It's Not Only Palladium That You Better Listen To / Commodities / Palladium

Whenever one hears the words precious metals, goldand silver spring to mind. But this world is much richer, and preciousmetals don’t end with the yellow or white metal. The less well knowncousins, platinum and palladium, can and do send valuable signals too. Beforewe examine silver, let’s take a look at something interesting in palladium.

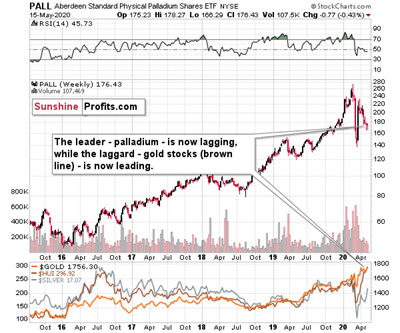

The interesting detail is palladium’s weakness. This precious metal was the one that soared most profoundly in thepast few years and while it recovered some of its 2020 declines recently, itappears to be back in the bearish mode as its unable to keep gained ground,even despite the move higher in the general stock market.

The previous leader is now definitely lagging. Andyou know what was leading? The previous laggard – gold stocks. And you knowwhat is leading now? Silver – as it usually does in the final part of theupswing. The HUIIndex is marked with brown in the bottom part of the chart. Whenleaders are lagging, and laggards are leading, one shouldrecognize that the market is topping – and that’s the key take-awayfrom the palladium and platinum analysis right now.

Palladium was the leader and platinum was actuallyone of the laggards. Palladium was down by 0.43 last week. And what didplatinum do?

Platinumrallied by 3.52% last week.

Thebig rally in platinumto palladium ratio is yet another sign from the relative valuationsanalysis pointing to a nearby top in the precious metals sector.

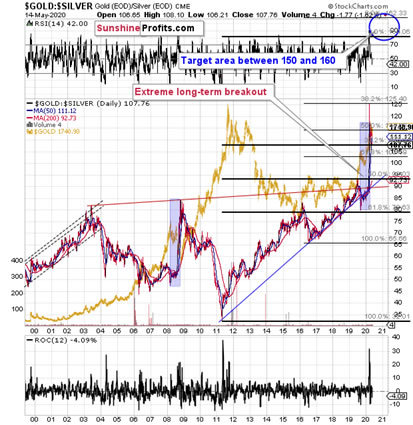

Having said that, let’s take a look at silver’sforecast. In case of the white metal, its ratio to gold might bemore important at this time than price itself.

The silver futures are trading at $17.73, and goldfutures are trading at $1,773, which means that in case of thefutures market, the gold to silver ratio has just moved to the 100 level.

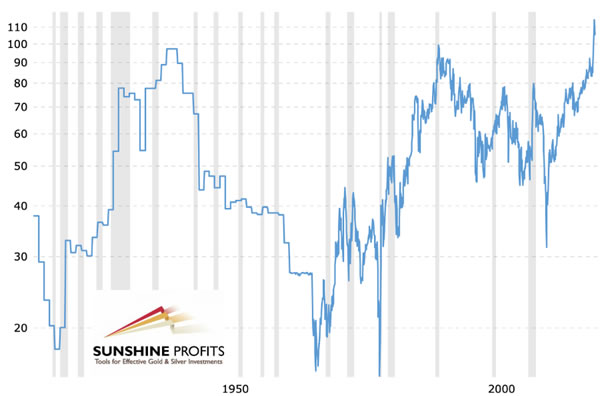

Earlier this year, the goldto silver ratio had broken above the very long-term and criticalresistance of 100. Is it really that surprising that silver is verifying thebreakout by moving back to the previously broken level? It’s not.

The key ratio for the precious metals market hasjust moved back to the previously broken resistance level and it’s verifying itas support. This is relatively normal that after a breakout, the price or ratiomoves to the previously broken level.

Yes, on a short-term basis, and looking at silverchart alone, the breakout above the April highs and a quick move to theearly-March highs was a clearly bullish phenomenon. However, this ignores thefact that silver is known for its fakeouts (fake breakouts)and that looking at its relative performance to gold has been more useful (andprofitable) than looking at its individual technical developments, especiallyif they were not confirmed by analogous moves in gold.

Consequently, we view the current action in silveras bearish, not bullish, especially since the gold to silver ratio moved backto the very strong support level (100), which likely means that silver’sstrength relative to gold is over, at least for some time.

Thankyou for reading the above free analysis. It’s part of today’s extensive Gold& Silver Trading Alert. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Signup for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.