Hey, Remember About Gold Price's Powerful Reversal? / Commodities / Gold & Silver 2023

Gold price has been falling in today’spre-market trading, but… Given the recent (HUGE!) weekly reversal, does itreally surprise anyone?

The Historical Context

Well, it might surprise those thateasily forget what happened in the previous weeks and focus on just theday-to-day price swings, but the truth is that the context provided by previousweeks, months, and years (and the performance of other markets!) matters a lot.

I previously wrote about some detailscoming from the broader perspective and some from the immediate-term analysis,and all that remains true. The recent weekly reversal was so huge that itsimpact on the next weeks really needs to be kept in mind at all times. It’s notlikely that a daily price moves in any direction (especially that gold is lowertoday…) would invalidate the implications of the powerful weekly (!) reversal.

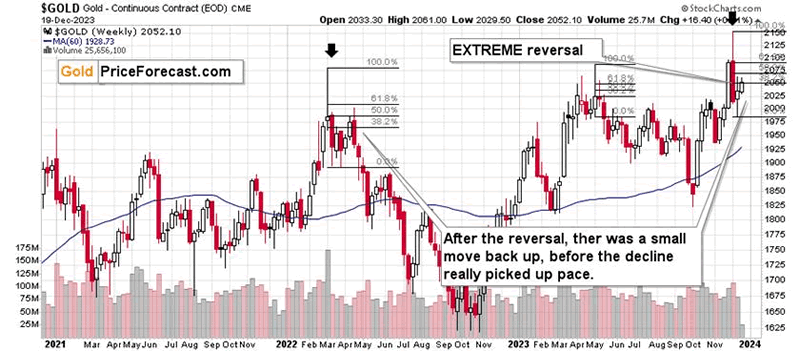

In case that massive reversal seems likea distant memory, here’s a reminder of what happened.

Gold soared above $2,100 only to plungeto almost $2,000, and in happened on huge volume. This was the most profoundweekly reversal in years. It was similar to the reversal that we saw in May2023 and the one from March 2022, and they both started big declines.

The same is likely this time.

This means that this and last week’s moves higher were just a small rebound before the decline’s continuation.

This is particularly likely given thefact that both previous weekly reversals were followed by some kind of bounce before thedecline really picked up pace. In 2022, it took several weeks before the second(lower) top formed, and in May 2023, the corrective upswing was over within aweek. Right now, we’re 1.5 weeks after the reversal, which means that the decline could start any day now.

Also, please note that in 2022, goldcorrected over 50% of the initial decline before finishing the rebound, and in May 2023, gold corrected slightly over 61.8% of the initial decline beforemoving south. This means that the size of the rally that we just saw is nothingextraordinary. In particular, it doesn’t mean that gold rallied so much that itinvalidates the immensely bearish implications of the recent weekly reversal.

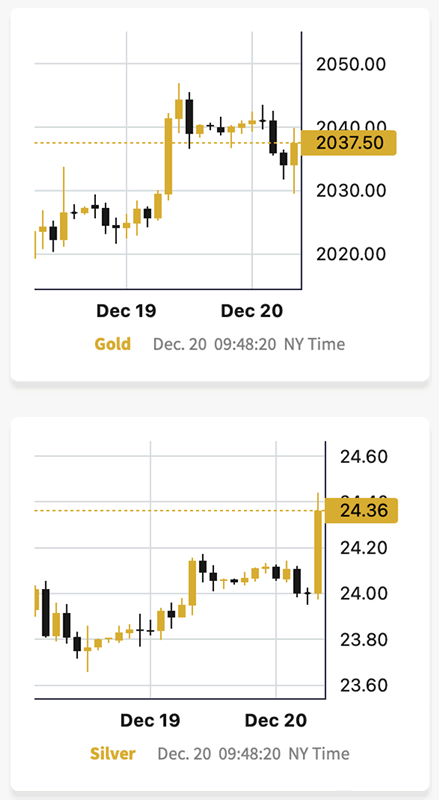

On a very short-term basis – the intradaybasis – we see that silver just outperformed gold, which very often precedessizable declines.

This means that the bearish indicationscome not just from the long-term charts but also from the very short-term ones.What about the junior mining stocks? Didn’t they rally too muchrecently to still be considered bearish?

No.

Analyzing Recent Trends

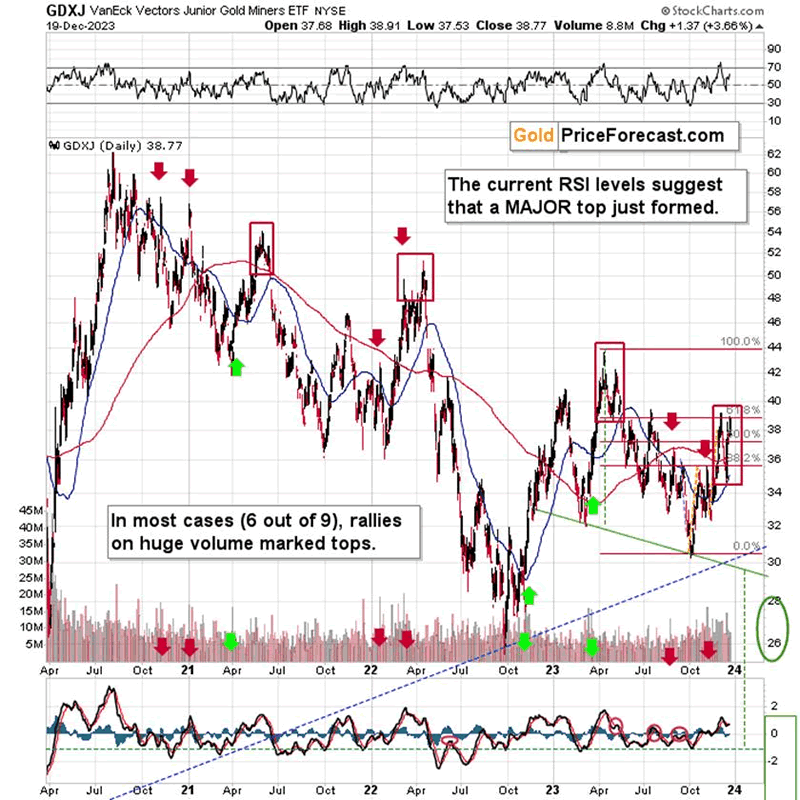

Please take a look at the areas that Imarked with red rectangles. They mark important tops in the GDXJ ETF. In thosecases, junior miners topped by first declining somewhat, then correcting, andthen sliding without looking back. In two out of three cases, the second(final) top was below the initial one, and in the remaining case (in early2022), the second (final) top, was slightly higher than the initial one.

So, is seeing the GDXJ close to theprevious top (but still below it) a bullish game-changer? Absolutely not.

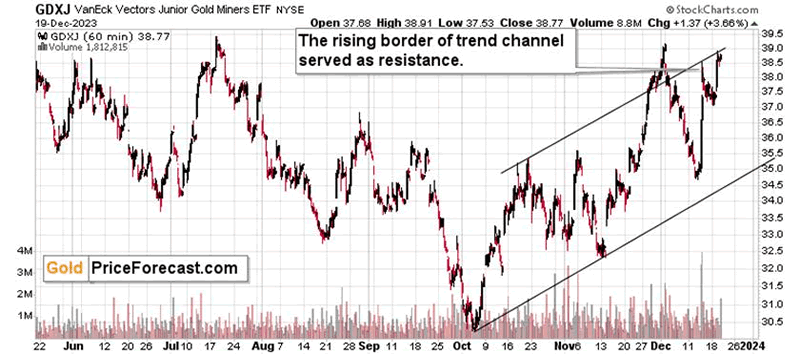

It’s not even a game-changer when we zoomin.

The junior mining stocks simply moved tothe upper border of its rising trend channel without breaking above it.

The previous highs provide resistance, soit’s unlikely – especially given gold’s weekly reversal! – that a really bigand sustainable rally would materialize here.

Especially given what’s happening in theUSD Index.

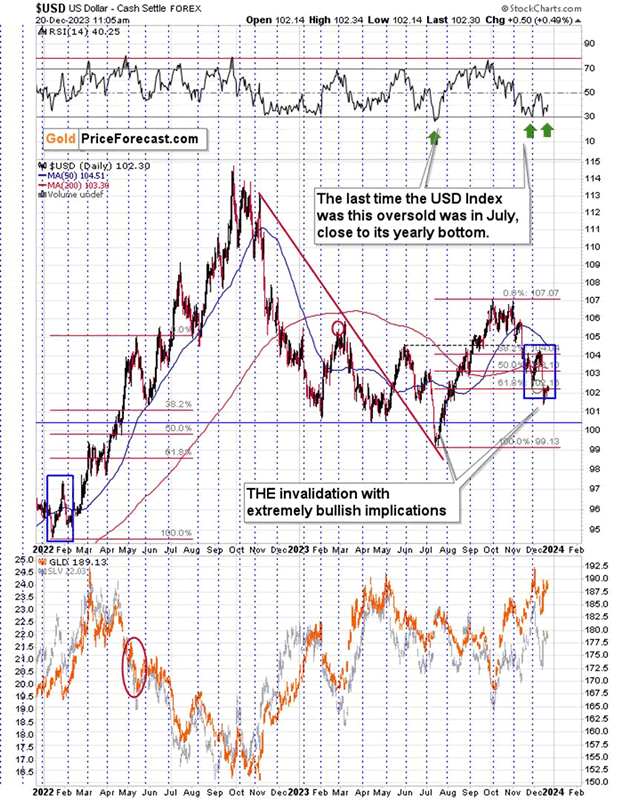

And what’s happening there is that we sawa comeback above the 61.8% Fibonacci retracement level based on this year’srally. This serves as the final confirmation that the bottom is indeed in.

The RSI at 30 indicated it, but thebreakdown’s invalidation confirms it. This bullish outlook (which is bearishfor the precious metals market) is also confirmed by the USD Index’s long-termchart, but Ialready wrote about it yesterday, so I don’t want to repeat myselfhere.

Now, before summarizing, I’d like totouch on two markets that also provide extra context for the precious metalsmarket: stocks and crude oil.

As you know, I’m commenting on the stockmarket every now and then, but I’m not providing trading indications for itspecifically because that’s not the area where I have the greatest experience.That’s why I’m using stock market charts and USDX charts not for trading thoseassets but as supportive indications of the main analysis that I’m conductingon the precious metals and mining stock charts. There are others, for example,Paul Rejczak, who specialize in this (stock market) area.

Paul opened his long positions on Feb.27, 2023 (with S&P 500 below 4,000) andis now considering closing them. I also think that stocks areextremely overbought here and, thus, likely to decline shortly, especiallysince they just approached their previous all-time high.

A decline in stocks is likely to triggera decline also in junior mining stocks – that’s the part of the precious metalsmarket that is most linked with the performance of stocks. By the way, the factthat junior miners were weak relative to gold over the medium term despite thestock market’s strong performance is simply another indication that the minersdon’t want to move higher, and that the recent rallies were simply counter-trendrallies, nothing more.

The rest of the precious metals market islikely to decline along with stocks, too (like they all declined in 2020, forexample), but junior miners are likely to be affected to the greatest extent.

The above doesn’t mean that all stockswould be likely to decline, though. This is the case as far as copper stocksare concerned, for example, but the situation in oil stocks is a bit different.They have their own specific technical set-up that could take them higherregardless of stock market’s decline – Anna described it in advance inlate November in her Oil Trading Alert.

So, yes, while I continue to think thatthe biggest trading opportunity is still in junior mining stocks, naturally,there are also other opportunities out there.

All in all, the outlook for the preciousmetals market remains strongly bearish and the potential for our currenttrading positions in junior mining stocks remains enormous.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.