Gold Trifecta of Key Signals for Gold Mining Stocks / Commodities / Gold and Silver Stocks 2020

Nothinglasts forever, and the brightest flame burns itself out the fastest. That couldvery well apply to the current situation around PMs.

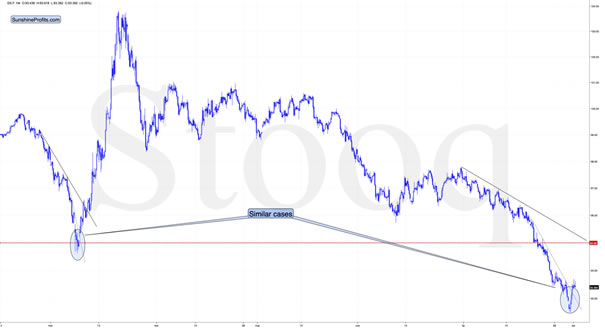

Speakingof indications pointing to the situation being excessive, let’s take a look atthe USD Index.

Rememberwhen inearly 2018 we wrote that the USD Index was bottoming due to a verypowerful combination of support levels? Practically nobody wanted to read thatas everyone “knew” that the USD Index is going to fall below 80. We werenotified that people were hating on us in some blog comments for disclosing ouropinion - that the USD Index was bottoming, and gold was topping. People werevery unhappy with us writing that day after day, even though the USD Indexrefused to soar, and gold was not declining.

Well,it’s the same right now.

TheUSD Index is at a powerful combination of support levels. One of them is therising, long-term, black support line that’s based on the 2011 and 2014bottoms.

Theother major, long-term factor is the proximity to the 92 level – that’s whengold topped in 2004, 2005, and where it – approximately – bottomed in 2015, and2016.

TheUSDX just moved to these profound support levels, and it’s very oversold on ashort-term basis. It all happened in the middle of the year, which is when theUSDX formed major bottoms on many occasions. This makes a short-term rally herevery likely.

Weeven saw a confirmation from USD’s short-term chart.

TheU.S. currency finally after a decisive short-term breakout. Back in March, theshort-term breakout in the USD Index was the thing that triggered the powerfulrally in it, as well as a powerful plunge in the precious metals market.

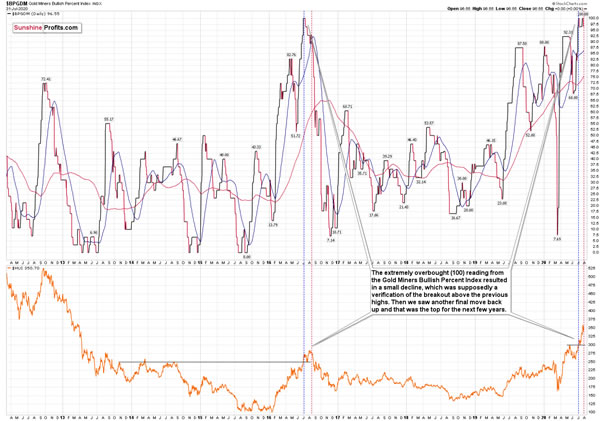

Consequently,based on this analogy, the implications for the near term are bearish for thePMs. Especially, when we consider the fact that Gold Miners Bullish PercentIndex showed the highest possible overbought reading recently.

Theexcessive bullishness was present at the 2016 top as well and it didn’t causethe situation to be any less bearish in reality. All markets periodically getahead of themselves regardless of how bullish the long-term outlook really is.Then, they correct. If the upswing was significant, the correction is alsoquite often significant.

Pleasenote that back in 2016, there was an additional quick upswing before the slideand this additional upswing has caused the GoldMiners Bullish Percent Index to move up once again for a few days.It then declined once again. We saw something similar also this time. In thiscase, this move up took the index once again to the 100 level, while in 2016this wasn’t the case. But still, the similarity remains present.

Backin 2016, when we saw this phenomenon, it was already after the top, and rightbefore the big decline. Given the situation in the USD Index, it seems thatwe’re seeing the same thing also this time.

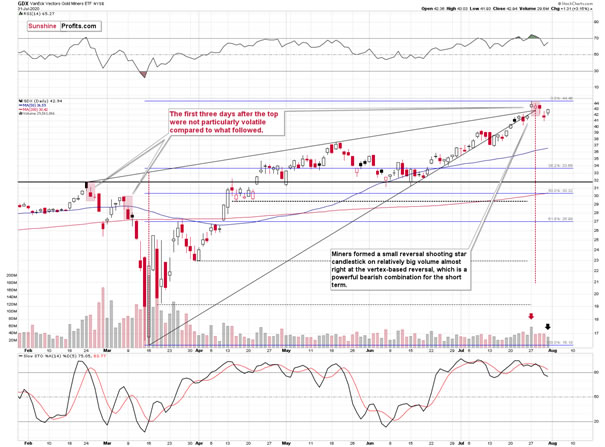

OnFriday, gold moved higher once again, but seniormining stocks refused to move to new highs. They didn’t manage toeven erase their Thursday’s decline. The volume that accompanied this dailyupswing was relatively low. This means that it’s likely that this is acounter-trend bounce, and not the bigger move higher.

Minerswere the first to top, and the short-term breakout in the USD Index indicatesthat other PM markets are likely to follow.

Pleasenote that the miners topped almost right at the vertex of the huge rising wedgepattern. Quoting last week’s analysis:

(…)huge rising wedge pattern is about to form a vertex today or tomorrow. The samerule that appliesto triangles has implications also here. The vertex is quite likelyto mark a reversal date. Given the overbought status of the RSI (given today’s upswing, it's almost certain to move above 70 once again) aswell as miners recent unwillingness to track gold during its continuous rally,it’s highly likely in my view that this will be a top.

Combinethe USDX situation with Gold Miners' Bullish Percent and vertex-based reversal,and you get a high likelihood of lower prices in miners next.

Thank you for reading today’s free analysis. Pleasenote that it’s just a small fraction of today’s full Gold & Silver TradingAlert. The latter includes multiple details such as the interim target forgold that could be reached in the next few weeks.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – ju7stdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.