Junior Gold Miners: New Yearly Lows! Will We See a Further Drop? / Commodities / Gold and Silver Stocks 2021

It seems that choosing GDXJ to shortthe PMs was a good decision – juniors closed the day at new 2021 lows. Will ourprofits only grow from now on?

Gold’s yesterday’s intraday attempt torally was not bullish. On the contrary, it was what usually happens rightbefore a big slide. Especially given the USDX’s breakout.

Let’s start with the latter.

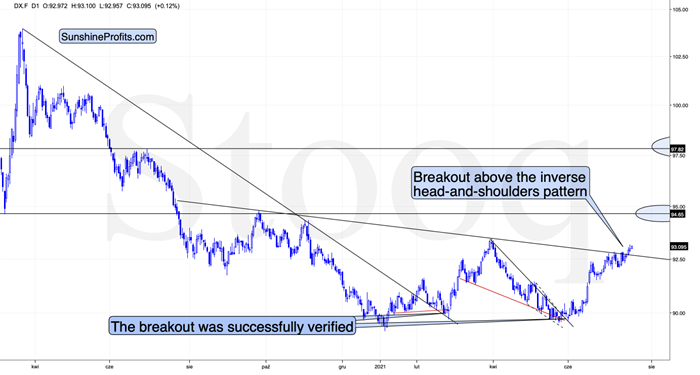

Yesterday there was a second session in arow when the USD Index closed above the neck level of the broad (~yearly) inversehead-and-shoulders pattern. Furthermore, it’s been moving slightly higherin today’s session, at least so far.

This is a very bullish price action – theUSDX’s breakout was not accidental, nor was it based on geopolitical news (thelatter tends to trigger temporary moves that are then reversed). Additionally,it was preceded by a consolidation. Consequently, it seems that this breakouthas a huge chance of being confirmed (we need just one more – today’s – dailyclose) and followed by another sharp rally. The previous highs at about 94.5are the initial upside target, but based on the inverse H&S pattern, theUSDX is likely to rally to about 98.

Therefore, what just happened (thebreakout above the formation’s neckline) has really bullish implications forthe U.S. currency. And since the latter tends to move in the opposite directionto gold, silver, and mining stocks, it’s also very bearish for them.

Goldand Its Stocks

That would be enough on its own to makethe outlook for the PMs bearish, but we have many more bearish indications, andsome of them are truly profound. The most bearish confirmation of the bearish priceprediction for gold doesn’t come from the USD Index but from the extremeunderperformance of gold stocks relative to gold.

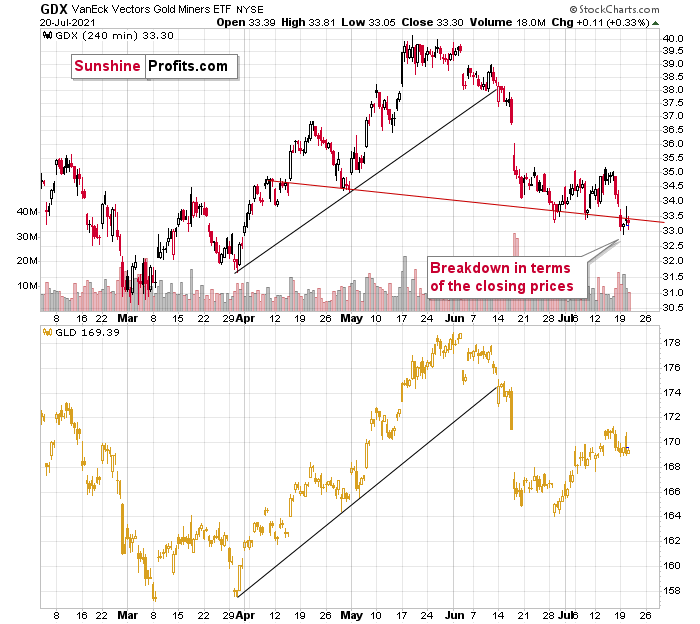

The GDX ETF (senior gold miners) movedbelow the recent lows, and it closed the day below the neck level of ahead-and-shoulders pattern based on the 4-hour candlestick chart. At the sametime, the GLD ETF is still relatively close to the middle of its previousdecline. If the comparison is still unclear, please consider the mid-Maybottom. The GLD ETF closed just slightly below it, while the GDX a few dollars below it.

And if you think this kind of relativeweakness is bearish, just wait until you see what the juniormining stocks did.

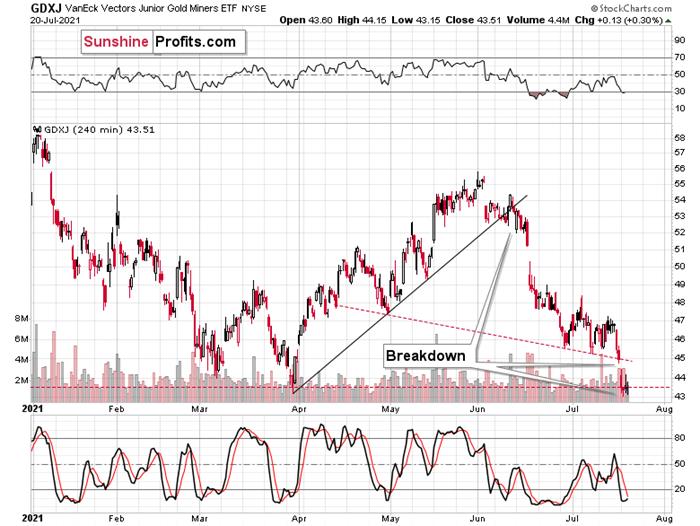

Junior miners declined not only below theneck level of the recent head-and-shoulders pattern (very clearly in both:intraday and closing price terms), but they actually closed the day at new 2021lows! And they didn’t invalidate this breakdown yesterday, despite the intradayattempt!

There are two markets that primarilyimpact the performance of the junior mining stocks. One is gold, and the otheris the general stock market. Gold is now about $140 above its 2021 lows, whilethe S&P 500 is over 16% above its 2021 highs. And yet, the GDXJ is belowits previous 2021 lows. It seems that choosing junior miners as a proxy forshorting the precious metals sector was a good decision – our profits arerising rapidly, and it seems that they are going to soar much more in thefollowing weeks.

What’s more, juniors are underperformingsenior gold miners too. You can see that by comparing the two previous chartsand by examining their ratio.

The ratio declines when juniorminers underperform seniors. This happens often when the general stockmarket declines – juniors are more correlated with the latter than the seniors.Interestingly, juniors underperformed recently, even while stocks were strong.If the general stock market declines from here, the underperformance is likelyto take an epic form – just as it did in early 2020.

This level of underperformance andweakness is truly breathtaking.

Ifminers – in particular, juniors – were able to decline so much withoutmeaningful help from gold and the general stock market, just imagine thecarnage they will suffer once this “help” finally arrives.

And given the breakout above the necklevel of the inverse head-and-shoulders pattern in the USD Index, it seems likethe key trigger to set the wheels in motion is already here.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.