Some INK picks have already doubled in the Venture V-shaped recovery

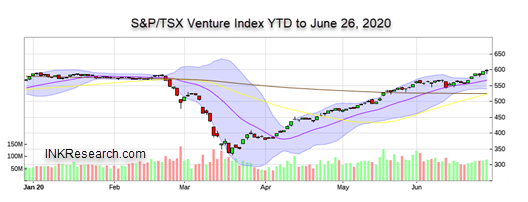

Today in the INK Market Report, we highlighted the bull market in Canadian junior mining stocks. While the North American economy may be challenged to put in a V-shaped recovery, Canada's Venture market appears to be succeeding with that letter of the alphabet. The S&P/TSX Venture Index jumped 5.6% last week and the Index is now up year-to-date. Money is clearly moving into the sector, pushing up valuations.

Canada's Venture Index is up almost 4% year-to-date (click for larger)

With the junior market being so strong, financings are finally getting done in the junior space. While most of the newly-raised money heads into the ground for exploration, some of it inevitably will find its way into stock promotion campaigns. It is always a good idea to read the fine print of any free newsletter touting a stock to see if the newsletter writer is being paid for coverage.

Importantly, high-risk oriented investors considering placing money into a junior speculative play that is being promoted should look to see the amount of officer and director ownership and if any of them have been buying recently. If ownership is low and insider buying is nowhere to be seen, maybe consider another candidate.

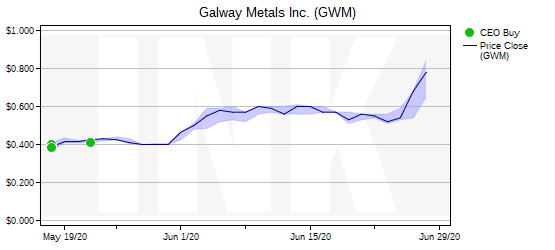

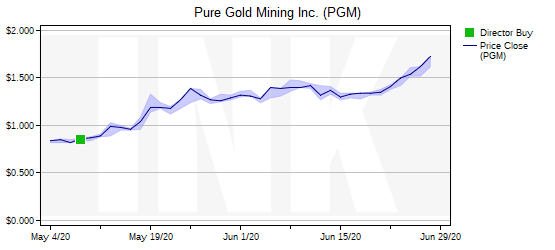

At INK, we do not accept payments for stock coverage, and we will let the insiders guide us towards more opportunity. In this bull run, so far, so good. Since May 8th, two INK Morning Report stocks Galway Metals (GWM) and Pure Gold Mining (PGM) have already doubled in less than two months.

Galway Metals (GWM) highlighted in the INK Morning Report May 19th

Pure Gold Mining highlighted in the INK Morning Report May 8th

It pays to support independent, non-sponsored research by subscribing and it pays to follow the insiders via INK signals. Not all insider buying or selling is the same and we use INK signals to put insider transactions into a winning context. We have been doing this since 2004.

While insider buying has recently tapered, our Venture Index remains in a bullish pattern for those risk-tolerant investors with a 12-month time horizon. Moreover, we could see insider buying pick up again if there is a cooling-off period for the juniors at some point this summer. That remains a significant possibility, so we will keep a bit of dry powder ready in order to take advantage of any low-volume selloffs which often happen in the junior market during July and August.

If you are not a Canadian Insider Club member, the time has never been better to join us. You will receive the INK Morning Report in your inbox every trading day, the INK Market Report every week, and the INK Top 40 every month along with a host of other features including a Google-ad free experience. Click here to find out more.

Disclosure: One or more INK employees holds GWM.