One Reason to Take a Bite Out of Chipotle Stock

CMG options are affordably priced at the moment, too

CMG options are affordably priced at the moment, too

It's been almost over a month since we last checked in with Chipotle Mexican Grill, Inc. (NYSE:CMG), when analysts were piling on the bull notes ahead of earnings. A lot has gone down since then, but the song sounds the same for Chipotle stock, as the analyst community remains skeptical.

According to Schaeffer's Senior Quantitative Analyst Rocky White, Chipotle stock showed up on a list of stocks with a high bullish chart score, but with less than 50% buy recommendations. More specifically, of the 26 brokerages covering CMG, 17 rate it a "hold" or "strong sell." Plus, the consensus 12-month price target of $849.93 is just a slim 4.6% premium to its current perch at $810.97. What this means is that the security is ripe for upgrades and/or price-target hikes that could vault it higher in the short term.

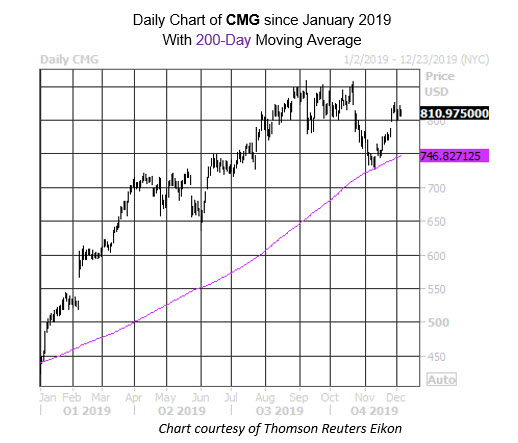

The word may already be spreading, as Cowen upgraded Chipotle stock to "outperform" from "market perform" just last week. After scraping the $856 level after earnings in October, the shares took a breather, but the pullback found support at their 200-day moving average. Year-to-date, CMG is up 87%.

Options traders have targeted calls with gusto lately. This is according to data from the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows a 10-day call/put volume ratio of 1.41. This ratio ranks five percentage points from an annual high, indicating the rate of call buying relative to put buying is unusual.

Options are certainly the right vehicle for anyone looking to invest in CMG's next move. The security's Schaeffer's Volatility Index (SVI) of 23% sits in the 9th percentile of its annual range. This means short-term options are pricing in extremely low volatility expectations right now.