Oil Price Rises Despite Larger US Crude Stocks. Russian Production Worries / Commodities / Crude Oil

The two global crude benchmarks are stillenjoying momentum that began on Thursday – despite larger-than-expected UScrude inventories – following reports from the financial press that Russia willcut oil exports from its western ports by 25% per month in March compared toFebruary in response to Western sanctions.

The two global crude benchmarks are stillenjoying momentum that began on Thursday – despite larger-than-expected UScrude inventories – following reports from the financial press that Russia willcut oil exports from its western ports by 25% per month in March compared toFebruary in response to Western sanctions.

These claims, however, have not yet beenconfirmed by the Russian Ministry of Energy.

The western ports of Primorsk, Ust-Luga,and Novorossiysk export around 2.5 million barrels of crude a day. Therefore, a25% reduction would imply a reduction in exports of 625,000 barrels per day, orabout 0.6% of the world oil supply.

This contraction would thus exceed thatannounced by the Russian Deputy Prime Minister in charge of Energy, AlexanderNovak, earlier in February by 500,000 barrels per day.

In addition to the disruptions in supplyfrom Russia, there is also growing demand from China and India, which mightshow signs of a market that could become even more tight.

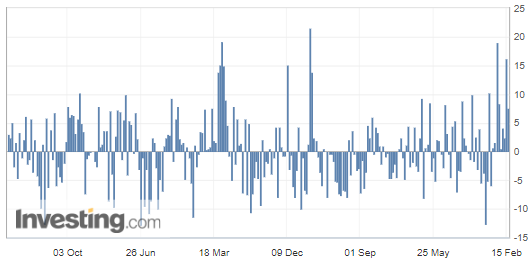

UnitedStates Crude Oil Inventories

Commercial crude oil reserves postedanother strong weekly rise last week in the United States, according to figuresfrom the US Energy Information Agency (EIA), marking their ninth consecutiveincrease.

These commercial stocks rose by 7.6million barrels, well above the 2.8 million barrels forecast by analysts.

This new increase in crude oil reservesshould have a downward effect on prices, but it reflects lower refineryactivity due to the infrastructure maintenance season. On the other hand, itwas accompanied by a decline in gasoline stocks:

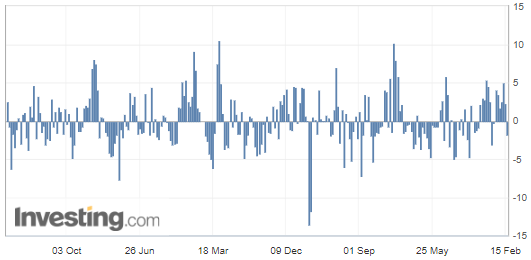

UnitedStates Gasoline Inventories

The pressure on the supply of distilledproducts can be explained by the relatively mild winter weather both in theUnited States and in Europe.

However, recession fears continue todominate the market – thus capping crude's gains – as major central bankscontinue to send signals that further interest rate hikes are in sight amidhigh inflation.

Chartingand Analysis

On a macroeconomic level, the US dollarindex (DXY/USDX) is returning to $105 territory, with the next quarterly pivottarget of $107 if the index breaks above 105.631 (its previous swing high), asI mentioned inmy previous article that such a breakout could be a sign of strongerbullish enthusiasm.

On the West Texas Intermediate (WTI)crude oil April 2023 futures contract, the bears gave up just on the lower sideof the short-term regression channel, thus decreasing chances of a breakoutbelow the short-term regression channel (the small one encompassed into thelarger one). Now, as the market recovers, it is probably aiming towards thequarterly pivot located around the $80 psychological level as the next target.

Have a nice weekend!

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.