Gold Weekly: 2018 Set To Be Juicy!

Gold enjoys an increasingly friendly macro environment.

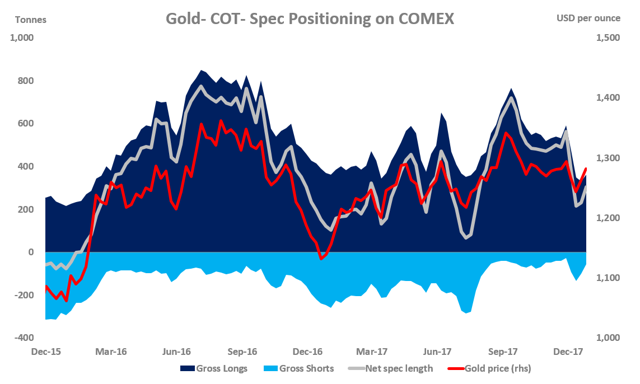

Speculators boosted their bullish bets over December 19-26, the CFTC shows.

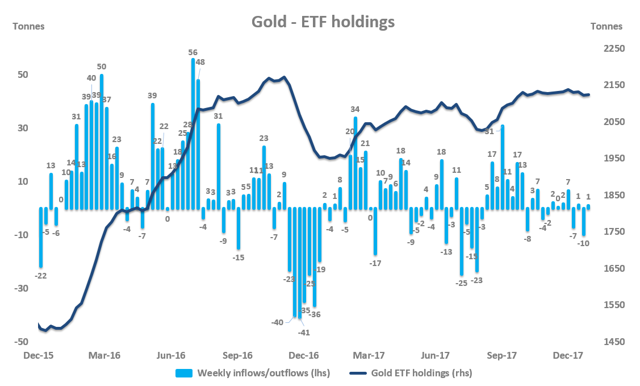

ETF investors were quiet over December 22-29, according to FastMarkets' estimates.

My long GLD position is moving for me. Expect further strength in course of 2018.

Introduction

Welcome to my Gold Weekly. Let me start by wishing you and yours all the best for 2018. I celebrated the New Year in Barcelona, enjoying the charming vibes of the city. I am still reflecting on my resolutions for this year.

In this report, I discuss principally my views on gold from a global macro perspective.

To do so, I analyse the changes in net speculative positions on the Comex (based on the CFTC statistics) and ETF holdings (based on FastMarkets' estimates). Then, I draw some interpretations about investor and speculator behavior. I conclude by sharing my short-term forecast for gold as well as my trading positioning.

Speculative positioning

Source: CFTC.

According to the latest Commitment of Traders report (COTR) provided by the CFTC, money managers lifted substantially their net long position over December 19-26 while spot gold prices strengthened 1.6% from $1,262 per oz to $1,282 over the corresponding period.

The net long fund position - at 305.49 tonnes as of December 26 - rose 75.16 tonnes or 33% from the previous week (w/w). This was driven by a combination short-covering (-43.77 tonnes w/w) and fresh buying (+31.39 tonnes w/w).

In the whole of 2017, the net long fund position in gold rose significantly by 182.55 tonnes or 149%, contributing to the rally of 13% in gold prices.

Investment positioning

Source: FastMarkets.

ETF investors bought a small 1 tonne of gold over December 22-29 while spot gold prices edged up 0.5% over the corresponding period. This came after a notable net outflow of 10 tonnes in the preceding week.

ETF investors were net sellers of 4.35 tonnes in December after leaving their holdings broadly unchanged in November (+0.75 tonnes) and October (-0.79 tonnes).

In the whole of 2017, ETF investors were net buyers of 173.38 tonnes of gold, which represents an increase of 8.8% in gold ETF holdings.

As of December 29, 2017, gold ETF holdings totaled 2,122.67 tonnes, according to FastMarkets' estimates.

My global macro view on gold

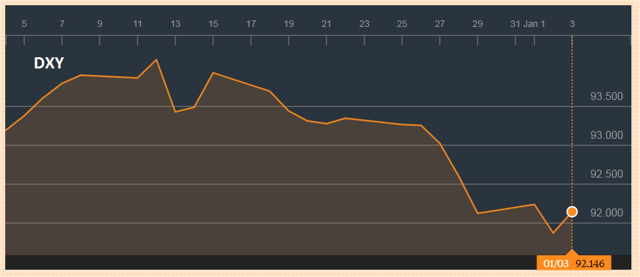

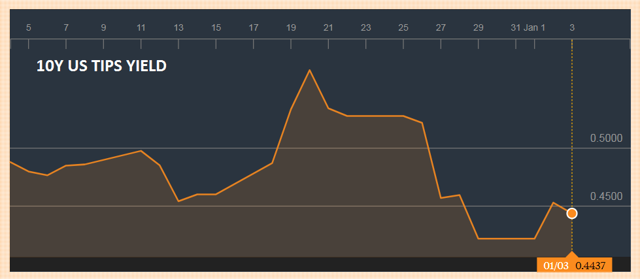

The macro environment for the precious metals complex has turned increasingly bullish of late, judging by the accelerating decline in the dollar and US real rates - the two key macro drivers of gold's spec/ETF positioning.

Source: Bloomberg.

As can be seen above, the dollar and US real rates have moved sharply lower since December 19, which has prompted financial players (more speculators rather than ETF investors) to expand their net long positioning in gold and other precious metals.

At the first glance, the fall in the dollar and US real rates seems to be hard to justify considering that the Congress approved the US tax reform on December 20, which should have logically pushed the dollar and US real rates higher on the back of stronger growth expectations.

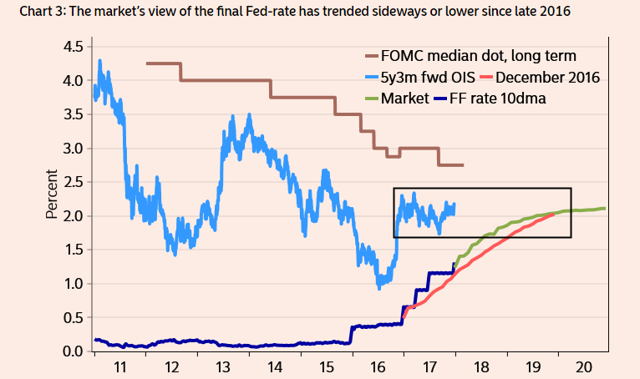

Source: Nordea.

But taking a closer look, I think that the weakness in the dollar and the drop in US real rates are essentially the result of the Fed. Indeed, the Fed exhibited a clear message throughout 2017, namely its intention to keep the neutral rate (R-star) low, evidenced by its regular dot-plot, as can be seen in the chart above. By producing a ceiling for forward rates due to a contraction in term premiums, US Treasury yields (and thus US real rates) have been capped. In turn, this has produced negative spillover effects on the dollar.

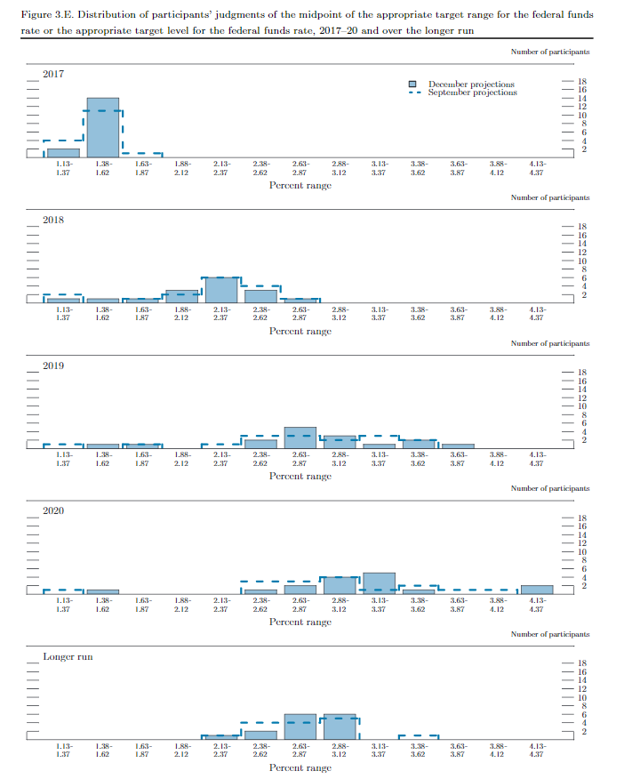

Source: Fed.

Even if the Fed minutes of the December 12-13 meeting (released on January 3) revealed that "some FOMC members" could see a faster trajectory of rate-hikes than the December SEP median forecast, due to the absence of material tightening in financial conditions in spite of the removal of the monetary policy accommodation, the overall view on the longer-run Fed funds rate remains dovish.

According to the minutes, "compared with their projections prepared for the September SEP, a few participants raised their projections for the federal funds rate in the longer run and one lowered it; the median was unchanged at 2.75 percent", as the table above from the Fed illustrates.

Against this backdrop, I am inclined to think that the weakness in the dollar and US real rates should continue throughout 2018 (unless an inflation surprise occurs), which in turn would boost net long speculative positions and ETF inflows in gold.

Trading positioning

I have been long SPDR Gold Trust ETF (NYSEARCA:GLD) since last summer to express my bullish view on gold.

Source: Trading View.

I built my position on June 5 at $120.74 and set a stop-loss at $112.00, corresponding to a 7.24% drop from my entry level. I presented my bullish case on June 6 (Gold Weekly: My Super Bullish Case).

While my long GLD position moved against me until mid-December, it has started to move for me since then. Currently trading at ~$125 per share, I have a little profit under my belt.

I think that the rebound in GLD will continue, reflecting my bullish macro view explained above. In this context, I am happy to maintain my long GLD position, expecting GLD to overcome its 2017 high of $128.32 in the first half of 2018.

For the sake of transparency, I will update my trading activity on my Twitter account and post my trade summary at the end of each report.

Final note

My dear friends, I hope you enjoyed the article. Thank you so much for showing your support by pressing the "Follow" button and sharing this article. I look forward to reading your comments below.

Again... Happy New Year!!!

Disclosure: I am/we are long GLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.