How To Play The Next Stage Of The Marijuana Boom / Commodities / Cannabis

In the biggest boost for cannabissince Canada legalized recreational use in 2018, the United Nations has reclassified marijuana, removing it from its most strict drug control list, paving theway for a flurry of positive legal activity the world over …

But while U.S. states line up tolegalize recreational use, and while a change of power at the White House bodeswell for cannabis stocks, there are two multi-billion-dollar elements that weremissing, and one upstart company is aimed directly at this kingdom.

The kingdom is quality cannabisunderpinned by the kind of big data that could make Big Pharma come knocking ondoors.

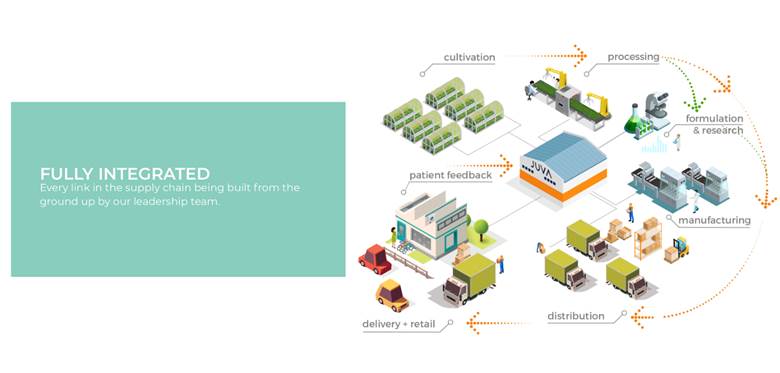

And one of the potential keys to thatkingdom could be held by Juva Life(CSE:JUVA; OTC:JUVAF), a California-based, vertically integrated company that isbuilding an entire ecosystem of cannabis cultivation, R&D, distribution,retail, delivery and the missing data and IP links.

This could make all the difference,and the timing is perfect ...

Five more states just legalized marijuana in ballot initiatives on November 3rd,and stock prices are already heralding the Cannabis Boom 2.0.

The first round was a massive spendby deep-pocketed cannabis companies on building quantity with little regard forquality … and investors failed to see sustained returns.

The second round is about data-driveninnovation, and that means quality.

And none of it means anything if BigData isn’t there to prove it up and sell it on.

In a rapidly evolved marketplace,it’s Juva Life’s “precision cannabis” that aims to put the money-making scienceback into marijuana.

Part cannabis stock... part thera-techstock... any of their 3 businesses could potentially reward investors withfront-page news in 2021.

Here are 3 reasons to keep a veryclose eye on Juva Life Inc this quarter:

#1 The Second Cannabis Boom Starts inCalifornia

Investors in the first cannabis boom in2018 who timed things right saw huge returns …

Aurora Cannabis Inc. (NYSE:ACB) went from $4.43 on November 4th to $11.21 on November 9th. Canopy Growth (NYSE:CGC) shot from $19 on November 4th to almost $25 five days later, in a run it hasn’t seen since the first cannabis boom of 2018. Tilray (NASDAQ:TLRY) surged from $6.00 on November 4th to over $10 on November 9th.But the first boom ended with a dullthud after a while because everyone focused on quantity rather thanquality--and there wasn’t enough science.

Now, the legal marijuana market is ontrack to reach $73.6 billion by 2027, according to Grand View Research.

And California--where Juva isbased--is one of the harbingers of the second boom--the better boom … thebigger and sustainable boom.

California's cannabis market isforecast to grow to $3.5 billion in 2021...

That’s even bigger than Canada’s market,and it’s a market that Juva Life (CSE:JUVA; OTC:JUVAF) plans to dominate by playing the game in an entirelydifferent way …

There’s probably only one guaranteefor success in the cannabis sector: patents, permits and licenses.

And that’s exactly where Juva has theserious advantage. Its CEO received the first-ever permit in the state ofCalifornia and Juva now has a head start on the competition.

But while they are on an aggressiveexpansion wave across California, they’re also aiming to make a significantfootprint in a national medical cannabis market that is heading to $9billion.

#2 The Biggest Money in Pot Is in Patentsand IP

The real money in Cannabis 2.0 is probablyin the patents … and Juva’s endgame is a focus on therapies, bolstered bygrowing retail sales revenues.

Juva’s flagship Hayward facility isalready permitted and under construction. It’s a massive 18,000 sq ft structurewith an adjoining 11,000 sq ft greenhouse.

And it’s ISO Class 5 cleanroom willbe the scene of Juva’s state-of-the-art “science of cannabis” research anddevelopment.

They will do everything in thisfacility from cultivation and research to manufacturing and retail--all focusedon achieving low-cost, high-quality growth operations combined withstate-of-the-art research.

On October 22nd, Juva received aConditional Use Permit, which is likely to expedite additional permitting, withfull production anticipated by mid-2021.

On October 22nd, Juva received aConditional Use Permit, which is likely to expedite additional permitting, withfull production anticipated by mid-2021.

It’s also just won conditionalapproval to develop a boutique flagship retail operation in a designer-styled environment at its Hayward facility by the city of Hayward.

Now comes the major push fordevelopment of “precision cannabis” products for targeted delivery of the“right formulation to the right individual at the right time”.

Juva Life (CSE:JUVA; OTC:JUVAF) is going after the IP scene full force acrossmultiple verticals, setting it up to be the “Integrated Vertical First Mover ofCannabis”, starting in California.

#3 This Is A Big Data Coup

Cannabis data is the differencebetween a successful market and a very successful market.

It’s the only thing connectingmedical cannabis to medical science …

It’s the missing element that couldcut millions of dollars off the costs of getting new cannabis based pharmaceuticaldrugs approved …

That also means it’s one thing thatwill attract the lucrative attention of Big Pharma.

It’s also one thing Juva has broughtto the table.

And when the company went public inNovember, it heralded a business plan of creating a potential--lucrative--nexusbetween medical cannabis and big pharma.

Juva is working with top scientiststo create the a research database that aims--for the first time ever to showconsumers, manufacturers, doctors, natural healthcare providers and Big Pharmaexactly which natural health products really work, for which healthproblems.

And it’s where natural health products get put on a soundscientific foundation, as Juva, led by CEO Doug Chloupek, works with top scientists for the ultimate evolution of cannabisresearch.

Their first 2,000 patient researchregistry has been approved...

And the results are expected within 6months, possibly making Juva a ripe target for Big Pharma.

Then Juva aims to patent and sell newcannabis brands targeted toward different ailments. That development isexpected to open big new markets for Juva in the medicinal space.

Juva’s big data system for cannabiscombined with its biotech prowess aims to create an entire life scienceecosystem … and one that would make it, for the first time in this industry’syoung history, efficient.

Juva’s (CSE:JUVA; OTC:JUVAF) state-of-the-art technology platform, if successful,won’t just help the industry find its footing and consumers find a heightenedlevel of confidence and efficacy, it will also present a valuable licensingopportunity for Big Pharma.

One of Big Pharma’s biggest problemsis the mountains of money it costs and time it takes to get new pharmaceuticaldrugs approved.

Juva’s research protocols, alreadyapproved by the Western Institutional Review Board, could speed up the processfor getting new medical products licensed for sale.

Welcome to California

This is where the second boom starts…

With a savvy company that’s plays thenew cannabis game in terms of patents, permits, licenses, science and bigdata.

Juva raised a total of $24 million inits pre-IPO funding rounds, helping it to become a fully integrated cannabiscompany. And that money is creating a revenue stream that is allowing it tobreak into the even more lucrative life sciences industry.

Retail cannabis is Juva’s entry intothe business. Scientific research on medical cannabis and a big data play that couldbring Big Pharma to its doors is Juva’s first mover advantage.

The news flow on this one is expectedto be fast for 2021, with patent applications, licensing and permittingannouncements across multiple verticals being put into position, not to mentionthe tailwinds of a change in regime in the White House.

Canada started the marijuana boom,but California is the catalyst for casting this net far wider.

By. Brenda Lansdowne

**IMPORTANT!BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READCAREFULLY**

Forward-Looking Statements

Certainstatements in this press release are forward-looking statements and areprospective in nature. Forward-looking statements are not based on historicalfacts, but rather on current expectations and projections about future events,and are therefore subject to risks and uncertainties which could cause actualresults to differ materially from the results expressed or implied by theforward-looking statements. Such forward-looking information includes thatcannabis use and sales will grow as currently predicted; timing of Juva’sconstruction or acquisition of facilities and commencement of associatedadditional revenues; that Juva will be granted patents for its specificformulations; that cannabis patents will prove valuable assets; Juva’s intendedexpansion into more markets; Juva’s plans to bring the latest science andtechnology to its product research and development; that it could be grantedgrowing and sales licenses; that Juva can lease new sales locations and gainbrand recognition; that through efficiency and vertical integration Juva cansubstantially lower its production costs and time below competitors; that Juvacan sell its product profitably; thatJuva will create a range of cannabis consumer healthcare products, to bedistributed through their own distribution channels; that Juva can successfullyintegrate pharmaceutical breakthroughs into its products; that Juva can achieveits sales targets and gross profit margins as planned; and that it will be ableto carry out its business plans.

Readers are cautioned to not place undue reliance onforward-looking information. Forward looking information is subject to risksand uncertainties which include, among other things: that regulatory approvalsmay not be obtained or may be obtained subject to conditions that are notanticipated; growing competition in the cannabis industry; announced orexpected business plans may not come to fruition because of inability to cometo final terms, or inability to obtain regulatory compliance; competitors mayquickly enter the industry; general economic conditions in the US, Canada andglobally; the inability to secure financing necessary to carry out its businessplans; competition for, among other things, capital and skilled personnel; thepossibility that government policies or laws may not permit legal cannabissales or growth or that favorable laws in place may change; interruption orfailure of information or other technology systems; the cannabis market may notgrow as expected; Juva’s drive for efficiency, time and cost savings may notachieve the expected results and its accomplishments may be limited; Juva maynot successfully develop a cannabis consumer brand; and it may not besuccessful in developing a cannabis based treatment for medical uses; even if itdevelops successful healthcare treatments, the products may not be accepted bythe market; the company may not be able to protect its intellectual property;its patent applications may be rejected or successfully challenged; Juva’sbusiness plan carries risk, including its ability to comply with all applicablegovernmental regulations in a highly regulated business; early entry risk byengaging in activities currently considered illegal under US federal laws; andregulatory risks relating to Juva’s business, financings and strategicacquisitions.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paidadvertisement and is not a recommendation to buy or sell securities.Safehaven.com, owned by Medtronics Online Solutions Ltd., and their owners,managers, employees, and assigns (collectively “Safehaven.com”) have been paidby the profiled company to disseminate this communication. In this caseSafehaven.com has been paid by Juva ninety thousand US dollars for this articleand certain banner ads. This compensation is a major conflict with our abilityto be unbiased, more specifically:

This communication should be viewed as a commercial advertisement only. We havenot investigated the background of the company. Frequently companies profiledin our alerts experience a large increase in volume and share price during thecourse of investor awareness marketing, which often end as soon as the investorawareness marketing ceases. We do not guarantee the timeliness, accuracy, orcompleteness of the information on our site or in our newsletters.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares of Juva andtherefore benefits from its price appreciation. Safehaven.com will not notifythe market when it decides to buy or sell shares of this issuer in the market.This is why we stress that you conduct extensive due diligence as well as seekthe advice of your financial advisor or a registered broker-dealer beforeinvesting in any securities.

NOTAN INVESTMENT ADVISOR. Safehaven.com is not registeredor licensed by any governing body in any jurisdiction to give investing adviceor provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consultwith a licensed investment professional before making an investment. Thiscommunication should not be used as a basis for making any investment.

OilPrice.com Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.