Site visit: Grid Metals reduces China risk for lithium project in Manitoba

Grid Metals (TSXV: GRDM; US-OTC: MSMGF) has got a plan B to start producing battery metal in case Ottawa torpedoes its leading option with China's Sinomine Resources.

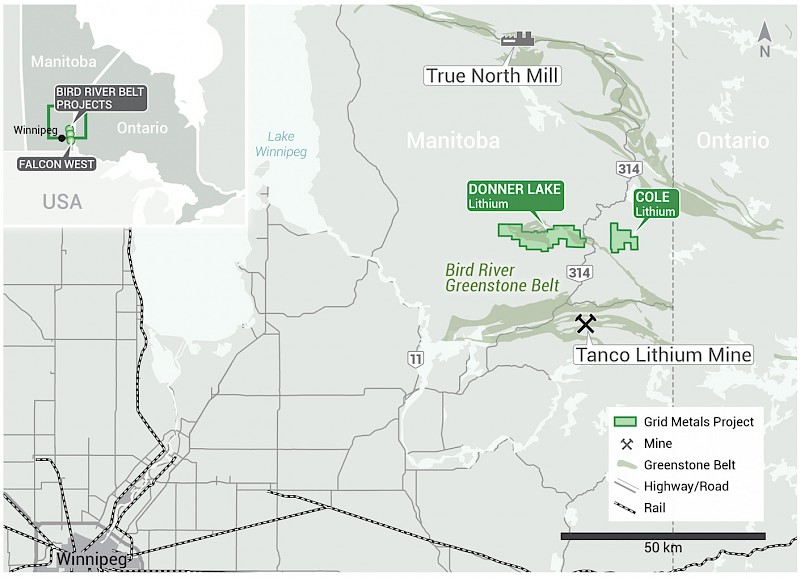

Toronto-based Grid is in talks to spend $4.65 million for the idled True North gold mine held by 1911 Gold (TSXV: AUMB), Grid president and CEO Robin Dunbar said on a site visit this month. The mill's 450,000 tonnes annual capacity would handle ore from Grid's Donner Lake hard rock lithium project in southeast Manitoba.

Buying True North, which operated for decades as San Gold's Rice Lake mine, is a backup for a deal Grid is negotiating with Sinomine's Tanco mill. There's concern after the federal government ordered China-controlled companies including Sinomine to divest some holdings last year.

"We would like to not be totally reliant on a deal with Tanco," Dunbar said. "TrueNorth, it's a little further away for trucking ore, but we would own that and it will be slightly larger."

Grid, with a stock market value of $19.3 million, wants to start building Canada's third lithium mine next year at Donner Lake 180 km northeast of Winnipeg. It would fast-track 5-6% spodumene concentrate to market via Tanco's mill by 2025. Sinomine has applied to quintuple the size of the mill to process 1 million tonnes of ore a year, which may turn the province into a lithium hub and attract a hydroxide plant to create battery-grade metal.

Watch a video of the trip, above.

Like others in the industry, Grid has pivoted away from other projects - nickel in its case - to take advantage of the increased interest in lithium to feed the green energy transition. But with further processing now still needed in China, the project highlights the predicament of the industry relying on the Asian giant at several stages, even right in Canada.

"A key question is what is Tanco going to do to become Canadian," said Dave Peck, Grid vice-president of exploration and new development. "They're going to have to over time."

Hydroxide plant?

With Donner Lake, the potential later development of Grid's Falcon West lithium project 100 km east of Winnipeg, and a much larger proposed Tanco mill increasing spodumene concentrate production, Dunbar said Sinomine and maybe others are considering building a lithium hydroxide plant in Manitoba.

"There's a big margin in a hydroxide plant," he said. "They're looking at how to do that because they think there'll be lots of concentrate producers but very few hydroxide producers."

That might nix the need for processing in China, but it would be years down the line and the Donner Lake project faces more immediate challenges. A scoping study released on Wednesday says preparing the True North site would cost $50 million, but there's been no preliminary economic assessment or prefeasibility study. There's concern over the federal government strategy that forced Sinomine to sell Vancouver-based Power Metals (TSXV: PWM) last year. There's also the potential of new battery technology to disrupt the industry and the unknown stance of a leftist NDP provincial government elected just this month.

"The NDP has union support in the northern part of the province where there's a lot of mining and there's some big revenue producers for the government in the Thompson nickel belt like Hudbay Minerals (TSX: HBM; NYSE: HBM)," Dunbar said. "But there's also the other side of the NDP, which is the environmental lobby."

Wab Kinew, sworn in last week, is Manitoba's first First Nations premier.

"First Nations communities that might benefit tangibly from future development, jobs, skills training, opportunities and economic progress will be putting some pressure on the new government to support these things," Peck said.

Map courtesy of Grid Metals.

Good relations

Grid has a Donner Lake exploration agreement with the Sagkeeng First Nation, though it will need an impact benefit agreement to start production, Peck said. Relations with provincial regulators are good and the company expects a mining permit within a year, he said.

Toronto-based Li Equities Investments (formerly Lithium Royalty), which owns 15% of Grid, holds a quarter of the project. It hosts 6.8 million inferred tonnes grading 1.39% lithium oxide (Li2O), according to an initial resource estimate in July. It's envisioned as a "modest-sized" open-pit operation to start, Grid says.

The 612-sq.-km Falcon West lithium project has historical assays including 12.2 metres at 2.2% Li2O and 10.5 metres at 2% Li2O. Grid expects to start its drilling there this year.

Negotiations with Tanco, 35 km from Donner Lake, began a year ago and a final agreement is still to be signed, Dunbar said. The plan envisions splitting profit 50/50 on sales of 5-6% spodumene concentrate from 200,000 tonnes a year of Donner Lake material. Concentrate output would be around 40,000 tonnes, Sinomine operations director Joey Champagne said during a site briefing.

The Tanco mine started tantalum and cesium output in 1968, Champagne said. It stopped tantalum in 2013 but is still producing cesium, which is used primarily in oil drilling. The mill produced lithium from 1993 to 2009 before restarting it two years ago.

Spodumene ore with lithium glows orange in Donner Lake core samples under ultraviolet light. Credit: C. McClelland

Bunker busters

China's state-owned Sinomine bought the site in 2019 from Boston-based Cabot (NYSE: CBT), a global chemicals company. Cabot reportedly sold Tanco's tantalum to United States defence contractors to harden bunker buster bombs, Peck said.

Grid has paid $300,000 for the True North mine and mill and would pay $1 million more after a 90-day due diligence period with 1911 Gold ends this month. It would also buy $450,000 of 1911 Gold stock for about 10% of that company and contribute $2.9 million to the mine's closure bond over three years, Dunbar said.The fully-permitted mine shut last November after declining underground grades made it unprofitable. The mill is valued at more than $200 million and could be refurbished by 2027 according to Grid.

The scoping study by Primero Group, which owns 6% of Grid, says converting the mill can produce spodumene concentrate at a cost of $316.14 per tonne. It recommended further engineering studies totalling $2 million. New metallurgy tests showed a 70% recovery rate and production of concentrate grading 5.5% Li2O and iron content of 1.4% ferric oxide, Grid said.

Dunbar was a banker with BMO before starting Mustang Minerals two decades ago with the Makva Mayville nickel project in the same southeast Manitoba region. The project holds 33.8 million indicated tonnes grading 0.27% nickel and 0.37% copper for 203 million lb. nickel and 276 lb. copper, according to a 2014 preliminary economic assessment.

Mustang became Grid in 2016. Its stock traded at 12? apiece on Wednesday in Toronto, within a 52-week window of 10? to 24?.

Canada's two producing lithium projects are the Tanco mine and the North American Lithium (NAL) project in Quebec operated in a 75-25 partnership between Sayona Mining (ASX: SYA; US-OTC: SYAXF) and Piedmont Lithium (NASDAQ: PLL; ASX: PLL). It made its first commercial shipment of spodumene concentrate in August.

"With car company demand set to accelerate, the market is underestimating the problems of the lithium supply side," Dunbar said. "With an agreement with Tanco, all we need is a mining permit and we're there."