It's Officially The Biggest Bubble Of All Time

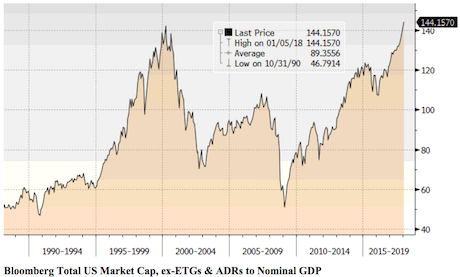

The market is now officially in the largest bubble relative to the economy in history.

Warren Buffett once famously stated that his favorite means of valuing stock was the stock market capitalization to GDP ratio. This was the very metric he used when he decided to avoid investing during the Tech Bubble.

Bill King of The King Report notes that based on this metric, stocks are now valued at 144.15% of US GDP, surpassing their previous peak set at the absolute top of the Tech Bubble in March 2000.

While some pundits may point to the economy or the Trump economic agenda for this move, the reality is that everything the markets have done since 2008 has been driven by the Fed creating a bubble in US sovereign bonds, also called Treasuries.

As I detail in my bestselling book The Everything Bubble: the Endgame For Central Bank Policy, when the Fed did this, it forced Treasury yields to record lows.

And because these yields represent "the risk-free rate of return" for the entire financial system ALL risk, including stocks adjusted accordingly.

This is why I coined the term The Everything Bubble in 2014. And it's why I am growing increasingly concerned about the recent moves in Treasury Bond Yields, as they broke above their 20-year downtrend,

What's coming will take time for this to unfold, but as I recently told clients, we're currently in "late 2007" for the coming crisis. The time to prepare for this is NOW before the carnage hits.

Graham Summers

Chief Market Strategist