Silver's Subtle Indication / Commodities / Gold & Silver 2023

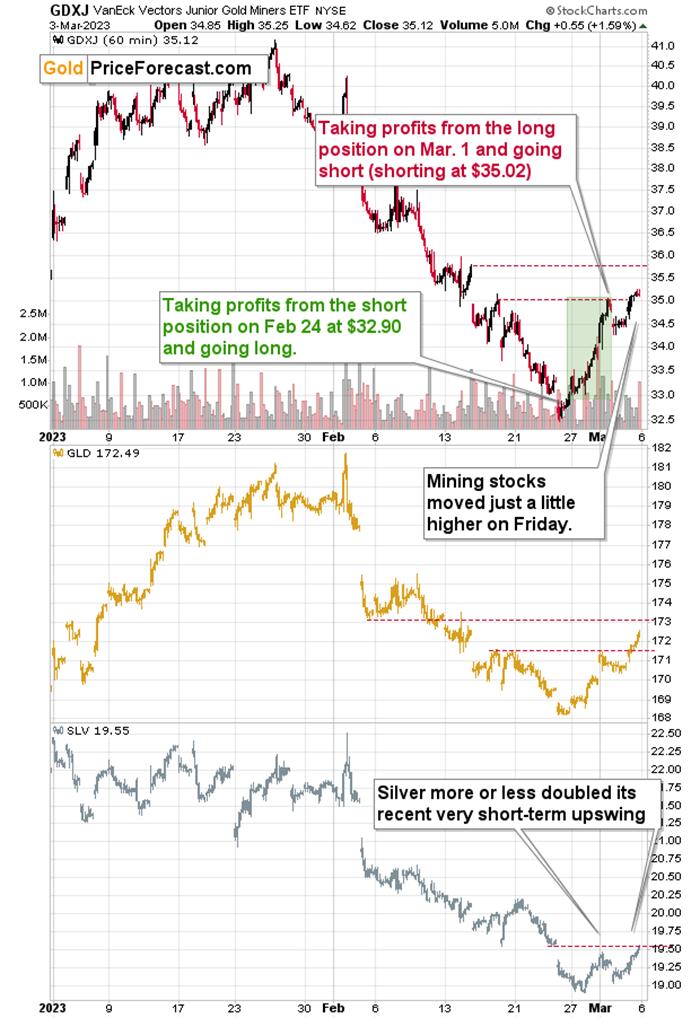

Namely, while the GDXJ (upper part of thechart) moved only a little above its recent high, silver has pretty muchdoubled its previous short-term upswing.

WhatAre the Suggestions?

To be clear, neither of those moveshigher was substantial. However, it is the relative performance that mattersfrom an analytical point of view.

As I have emphasized many times before, miners tend to underperform gold close totops, while silver tends to catch up. That’s something that we saw on Friday.

While it doesn’t guarantee that the topis already in, it does indicate two important things:

In terms of resistance levels, the SLVETF (a proxy for silver) hit the upper border of its recent price gap, whilegold and silver haven’t moved to their next important resistance levels. Theydid move above the previous resistance levels and made a one daily close abovethem. This means that the small (very small in the case of the GDXJ ETF)breakout is not confirmed at this moment.

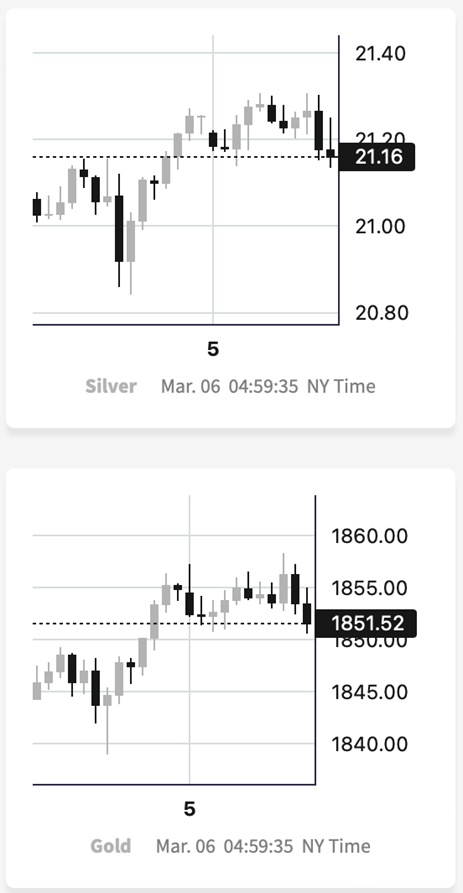

So far, gold and silver are both down intoday’s pre-market trading (chart courtesy of https://www.SilverPriceForecast.com/).

Consequently, it wouldn’t be surprisingto see the above-mentioned breakouts be invalidated shortly – perhaps as earlyas today.

DoSmall Upswings Mean Anything?

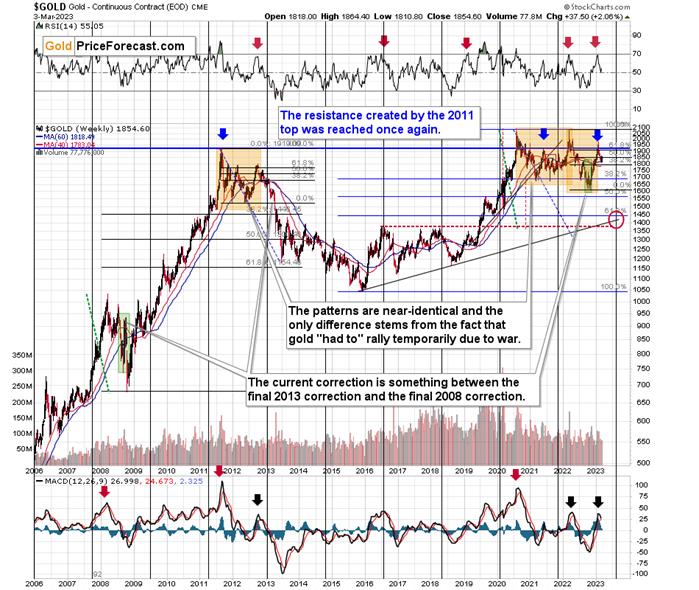

Forecasting gold prices in the short run is not an easy task right now, as gold moved toone of its resistance levels (the mid-June 2022 high), but didn’t move to thecombination of particularly strong short-term resistance levels yet. It doesn’tneed to reach the latter, as the strong medium-term outlook remains to thedownside and the RSI indicator has already moved to the middle of its tradingrange, thus doing what, back in mid-2022, meant that the key part of the rallywas over.

Still, if gold were to move higher, to about $1,772, it would be likely to topthere.

What does it all mean from broad point ofview?

Pretty much nothing.

The possible additional tiny upswing ingold is likely to not even be visible on gold’s long-term chart, while thesizable medium-term downside is clearly visible.

It’s even clearer in the case of goldstocks. The possible tiny move higher is practically irrelevant from thelong-term point of view, and taking into account how low the mining stocks arelikely to slide (and how big our profits are likely to be thanks to thisslide), it doesn’t make much sense to focus on it, especially since we alreadytook profits on what seems to have been the easy part of the corrective upswing.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our free gold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.