Small-Cap Gold Mining Stocks Are Getting Attention

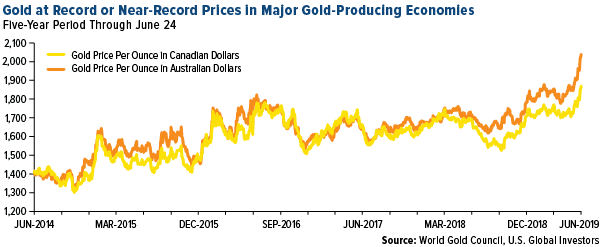

Gold crossed above AUD$2,000 for the first time ever last Friday. In Canada, its price is within striking distance of its 2011 record high of nearly CAN$1,880.

Smaller mining companies have historically appreciated much faster than larger industry players when the price of gold has taken off. Westhaven Ventures has grown 326% in the last 12 months.

Wallbridge Mining and Wesdome Gold Mines are both up over 100% in the last 12 months.

With the price of gold trading above $1,430 an ounce as of June 25, now might be a good time for generalist investors to consider getting exposure to the yellow metal. Many investors have done just that. Bloomberg reports that SPDR Gold Shares, the world's largest ETF backed by physical gold, attracted nearly $1.6 billion last Friday alone, the fund's biggest one-day haul since its inception in 2004.

There are other ways to get exposure besides bullion, of course, and that includes producers and explorers of the metal. But it's important to get the right kind of exposure.

I believe one of the best ways to get access right now is with junior, small-cap miners headquartered in economies where the price of gold has surged to record or near-record highs. Priced in the strong (yet weakening) U.S. dollar, gold has done well in June, but it's still some ways away from its all-time high of around $1,900. Because of favorable currency exchange rates versus the dollar, the metal has performed even better in Australia, having crossed above AUD$2,000 for the first time ever last Friday. In Canada, its price is within striking distance of its 2011 record high of nearly CAN$1,880.

Higher gold prices, then, have been a major tailwind for producers headquartered in Australia and Canada, the number two and number five gold-producing countries by output in 2018.

Many of the Best Opportunities Are in Junior Gold Miners

Smaller mining companies have historically appreciated much faster than larger industry players when the price of gold has taken off.

This has especially been the case when a junior miner has reported a new discovery from a drill hole that shows a high grade of mineralization. In October of last year, Vancouver-based Westhaven Ventures (OTC:WTHVF) reported positive drill results at its Shovelnose gold property in British Columbia. Its stock jumped more than 345 percent following the news, from $0.24 per share on September 28 to $1.07 by the end of October.

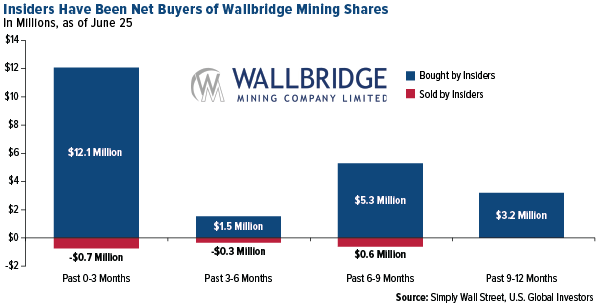

The same thing happened with Wallbridge Mining (OTC:WLBMF). In September 2018, the Ontario-based miner announced positive results from its underground drill program at its 100 percent-owned Fenelon gold property in northwestern Quebec. Shares of the $165 million market cap company doubled in value that very month, from $0.11 to $0.22 per share.

And it appears there could be even further upside potential, judging from Wallbridge's recent insider buying activity. Within the past three months through June 25, insiders - which include directors, officers, executives, and other employees - have gobbled up as much as $12.1 million in Wallbridge shares while selling only $700,000. Such activity has traditionally been a sign of confidence in anticipated growth.

Other top performers? Wesdome Gold Mines (OTCPK:WDOFF) is up 112.6 percent over the last 12 months through June 19. K92 Mining (OTCQX:KNTNF) is up 96.6 percent and Kirkland Lake Gold (KL) up 93.8 percent.

How High Can Gold Get?

Looking ahead, I believe this gold rally is just getting started. Prices have been muted in the past year thanks to the strong U.S. dollar relative to other currencies, but we're already seeing some weakness on anticipation that U.S. interest rates will be cut sooner rather than later. What's more, the pool of negative-yielding government bonds around the world has expanded recently to $13 trillion, a new record amount. Historically, negative yields have been constructive for gold prices.

If you believe that these developments suggest higher gold prices, it might be worth it to you to look into junior gold stocks.

--

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 03/31/2019: Westhaven Ventures Inc., Wallbridge Mining Co. Ltd., Wesdome Gold Mines Ltd., K92 Mining Inc., Kirkland Lake Gold Ltd.

Disclosure: I am/we are long WTHVF, WLBMF, WDOFF, KNTNF, KL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Follow Frank Holmes and get email alerts