Mining's Tesla moment: DeepGreen harvests clean metals from the seafloor

A first look at DeepGreen Resources, a seafloor mining startup partnered with Glencore, Maersk, and Fiore Group to disrupt the metals industry and defend the environment.

Growing up on his family's dairy farm in Queensland, Australia, Gerard Barron developed a work ethic that has helped him realize success in diverse industries. Barron has built and sold successful ventures in the finance, publishing, international distribution, and telecommunications sectors.

He co-founded and was CEO for more than 10 years at AdStream, one of the world's leading advertising technology software-as-a-service companies. AdStream's annual revenues are now over $100 million.

A self-described "active investor", Barron backed geologist and friend David Heydon's vision for a pioneering underwater mining company, Nautilus Minerals, in 2001, around the same time he was founding AdStream. Barron and Heydon had complimentary skillsets, with Barron excelling at communication, and fundraising, and Heydon coming up with ideas and contributing technical skills.

By 2007, Nautilus had gone public and raised over $400 million. Heydon felt new management skill sets would be required, so he stepped aside as CEO. By that time, Barron had turned a $226,000 investment into $31 million, and he successfully exited his position near the height of the market, an incredible six year trade.

DeepGreen CEO Gerard Barron aims to build DGR into the world's first zero waste metals producer

In 2011, Heydon, along with his son Robert, founded DeepGreen Resources Inc. (DeepGreen), a private Canadian company, and turned to Barron to help them get access to capital to support their new dream of creating the world's first producer of clean metals, with zero waste material after processing.

Think about that for a second: a long-term supply of metals without scarring the earth or creating waste materials.

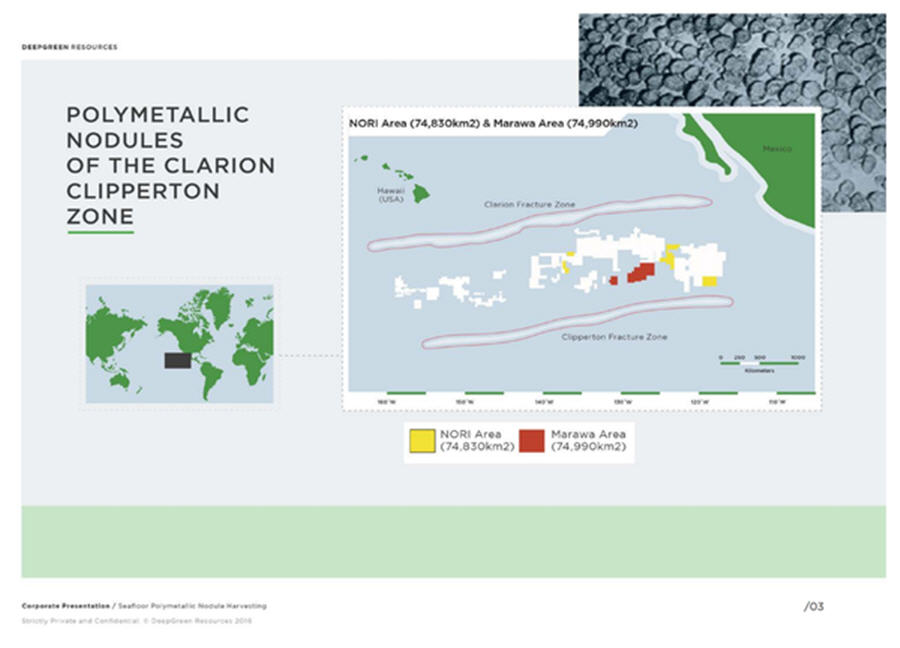

DeepGreen is one of a handful of private companies that have succeeded in obtaining licences from the International Seabed Authority (ISA) to a reserved area of the Clarion Clipperton Zone (CCZ) of the East Pacific Ocean. Others big name players interested in the space include China Minmetals, Lockheed Martin, and DEME Group.

DeepGreen has two exploration licenses in the CCZ, known to host a massive resource of high grade polymetallic nodules since the 1870's. These nodules are rich in nickel, copper, manganese, cobalt, and other important rare earth minerals, amounting to a copper equivalent grade of over 7%.

The nodules located in the CCZ have been successfully trial mined in the 1970s, but the ISA did not exist at the time and thus exclusive rights to commercialize the deposits in international waters could not be obtained. Today, a title regime has been established by the ISA and significant technological advancements in the offshore oil & gas industry have been made that may translate to the seafloor minerals industry.

Barron and Heydon are dedicated to bringing their DeepGreen dream to fruition and believe they are well positioned to do so for a number of reasons:

DeepGreen is focused on areas located in international waters and thus under the purview of the ISA. This means that there is a set of very clear rules and regulations outlining what DeepGreen is permitted to do and how they are permitted to do it. In other words, the regulatory and geopolitical issues that often plague offshore operations should not be a factor.DeepGreen is focused on harvesting polymetallic nodules, which are mineral precipitates formed of concentric layers of iron and manganese hydroxides around a core. Unlike underwater volcanogenic massive sulfide (VMS) ore deposits, which require excavation of large rock deposits and processing into smaller pieces in order to pump the material to the surface, these golf ball to potato sized nodules occur over extensive areas of the seafloor, ready to be harvested without any cutting or grinding as they are not attached to substrate.The size and scale of the nodule resource is remarkable. DeepGreen has potential for centuries of mine-life of a conventional mine. The material could produce LME-grade nickel and cobalt, premium grade manganese dioxide and copper sulphide, as well as zinc sulphide concentrate, high-grade silica and iron hydroxide, and a nitrogen-calcium feed for the fertilizer industry.From an environmental standpoint, D eepGreen is aiming for zero tailings generation, with the potential for this to be a step change for the minerals industry, where disposal of large volumes of toxic tailings is considered one of the biggest environmental impacts imposed by land-based mining. To this end, DeepGreen has spent considerable time and resources in developing a proprietary, patented hydrometallurgical processing technology to efficiently extract and produce high grade manganese, nickel, copper, and cobalt products from the nodules.Seafloor mineral extraction also offers a socially sustainable alternative to terrestrial mining as itdoes not impact local landholders or heritage lands, nor does it cause population displacement.To date, DeepGreen has invested approximately US$19 million, including US$5 million from Glencore at US$2.50 per share in 2012. As part of this transaction, Glencore was granted an offtake arrangement enabling it to take 50% of the nickel and copper produced from one of the areas in which DeepGreen has an interest.

In March 2017, DeepGreen entered into an arrangement with Maersk Supply Service pursuant to which Maersk has committed one Anchor Handler Tug Supply (AHTS) Vessel and one Subsea Support Vessel (SSV) for a total of five marine campaigns to the company's NORI Area D Project from 2017 through 2019. The AHTS vessel will support environmental studies of the seabed reaching a water depth of 4000+ meters and the SSV will be utilizing its deck capacity as well as crane capabilities for testing the nodule harvester prototype. Maersk's service contribution of approximately US$25 million will convert to DeepGreen common shares at US$1.25 per share.

On May 30, 2017, DeepGreen announced plans to go public by way of a reverse takeover of DV Resources, a publicly-traded mineral exploration company managed by Frank Giustra and Gord Keep's Fiore Management and Advisory.

DeepGreen is also planning to raise up to US$20 million by way of an offering of subscription receipts at a price of US$1.25 per subscription receipt. Proceeds from the offering will be used to fund marine cruises for environmental studies, development studies, and general corporate purposes. There will be roughly 127 million shares outstanding following completion of the RTO.

Barron says DeepGreen will focus on purpose-oriented investors, rather than traditional mining audiences, for finance. The company plans to build networks in London, New York City, Los Angeles, and San Francisco, where the largest pools of capital are concentrated, including those focused on clean and socially conscious investing. Large international technology firms will also be targeted given the need for the metals contained in the nodules in the production of lithium-ion batteries.

Vancouver based mining entrepreneurs Paul Matysek and Brian Paes Braga, Executive Chairman and CEO at Lithium X Energy, respectively, have agreed to join DeepGreen's board of directors. Los Angeles-based private equity investor Sam Englebardt will also join Heydon and Barron on the board. Management will consist of Barron as CEO, Robert Heydon as COO, Jon Machin as Head of Offshore, and Dr. Samantha Smith as Head of Environmental and Social.

DeepGreen will publish a Preliminary Economic Assessment (PEA) soon describing the resource, the harvesting and processing approach, and preliminary project economics.

Closing of the deal is subject to completion of the financing, exchange approval, and other customary conditions.

Read: DV Resources Ltd. Announces Acquisition of DeepGreen Resources https:[email protected]/dv-resources-ltd-announces-acquisition-of-deepgreen

Disclaimer:

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Tommy Humphreys is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Tommy Humphreys is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Tommy Humphreys' online newsletter, especially if the investment involves a small, thinly-traded company that isn't well known.

Tommy Humphreys' past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Tommy Humphreys owns shares in the companies he features, and that is the case with respect to DeepGreen. For those reasons, please be aware that Tommy Humphreys can be considered extremely biased in regards to the companies he writes about and features in his newsletters, including DeepGreen. Because Tommy Humphreys owns shares of DeepGreen, there is an inherent conflict of interest involved that may influence his perspective on DeepGreen. This is why you should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities.

Tommy Humphreys may purchase more shares of Leagold for the purpose of selling them for his own profit and will buy or sell at any time without notice to anyone, including readers of this newsletter.?EUR? ?EUR?Tommy Humphreys shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter (specifically DeepGreen) will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Tommy Humphreys does not undertake any obligation to publicly update or revise any statements made in this newsletter.

by @tommy on June 5, 2017 for CEO.CA