Options Bulls Scored Big On This Red-Hot Oil Stock

Subscribers to Schaeffer's Option Advisor service won big on our Phillips 66 (NYSE:PSX) February 87.50 call recommendation. Here's a closer look at what initially drew us to PSX, and how the successful options trade unfolded.

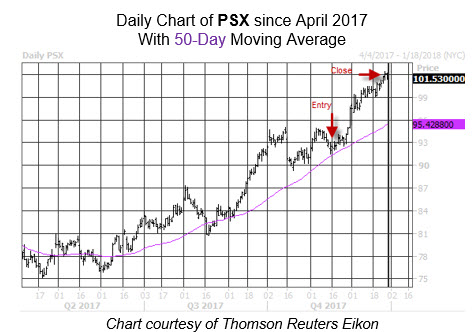

When we recommended the call option in mid-November, Phillips 66 stock sported a year-over-year lead of 11.4%. PSX had recently pulled back from record high levels, but the shares had found support at their 50-day moving average. The oil issue bounced off this trendline back in September, which was in the same neighborhood as the stock's 2015 high. An additional layer of support was found at the round $90 level, which was 20% above PSX's 2017 closing low.

Short sellers were also in covering mode. Short interest on Phillips 66 fell by 17% in the reporting period before our recommendation. However, there were still 6.3 million shares tied up in short interest, three times PSX's average daily trading volume. This was a great source of potential buying power that could enter the market.

Despite the encouraging technical setup, there was room for analysts to upgrade the stock. Of the 14 brokerages covering PSX at the time, only six maintained "buy" or "strong buy" ratings. A round of bullish brokerage notes could bring more buyers to the table.

Finally, anyone that was looking to buy short-term options could have done so for an apparent bargain at that time. PSX's Schaeffer's Volatility Index (SVI) of 17% ranked in the bottom one-third of annual readings, signaling relatively muted volatility expectations.

As expected, PSX stock began to rally off support, and gapped higher in early December after the company received some encouraging news with its Gray Oak Pipeline system. When Phillips 66 shot to a record high on Dec. 27, our 100% target was achieved.