Gold Stocks Break to New Yearly Lows! / Commodities / Gold and Silver Stocks 2021

Ladies and gentlemen, we have abreakdown! Gold stocks underperformed the yellow metal so much that theyreached the lowest levels seen this year…

The HUI Index (goldstocks) broke to new 2021 lows while the USD Index broke to new 2021 highs.Just as I’ve been warning you.

Mining stocks’ extremeweakness relative to gold continued yesterday, and while it may seem likethe weakness has to have a limit, this limit is likely still quite far from themarkets right now.

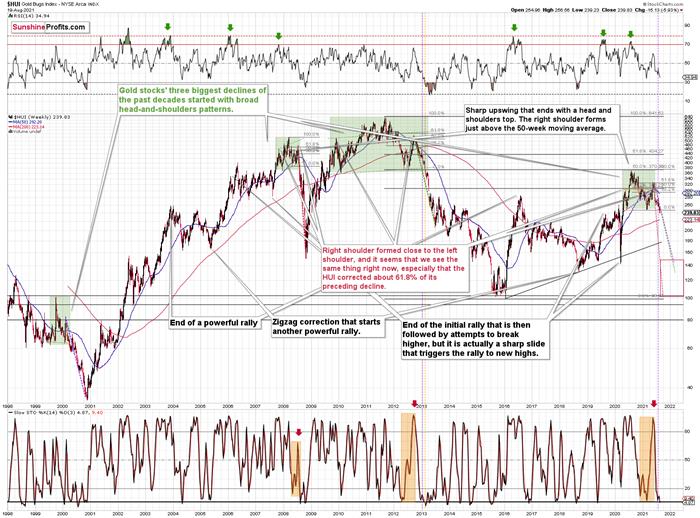

Let’s take a look at the long-term HUIIndex chart for details.

Remember when I told you that the tinybuy signal from the stochastic indicator was unlikely to trigger anything morethan a brief pause? That was based on the analogy to what happened in late 2012when miners paused, and then the decline simply continued. Well, gold stocksdid exactly that and gold stocks declined once again. Right now, they are rightafter the breakdown to new yearly lows, and this has profound implications inlight of the analogy to the 2012 – 2013 decline.

You see, when the HUIIndex declined below the previous lows back in 2013, it meant that thebiggest part of the slide was underway. The profit potential was still there,as it was still the first half of the biggest decline, but it meant thatwaiting for another big rebound in order to add to one’s short positions wasnot a good idea.

To clarify, there were two short-termconsolidations soon after the breakdown in 2013. One of them took the HUI about4% higher (in February 2013) and then we saw a decline. Afterwards, about 7%-8%correction (in March 2013) followed and then the biggest part of the declinetook place.

Consequently, we might see aconsolidation in gold stocks quite soon, but I wouldn’t expect it to beanything to write home about. At the current price levels, 4% – 8% means adecline of about 9 – 19 index. In the case of the GDXJ (if it moved in tunewith the HUI), it would imply a move up by $1.5 - $3.

Of course, this is a hypotheticaldiscussion of what might happen when gold stocks correct, but it doesn’t imply that they are likely to correct now. Actually, the opposite seemslikely because of the HUI’s breakdown and the USD’s breakout. Again, forecastinggold stocks at higher levels in the near term might be a dangerous thing todo.

So, to clarify, the above-mentionedcorrective upswing is likely to take place after another short-term move lower.If the GDXJ bottoms at about $35, then seeing it correct to about $36.5 - $38will be quite normal.

As far as the short-term price moves inthe mining stocks are concerned, my previous comments remain up-to-date.Yesterday, I wrote the following about the GDX ETF:

Whathappened? Senior gold miners finally broke decisively below the neck level of their head-and-shouldersformation, while juniors’ freefall continued.

Yesterday, senior miners closed below theneck level of the pattern for the second day, which means that the breakdown isalmost confirmed.

The GDX has encountered strong supportprovided by the previous 2021 lows, but it doesn’t mean that we have to see arebound here. Why? Because other proxies for mining stocks are already afterthe breakdown. This is the case with the GDXJ ETF, the HUI Index, and also theXAU Index. Even silver stocks – the SIL ETF –closed below the previous 2021lows for the second day in a row.

So, did mining stocks encounter strongsupport here? Not really, only one of the proxies did – the GDX ETF. Theremaining ones are already after a breakdown to new 2021 lows, and if we get aweekly close below them as well, the breakdown will be confirmed.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.