Nevada-Focused Gold Firm Amends Agreement to Acquire Gold Project

Certain terms are revised regarding Fremont Gold's acquisition of Griffon on the Cortez Trend.

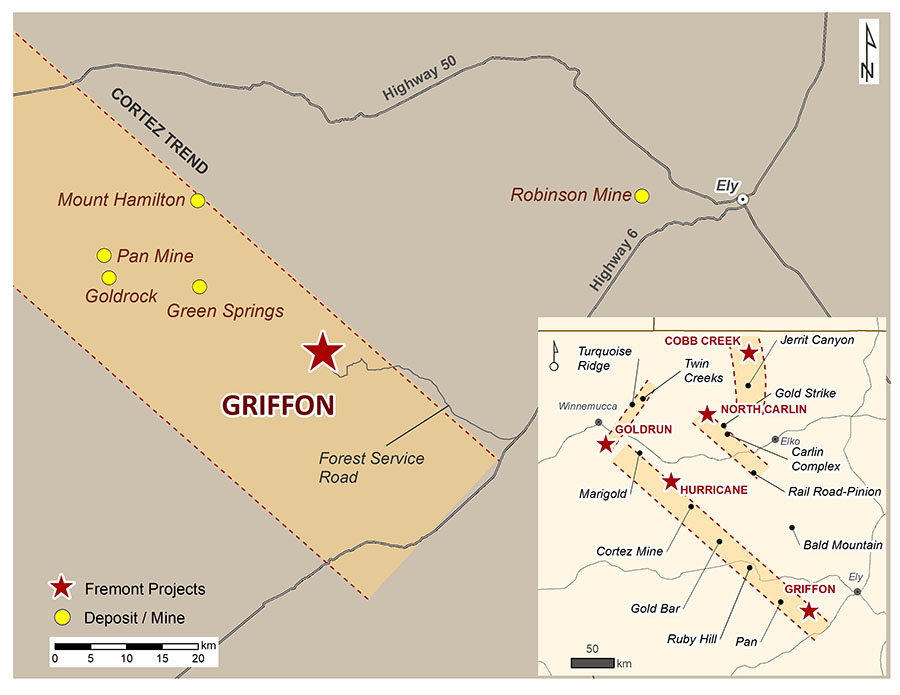

Fremont Gold Ltd. (FRE:TSX.V; FRERF:OTCQB; FR2:FSE) announced in a news release it has amended the terms of the option agreement for its acquisition of the Griffon gold project on Nevada's Cortez Trend.

The original agreement of December 2019, entered into with Liberty Gold Corp. subsidiary Pilot Gold (USA) Inc., included a requirement that Fremont pay Pilot $50,000 on Dec. 16, 2020. It also called for Fremont to issue to Liberty a number of common shares that would increase Liberty and its affiliates' share ownership to 9.9%.

Fremont and Pilot recently agreed to a few modifications of the terms. One is that instead of the $50,000 payment due Dec. 16, 2020, Fremont will pay $25,000 and do so after the Toronto Stock Exchange (TSX) approves the revised terms.

The other change revises the issuance of shares. Now, Fremont will issue 10 million common shares to Liberty over four years. Fremont already has issued 2.5 million shares and will issue another 2.5 million after the mentioned TSX approval. Fremont is to pay the third tranche on or before Dec. 16, 2022, and the final one on or before Dec. 16, 2023. The company noted that these securities will be subject to a four-month hold period.

Read what other experts are saying about:

Fremont Gold Ltd.[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Fremont Gold and Liberty Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Liberty Gold, a company mentioned in this article.