Royal Gold: Still One Of The Strongest Streaming Companies

Royal Gold's income statement was overshadowed by tax expenses and an impairment charge.

The cash flow results look much better.

Pascua-Lama seems to be a dud, delays at Mt Milligan will be felt in the next two quarters, but New Gold's Rainy River will soften the blow.

Introduction

Whilst the other streaming companies like Franco Nevada (FNV) and Wheaton Precious Metals (WPM) enjoy more attention from the investor community, Royal Gold (RGLD) is a smaller outfit which definitely deserves some attention as well.

RGLD data by YCharts

RGLD data by YCharts

Royal Gold currently has 65.5M shares outstanding, for a total market capitalization of $5.8B. Keep in mind the company's financial years are not aligned with the calendar years. The financial year-end for Royal Gold is on June 30.

The results of the first nine months of the year indicate the company is on track

Royal Gold sold approximately 49,000 ounces of gold, 272,000 ounces of silver and 4.5 Million pounds of copper in the third quarter of its financial year. According to the company, this is the equivalent of 63,000 gold-equivalent ounces, as the higher copper price provides a nice boost to the gold-equivalent calculations.

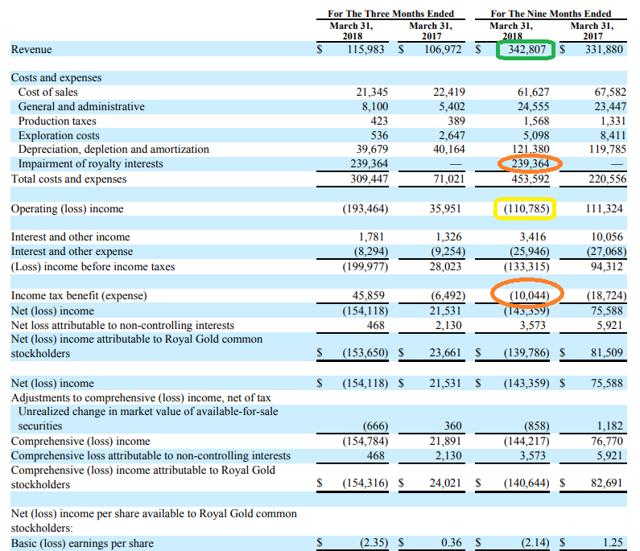

The total revenue however, was higher than expected based on the aforementioned production results. Royal Gold reported a total revenue of $116M, as the royalty payments (which obviously aren't included in the streaming results) added an additional $33M to the top line. An 8% increase compared to the third quarter of the previous financial year. Looking at the 9M results, Royal Gold's total revenue increased by almost 4% to $343M.

Source: SEC filings

Don't let the operating loss of $111M fool you; this was caused by a $239M impairment charge in the most recent quarter, as Royal Gold reduced the value of the Pascua-Lama project (owned by Barrick Gold (ABX)) on its balance sheet, after Barrick had to suspend its activities to advance the property. On top of that, Barrick also reduced the reserves as it re-classified 14 million ounces of gold from the reserves to the resources. A serious issue, but that's the main risk associated with an investment in a streaming company the companies that effectively own the project still need to make sure the project works, and an upfront streaming-related payment often is a bit like a jump in the deep.

This impairment charge (as well as the interest expenses) are the main reason why Royal Gold's first nine months of the year appeared to be pretty bad with a net low of $140M or $2.14 per share...

But as the business model of streaming companies is based on huge capital investments up-front, the free cash flow results are usually better than the income statement. After all, the acquisition of a stream is paid before a single ounce of gold or silver gets delivered, where after the stream gets depreciated on the income statement, but said depreciations obviously don't result in an additional cash outflow.

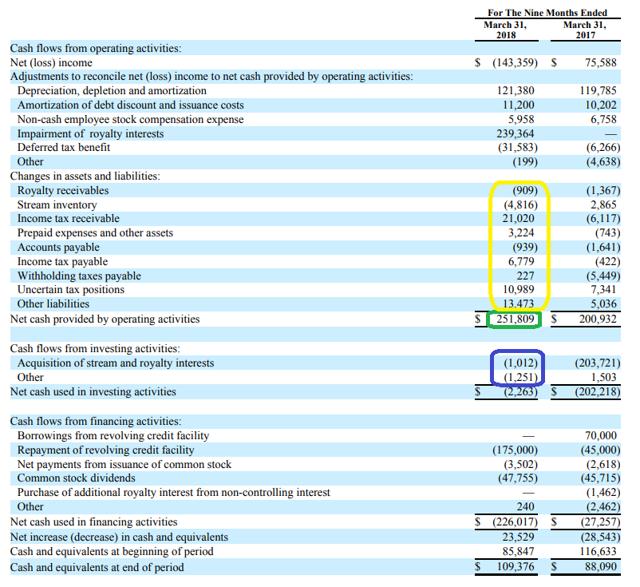

Source: SEC filings

Royal Gold reported an operating cash flow of $252M, but this incorporated a positive contribution from changes in the working capital position. After making the necessary adjustments, the 'real' operating cash flow was approximately $203M. As virtually no new streams or royalties were purchased, the capex was almost zero, resulting in a free cash flow result of $200M.

Thanks to this strong cash flow result and the contribution from the working capital changes, Royal Gold was able to repay $175M of the credit facility, which should reduce the interest payments going forward.

Source: company presentation

How does the US tax reform have an impact on Royal Gold?

As Royal Gold is an American company and doesn't seem to be using any 'sunny islands' for its streaming and royalty deals (like most other streaming companies do), the new US tax law is very important for the company's bottom line. A reduction from 35% to 21% is a substantial improvement, but as RGLD's financial year isn't following the calendar year, it has applied an average corporate tax rate of 28% on this year's results.

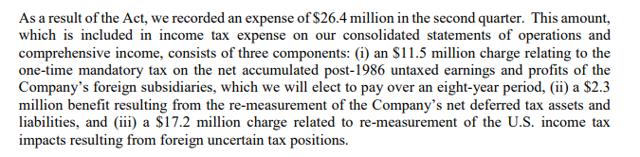

But there's more. In the second quarter of its financial year, Royal Gold reported a total tax expense of $26.4M. Perhaps this was a negative surprise to some investors as most companies were able to report a (deferred) tax benefit from the changes in the tax regulations, but Royal Gold was transparent about what happened and broke it down for us:

Source: press release

These non-recurring tax expenses were incorporated in the financial results, and Royal Gold should see a positive impact from here on.

Investment thesis

With a strong balance sheet and New Gold's (NGD) Rainy River project finally starting to contribute gold and silver to Royal Gold's consolidated output, the company seems to be in a relatively good shape. Unfortunately the Pascua Lama issues will destroy quite a bit of value as I'm not so sure Royal Gold will make any money on that deal (especially if you use a discount rate to calculate the sum of the cash flows Royal Gold hopes to receive).

Q4 FY 2018 and Q1 FY 2019 will be light due to a reduced contribution from the Mt Milligan project (operated by Centerra Gold), but I hope Rainy River will be able to mitigate the impact. As New Gold indicated Rainy River was on the right track in April considering a sharp increase of the production rate, I am confident Royal Gold's cash flow profile will remain intact.

With an adjusted operating cash flow of just over $4/share, Royal Gold isn't cheap at all. But it's definitely a good idea to keep an eye on its performance as the recent weakness on the gold markets could provide an opportunity to initiate a position.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Long Barrick Gold and New Gold.

Follow The Investment Doctor and get email alerts