How Options Traders Profited Off This Flailing Chip Stock

There was options-related optimism ready to unwind

There was options-related optimism ready to unwind

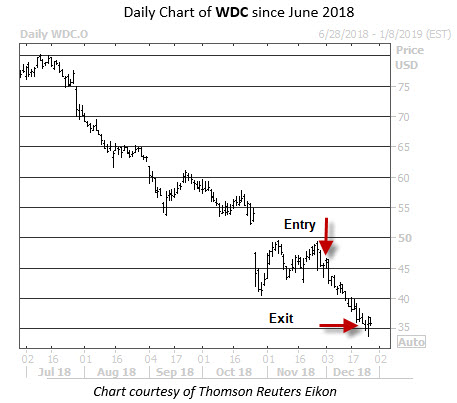

Subscribers to Schaeffer's Options Advisor service scored a 100% profit with the Western Digital Corp (NASDAQ:WDC) April 47.50 put we recommended. We'll take a closer look at why WDC appeared on our bearish radar, and how the winning options trade unfolded.

In the latest December issue of Options Advisor, Western Digital stock had already shed 50% year-to-date. On Oct. 26, WDC fell 18.2% in a brutal post-earnings dive. This bear gap took the shares below their 2018 half-high at $53.50, settling under the $47.50 level, an area that has since served as stiff resistance.

Short sellers were starting to come out of the woodwork, too. Short interest was up almost 47% from its mid-June lows, yet that only accounted for a slim 4% of WDC's total available float. Further, this total was 70% off its peak short interest levels from 2016. In short, there was ample room aboard the bearish bandwagon.

In the options pits, there was plenty of optimism to be unwound. The stock's 10-day call/put volume ratio stood at 1.24 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). A shift in sentiment was in play to pressure the shares even lower. Plus,WDC had tended to make outsized moves relative to what the options market was expecting, per its SVS reading of 82 -- making it an attractive target for premium buyers.

After our put recommendation, Western Digital stock continued to slide on the charts. A C-suite transition, and some ensuing bear notes, put added pressure on the semiconductor name. We closed our position on Monday, Dec. 24, allowing our subscribers to lock in a 100% profit in less than a month.