INK Edge August Top 40: G-economy stocks maintain their lead

Today, for INKResearch.com subscribers and Canadian Insider Club members, we published our August Top 40 stock report. In every issue, we provide some context for the list of the 40 highest INK Edge ranked stocks, and today I am sharing with our entire community our take on current market and economic conditions which was published in the report. To see the list of the top 40 stocks, please join us. I would encourage you to join us soon as we will be increasing membership prices this fall. We also need to further restrict some data features on Canadian Insider due to rising data costs and in recognition of our growing Club membership base.

Inflation is leading

Back on March 19th, we sent out a special morning report which introduced our D versus G economy framework to assess risk and opportunity as the world worked through COVID-19. For a quick throwback to what we said, watch the 90-second video summary on INK Ultra Money.

As our regular readers will know, the D-economy represents a debt-driven deflationary outcome while a G-economy is characterized by government-led inflation. Inflation expectations would be the key factor in determining what type of economy would dominate and which types of assets would perform the best. Under D, bonds, cash, and gold would be expected to do well while under G, stocks and precious metals, including silver, would likely outperform. As it turned out, March 19th marked the bottom in inflation expectations this year. In fact, inflation expectations as measured by Treasury breakevens are generally back to where they were before the US recession started in February. Inflation is recovering faster than the economy, and that is something you will not hear from the bond bulls!

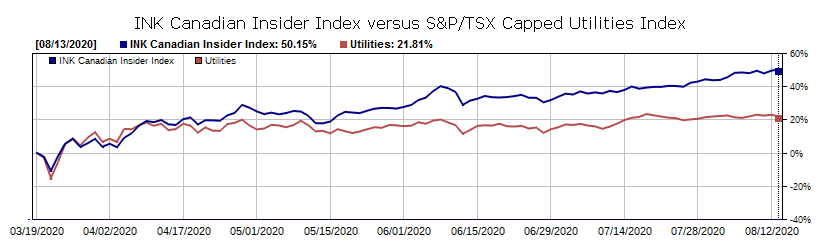

Meanwhile, the relative performance of assets has evolved as our framework expected. Inflation-sensitive stocks have outperformed bond-mimicking equities. For example, as of August 13th, the INK Canadian Insider Index, which is used by the Horizons Cdn Insider Index ETF (HII), is up 50.2% from March 19th, while the bond-sensitive S&P/TSX Capped Utilities Index is up 21.8%, less than half (see chart below). However, the big winner has been the junior mining dominated S&P/TSX Venture Index which is up 109.6%.

After such strong runs, it has us wondering if these inflation-oriented stocks can keep going or if the D-economy will strike back like the evil empire. We delayed this month's Top 40 to try and get a better sense of where we stand in relation to that question.

Since the COVID-19 crisis hit, the Federal Reserve has been successful at suppressing bond yields for the most part, even in the face of rising inflation expectations. However, late last week we began to worry that bond yields may start to head higher on the back of massive Treasury supply and rising inflation. In our Monday market and morning reports, we warned that software stocks appear vulnerable. In addition, our Venture Indicator, which tracks insider sentiment across the junior market, sent a short-term bearish signal over the weekend which we also discussed in our Monday market report.

As the week progressed, events unfolded remarkably as expected. On Tuesday, Venture stocks sold-off sharply, and over the last few days, software stocks have lagged as Treasury yields jumped.

Because we wanted the Top 40 rankings to capture the developments in the market over the past week, we have written these comments ahead of the August 13th ranking process being completed. So we will not be commenting on specific stocks on the list. Instead, we will share our thinking in terms of the implications of these developments for investors. If you are looking for the Big 10 list of the highest-ranked, largest-capped stocks, we will post it in the stock ideas channel of INK Chat. (subscribers should contact us if they have not received an invitation).

Generally, the move up in Treasury yields brings some good news for Canadian investors as it likely signals either more inflation or more growth ahead. In the Canadian market, we have plenty of stocks that can capitalize on either development. Ideally, we would be looking for companies with good pricing power domestically or which have exposure to areas of the global economy that will benefit from a weaker US dollar. We will avoid over-weighting bond proxies such as dividend-focused ETFs and defensive growth names including utilities, telecom, and software.

As for junior resource stocks, the recent gold and silver miner pullback was due at some point. We suspect the next phase of the Venture rally will not be as inclusive in terms of the big gainers. Companies with average or below-average management that used the recent run up to issue significant amounts of stock with generous warrant teasers may find it harder to keep up with stocks that have leaner capital structures, solid assets, and accomplished management teams. Meanwhile, polymetallic miners and oil & gas stocks which have lagged the rally and have sunny or mostly sunny INK Edge outlooks may be names to consider if you are looking to deploy more money into the junior space over the next few weeks. For those who have truly adventurous streaks, cryptocurrencies and cryptocurrency-related stocks may offer a nice complement to the precious metals complex.

We will close off this report with this final thought. While the dark D-economy empire may not be striking back, the volatility devils may well be running amok throughout markets in the coming weeks. We doubt that any asset class will be spared their mischief.

The Top 40 stock list is generated based on INK Edge V.I.P. outlook rankings as of August 13, 2020. The Horizons Cdn Insider Index ETF (HII) uses the INK Canadian Insider Index under license with INK Research.