Silver Price Still Underperforming Gold / Commodities / Gold & Silver 2023

While the yellow metal hit a newrecord high, the silver price remains below its post-pandemic peak.

Recession RisksLoom Over Silver

While gold has dominated the headlines recently,silver and mining stocks have been material underperformers. And with thelatter better barometers of investors’ enthusiasm, their relative weaknessshould concern the permabulls.

Likewise, with weak economic dataunlikely to help silver when investors fully digest theramifications (look past pivot optimism), a 2024 recession could push silverback to its 2022 lows.

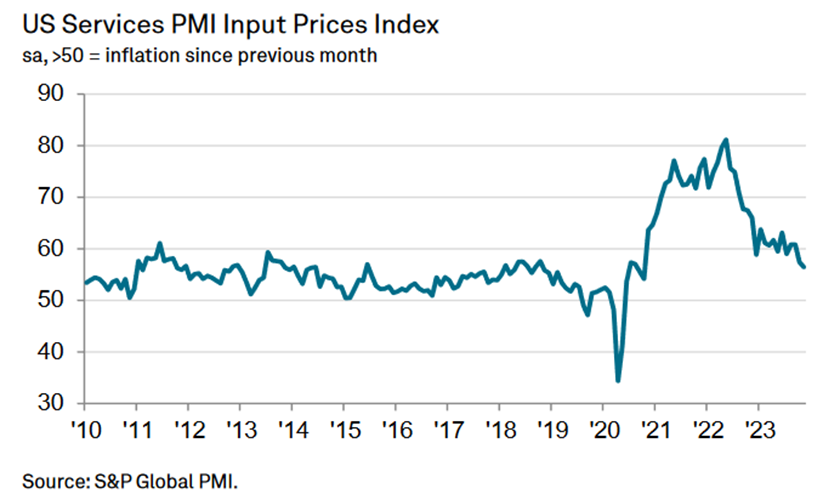

For example, S&P Global released itsU.S. Services PMI on Dec. 5. Chris Williamson, Chief Business Economist atS&P Global Market Intelligence, said:

“Firms providing both goods and serviceshave become increasingly concerned about excessive staffing levels in the faceof weakened demand, resulting in the smallest overall jobs gain recorded by thesurvey since the early pandemic lockdowns of 2020.”

Furthermore, after “evidence of sparecapacity led to the non-replacement of voluntary leavers,” it’s another signthat the U.S. labor market has weakened. And while we warned that a recession, not inflation, is the nextbearish catalyst, lower pricing pressures are normal when demand wanes atthis part of the economic cycle.

Please see below:

To explain, services inflation has beenthe primary driver of the pricing pressures, as manufacturing PMIs havestruggled. Thus, if (when) outright deflation occurs, risk assets like the PMsand theS&P 500 should come under heavy pressure.

Continuing the theme, Challenger, Grayand Christmas Inc. released its job cuts report on Dec. 7. An excerpt read:

“So far this year, companies haveannounced plans to cut 686,860 jobs, a 115% increase from the 320,173 cutsannounced in the same period last year. It is the highest January-Novembertotal since 2020, when 2,227,725 cuts were recorded. Prior to 2020, it is the highest year-to-date total since 1,242,936cuts were announced through November 2009.”

The report added:

“Companies are expecting slower growth inthe coming months, particularly in industries that support consumers.”

Plus, with 2024 looking nothing like 2021or 2022, the report provided more evidence of a labor market confrontingserious problems, which should help spur the USD Index asvolatility increases.

Please see below:

Uh-Oh Canada

The Bank of Canada (BoC) held itsovernight lending rate steady on Dec. 6, as higher long-term interest rateshave materially impacted the Canadian economy. The statement read:

“In Canada, economic growth stalledthrough the middle quarters of 2023. Real GDP contracted at a rate of 1.1% inthe third quarter, following growth of 1.4% in the second quarter. Higherinterest rates are clearly restraining spending: consumption growth in the lasttwo quarters was close to zero, and business investment has been volatile butessentially flat over the past year.”

And with demand destruction poised to hitits neighbor next, the BoC added:

“In the United States, growth has beenstronger than expected, led by robust consumer spending, but is likely toweaken in the months ahead as past policy rate increases work their way throughthe economy.”

So, while risk assets have celebratedthis weakness, oil prices have run for cover.And with crude’s collapse likely to filter into other assets once they catchon, silver and mining stocks should be among the hardest hit when the dramaunfolds.

Finally, Walmart CEO Doug McMillon saidthat unpredictability could reign in 2024, even as deflation unfolds across theU.S.’ largest retailer. Thus, while securities are priced for a perfectlanding, plenty of indicators signal a much different outcome.

Overall, silver’s strength is much moresemblance than substance, as rate cuts typically occur when economic growthfalters. And while investors assume they can skip the recession volatility,history suggests otherwise. As such, we believe assets like silver, the GDXJETF and the S&P 500 should face selling pressure in the monthsahead.

To avoid missing important inflectionpoints, subscribeto our premium Gold Trading Alert. Our expert technical analysis hasallowed us to profitably trade in and out of positions on several occasions andhas resulted in an 11-trade winning streak. And with future volatility poisedto create even more prosperous opportunities, there has never been a bettertime to become a member.

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.