all of the money that it raised in the public offering, use it to purchase gold, and stick it in a vault (in this case, the metals are held by the Royal Canadian Mint). As the number of shares issued by a closed-end fund does not change except for on rare circumstances, it does not need to worry about changing the amount of gold that it has in storage.

This also allows the fund to have a second advantage that cannot be matched by any of the exchange-traded funds. It is also a feature that makes this fund comparable to holding physical gold - the shares are fully redeemable for actual physical gold from the fund's vault. On a monthly basis, shareholders can opt to convert their shares into physical bullion. It does require a fairly large number of shares to do this though, as the gold in the vault consists of London Good Delivery bars. A London Good Delivery bar must be at least 99.95% pure and have a gold content of 350-430 troy ounces. At today's price, one of these bars is thus worth $452,014.50 to $555,332.10. As these are the only form of gold in the vault, all redemption requests must be incremental of these figures, so they do represent quite a lot of money. However, just the fact that the shares are fully backed by physical gold should boost confidence for people otherwise concerned about paper gold.

Another major advantage that PHYS has over the ETFs is that it holds its gold in fully allocated accounts whereas the ETFs use unallocated accounts. A fully allocated account means that the fund holds title to specific bars that are being stored in the custodian's vault. This is not the case with an unallocated account where there is no title to any of the bars that are stored in the custodian's vaults; it merely promises that the custodian owes a specific amount of gold. In the event of a bankruptcy of the custodian, GLD and similar funds will most likely just be an unsecured creditor to the value of their claims against the custodian's gold and may not actually get it. In contrast, because PHYS holds title to the gold, it will actually get the gold.

Why Own Gold?

As some investors may point out, gold has not really been a very good performing asset over the past five years as it still sells for roughly the same price as it did back in early 2014:

Source: Kitco

Source: Kitco

This is certainly far worse than stocks and most other risk assets have delivered over the period. However, I tend to view gold not so much as an investment but more as a safe haven and a store of wealth. Unlike fiat currencies such as the U.S. dollar, gold cannot be created out of thin air, so there is only a limited supply of it to go around. Fiat currencies can be created at the push of a button, which creates a constant temptation for governments to do this in order to fund their political dreams. In fact, as I discussed in a previous article, there are some politicians in Washington who have been proposing this. However, there are only a finite supply of goods and services in the economy, and these do not increase just because the money supply does. Therefore, when the money supply increases, it results in more money chasing the same quantity of goods and services, which pushes prices up. This is the root cause of inflation. In theory then, as gold supply is also finite, this should push gold prices up, allowing gold to maintain its purchasing power.

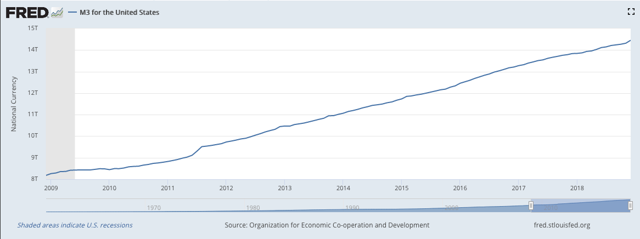

Prior to 2008, the Federal Reserve maintained a balance sheet containing less than one trillion dollars in assets. Today, that number sits at about $3.9 trillion. While this is less than the $4.4 trillion that it had at the peak, it is still far more assets than the central bank had prior to 2008. This growth in assets was the result of multiple rounds of quantitative easing (essentially money printing) that the institution undertook in response to the financial crisis. In addition to this, the Federal Reserve reduced interest rates, which increased the demand for loans and ultimately resulted in the creation of more money. As we can see here, the M3 money supply has essentially doubled over the last 10 years:

Source: Federal Reserve Bank of St. Louis

Interestingly, this has not seemingly produced inflation, as the official measure has more or less consistently remained below the Federal Reserve's 2% annual target. There has certainly been asset inflation though as massive amounts of new money has poured into the stock market, real estate, and other risk assets. In fact, it is rather stunning that gold has not increased in value along with these other assets.

Various central banks around the world seem to hold this belief too as they have begun increasing their purchases of gold. One of the most prominent of these is the Russian Central Bank, which bought one million ounces of gold in February 2019 alone, bringing its total up to 2,149 tonnes. This makes the Russian Central Bank officially the fifth largest holder of gold bullion in the world, resulting from purchases that it has been steadily making over the past few years. The Russian Central Bank is not alone in this either as Yahoo! Finance reports that globally central banks increased their gold holdings on a net basis by 35 tonnes in January alone, which was the largest January increase on record. There were nine banks, mostly in emerging markets, that were responsible for this increase. It is quite clear that these institutions are using the current low gold price to hedge their exposure to the developed market currencies, especially the U.S. dollar. As this buying will create demand pressure on gold prices, investors would be wise to acquire some gold of their own.

The Federal Reserve began backing off of this easy money policy back in 2016 but recently has indicated that it will not be able to completely accomplish this goal. This is evident in its new plan to halt interest rate hikes and the planned reductions to the balance sheet for the remainder of the year because such actions would be "too damaging to the economy." Unfortunately, this may leave the bank with insufficient ammunition to fight the next recession and points to a need for continual new money creation to maintain the economy. This is clearly bullish for gold if for no other reason than to protect the money that you worked hard to obtain.

Valuation

The fact that PHYS is a closed-end fund offers it another advantage over its ETF peers in the area of valuation. This is because closed-end funds do not always trade at net asset value so we may be able to buy the gold in the fund for less than it is actually worth. That is the case right now as the fund currently has a net asset value of $10.52 per share but trades for $10.45 per share, a 0.63% discount. Admittedly, this is a small discount but it is still a discount, and since the shares are redeemable for physical gold, it provides investors with a way to get the gold for less than it is actually worth.

Conclusion

In conclusion, PHYS offers a number of advantages over other bullion funds that should make it the vehicle of choice for playing a position in gold. There are also strong reasons to consider putting some money in gold as a way to protect your wealth against the loss of purchasing power that will inevitably come as the Federal Reserve continues to support the economy. Overall then, it would be wise to add some shares of PHYS to your portfolio.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PHYS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am considering an investment in gold, although I have not decided how I will acquire it. I may initiate a long position in any of the funds discussed in this article in the near future or I may purchase physical gold directly from a bullion dealer.

Follow Power Hedge and get email alerts