SILJ: Silver Looks Weak And Landmines Are Everywhere

Silver ended the week closing at its lows, now down to $14.40/oz.

The trend is also down for silver stocks since peaking in Q1.

Caution is warranted at this time since risks are heightened for individual company failure (particularly producers) in a low price environment where profit margins have been greatly eroded.

Hecla Mining and Coeur Mining are just two examples of companies currently going through tough times and struggling to generate free cash flow.

Diversification is key to survival in a tough market.

The new year got off to an impressive enough start for silver and in particular silver mining stocks, with many companies seeing their share prices climb steadily higher into the double-digit range during Q1 before starting to fizzle out at the start of Q2.

Now, as we enter deeper into mid-May, perhaps the popular expression of "sell in May and go away" is most apt to apply to the silver sector these days.

The Current Trend is Down

For the metal itself, silver ended the week at $14.40/oz, falling another -0.51%, closing the day dismally at its lows.

Source: Silverprice.org

Source: Silverprice.org

As for the silver stocks, some companies are holding up better than others, but the overall trend is down. Unfortunately, at least in the near term, it looks like the bear has taken control over the precious metals sector again (after showing brief signs of life, gold too has retreated off its highs and ended Friday's session at $1,277/oz). As I alerted in my previous article, whenever I see the spot price of silver languishing below $15/oz from a risk vs. reward perspective, I prefer shifting my own focus towards more diversified ETF products to try and mitigate risks.

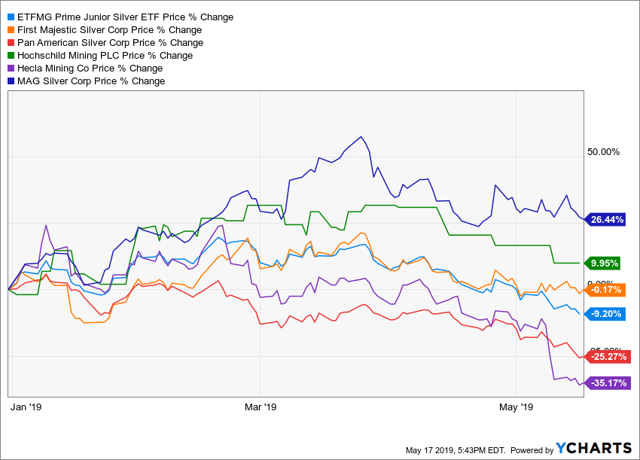

The following chart takes a look at the share price performance year-to-date for the ETFMG Prime Junior Silver ETF (SILJ) and its top 5 holdings (on an individual basis).

SILJ is down -9.20% First Majestic Silver (AG) is down -0.17%. Pan American Silver (PAAS) is down -25.27%. Hochschild Mining (OTCPK:HCHDF) is up 9.95%. Hecla Mining (HL) is down -35.17%. MAG Silver (MAG) is up 26.44%.As you can see from the figures above, the numbers are scattered all over the place, and although much of the times things look most obvious with the benefit of hindsight, in actuality, in real-time, it can be a rather difficult task trying to separate out all these different companies in hopes of picking out just the winners.

Mitigating Risks

So, although some silver stocks such as HCHDF and MAG are clear standouts in the sector so far this year, others such as PAAS and especially HL (a stock that will be discussed in more detail in the subsequent section) have been serious underperformers.

Going with a more diversified ETF product won't ever get you the best overall returns in the sector, but it should do its part in helping to smooth out the peaks and valleys. In other words, an ETF can greatly reduce volatility in a sector that is widely known to exhibit exactly such a trademark.

Now, volatility is not always a bad thing, and in a bull market it can be a speculator's best friend in helping to unlock massive outperformance to the upside.

For example, during the last bull market/rally in silver stocks (from January 19, 2016, up to August 1, 2016) even an ETF such as SILJ still managed to deliver the following returns.

SILJ was up 330.6%.However, given that silver is now trading at only $14.40/oz (no longer in the $20/oz range like it was back in the summer of 2016), it's safe to say that we are a long ways away from entering a new bull market in silver.

Therefore at this time, risk management is imperative for any speculators daring enough to dabble in the silver space at this juncture. Although it's true that mining is an especially tough (and capital-intensive) business and any company is capable of going bust at any given moment, producers are arguably most sensitive to declining metals prices because they have operations to run, staff to pay, often times huge debts to service, and putting a mine on care & maintenance is often much easier said than done.

In contrast, it's typically more straightforward for nimble developers/explorers to halt work, close up shop, and conserve working capital at all costs while waiting out the bear market to end.

With all that said, there is a widely held belief amongst speculators that at the start of any bull market/rally in silver, the producers will typically be the first to receive the "green light" signal to start advancing higher in share price because the quickest path to money is through them. Further because producers are typically larger cap companies, they provide enough liquidity to allow for institutions (and other big money entities) to invest in, which can provide even further rocket fuel to share price advances in an emerging bull market. For these reasons, it can help to explain why certain speculators will insist on constructing a portfolio with sufficient exposure to producers, despite all the risks involved.

Therefore, again, to balance risk vs. reward in a tough market, speculators might want to consider owning shares of an ETF product like SILJ which can provide heavy exposure to producing companies while at the same time also letting one hedge their bets across many stocks.

Top Holdings

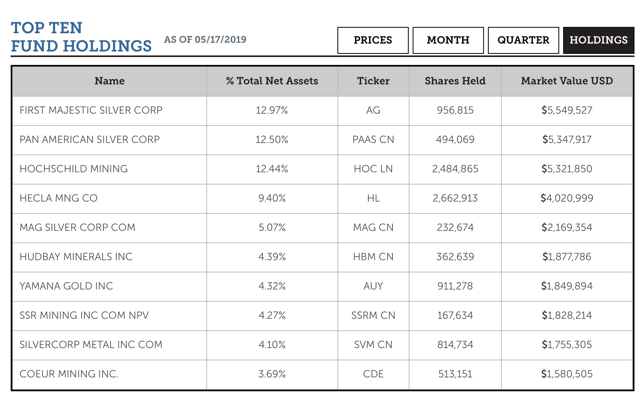

The SILJ ETF contains 30 holdings in total of various mining companies (i.e., producers, developers, explorers), primarily focused on stocks with a notable silver production profile.

Worth noting, the top 10 positions alone (all producers) account for ~73% weighting of the overall portfolio; they are as follows:

Source: etfmg

Picking the Wrong Stocks

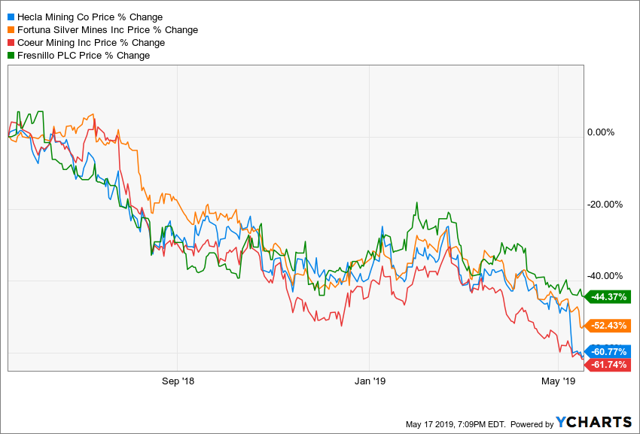

Speaking of mitigating risks, specifically with producers, here's a zoomed out chart over the last year, showing very clearly some examples of how bad things can get if one picks the wrong individual stocks during a "bad" market.

HL is down -60.77%. Fortuna Silver (FSM) is down -52.43%. Coeur Mining (CDE) is down -61.74%. Fresnillo (OTCPK:FNLPF) is down -44.37%.Hecla Mining, this time shown over a longer one-year time frame, once again gives us an example of an overwhelmingly poor performer, as it can be seen above that shares of HL have been absolutely shredded, most recently plummeting further still after the company reported a net loss of -$25.7 million for Q1, outlining further problems (not to mention negative cash flow) experienced at both its Casa Berardi mine located in Quebec and its gold operations out in Nevada.

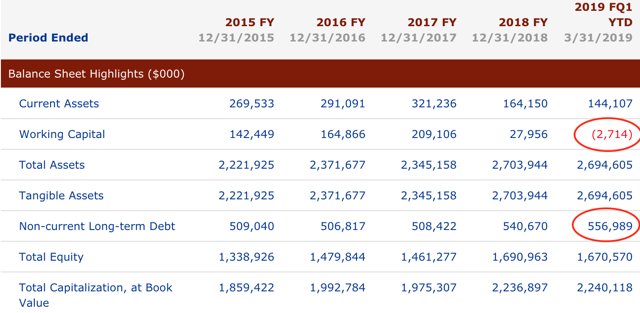

With a balance sheet featuring a negative working capital of only $2.714 million and debt of ~$557 million, there doesn't seem to be an easy way out for Hecla, especially not if metals prices don't recover in a hurry to help increase profit margins.

Source: Hecla Mining Financial Highlights

Source: Hecla Mining Financial Highlights

HL currently takes up a substantial 9.40% weighting in SILJ, and one has to ponder how much more destruction this particular holding will be allowed to inflict before allocation is reduced or the stock is removed entirely from SILJ?

But it should be noted again that in a low price environment for metals, it's going to be tough for a lot of companies, not just Hecla Mining, to make money.

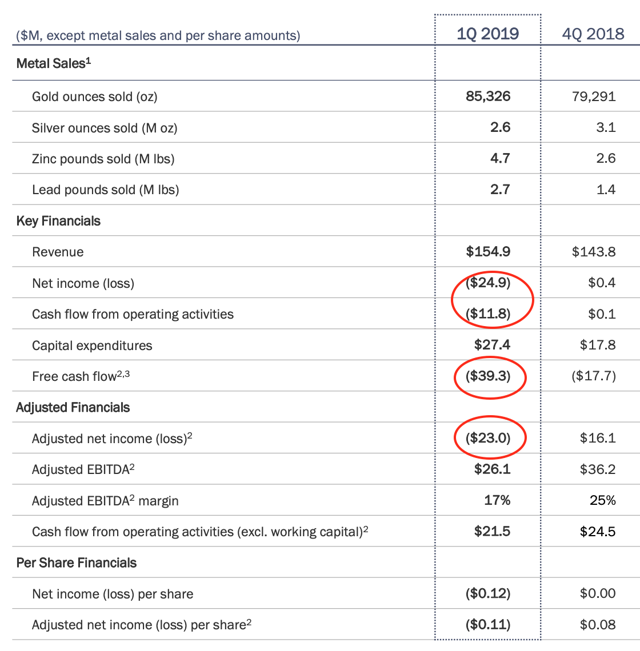

For instance, Coeur Mining also reported underwhelming Q1 results, showing a net loss of -$24.9 million and negative free cash flow of -$39.3 million.

Source: Coeur Mining 2019 First Quarter Earnings Presentation

Source: Coeur Mining 2019 First Quarter Earnings Presentation

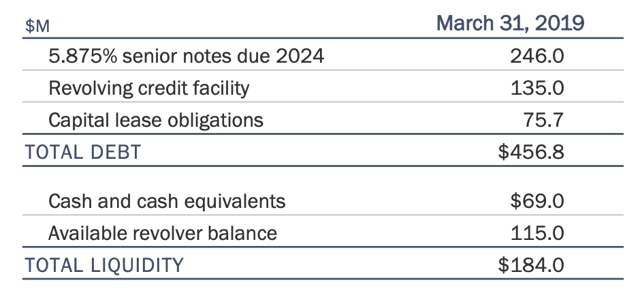

Coeur Mining's balance sheet shows a cash balance of $69 million with total debt registering at $456.8 million.

Source: Coeur Mining May 2019 Corporate Presentation

Source: Coeur Mining May 2019 Corporate Presentation

Perhaps the above numbers aren't as alarming for Coeur Mining as is the present situation going on over at Hecla Mining, but with not much cash left, a whole lot of debt to service, and low metals prices, it would be tough even for the most optimistic of speculators to envisage how the balance sheet will turn around for both companies moving forward from here barring some kind of ferocious bull market taking place ala 2016 to come and save the day.

Currently, Coeur Mining takes up a 3.69% weighting in the SILJ ETF and is a top 10 holding.

At this point, one might be pondering why do some speculators and ETF products such as SILJ insist on allocating such a large weighting of their portfolios in favor of marginal producers (e.g. HL, CDE) when the current financials look to be in such bad shape?

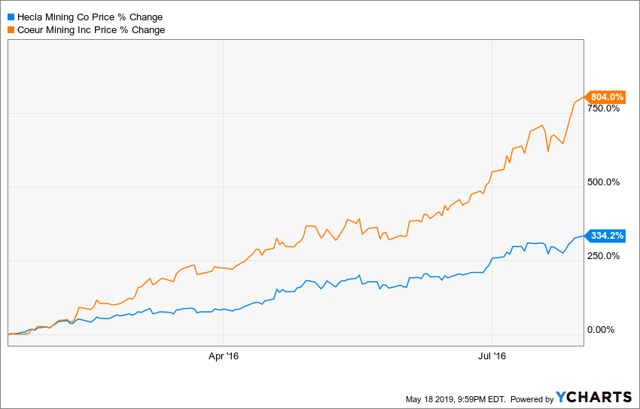

As it turns out, it's because these producers are so marginal that they tend to outperform most of their peer groups in a bull market (particularly a raging one) as they can quickly go from being cash-strapped (i.e. negative free cash flow generating) to turning lots of profits as their profit margins expand with rising metals prices.

In fact, during the 2016 run-up in silver stocks, the aforementioned "marginal producers" both produced epic returns for shareholders.

HL was up 334.2%. CDE was up 804%.However, it should go without saying that timing when the next turn will occur for metals prices and mining stocks is exceptionally tricky, and the end results can be catastrophic for speculators who bet on the wrong stocks.

Final Thoughts

At this time of writing, both HL and CDE are included in the top 10 holdings list on the SILJ ETF, which goes to show exactly how difficult it can be trying to separate out the wheat from the chaff; ETF products can (and do) get it wrong too, which reaffirms the importance of diversification in a down market.

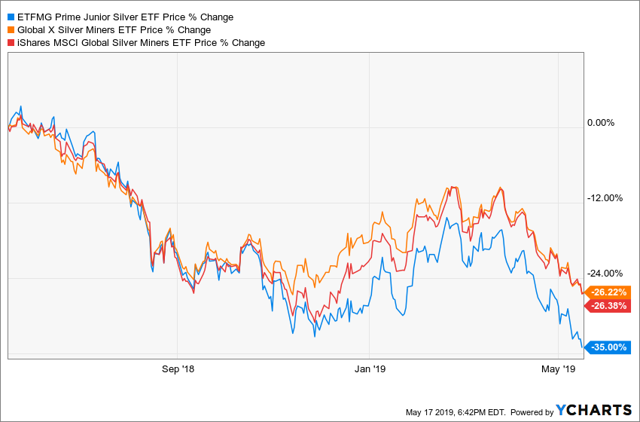

The following shows a one-year performance chart for a select few silver ETFs.

SILJ is down -35%. Global X Silver Miners ETF (SIL) is down -26.22%. iShares MSCI Global Silver Miners ETF (NYSE:SLVP) is down -26.38%.Across the board, the share price performances of the above three ETF products over the past year are cringeworthy on their own, but they are still demonstrably better than some of the worst figures that can be found across the industry (e.g., HL, CDE); again, picking the wrong individual stocks can have devastating consequences to one's portfolio.

Of course, if speculators are not particularly enamored by certain holdings/weighting contained within an ETF product, such as SILJ, they can always feel free to construct their own "custom" ETF. Naturally, choosing to speculate via "manual mode" will take a lot more work and research (not to mention active trading) as opposed to going on "auto pilot" (which is what an ETF is supposed to do).

Regardless of the approach one ultimately elects to choose for themselves, silver looks weak at the moment, down to $14.40/oz, and the share price of many/most silver mining stocks have started to collapse back down, after peaking in Q1 of this year. Right now, it's a most challenging environment fraught with landmines everywhere. As such, diversification is the name of the game and key to survival until (hopefully) better days return to the silver sector.

Disclosure: I am/we are long SILJ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow FI Fighter and get email alerts