Gold / Silver Ratio: Slowly I Toined... / Commodities / Gold & Silver 2020

Toined the macro, that is (in Moe’s Brooklyn accent). Step by step…

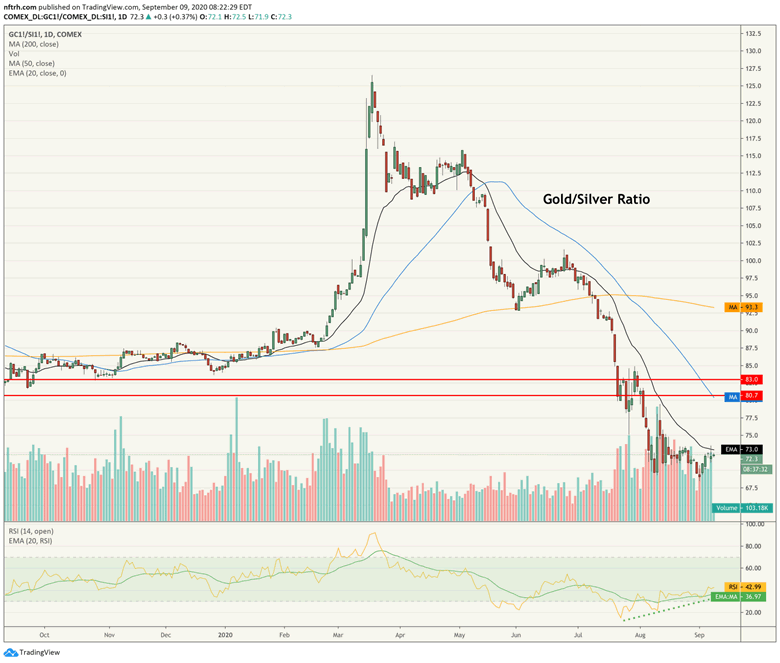

A rising Gold/Silver ratio preceded the March disaster, made an ill-fated bounce pattern in May-June and then got hammered by the 24/7 liquidity spigots opened up by a desperate Federal Reserve and Trump admin. They are desperate because the inflation MUST take hold in order to keep the system from unwinding to its fundamentals, which of course are nothing but robo-printed (funny) munny (political commentary withheld from this post, but insert what we all know here if you’d like…).

[edit] And while we’re at it, let’s insert here the republic for which it stands…

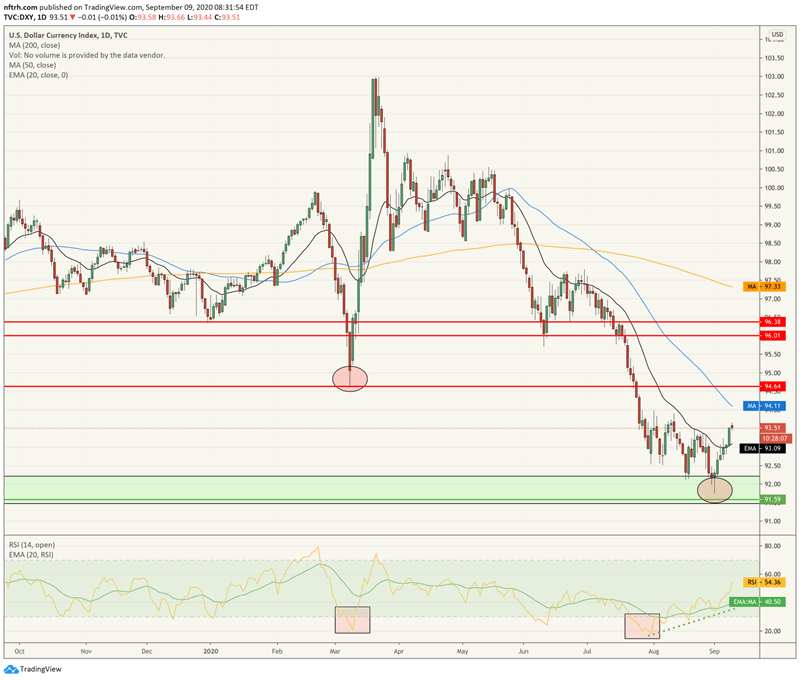

The Gold/Silver ratio would follow its positive RSI divergence and turn up here if it is to confirm the US dollar’s bounce. Then the two would turn together to the degree that the liquidity-driven, risk-on world would take a correction.

They are after all the 2 riders of macro liquidity destruction.

As shown yesterday, USD is on its long awaited counter-trend bounce after an RSI divergence of its own. The two could align to create a mini issue on the macro or a more maxi one. Mini could see USD hit the down-trending SMA 50 or initial resistance below 95. Maxi would set Unc’s sights on 96.

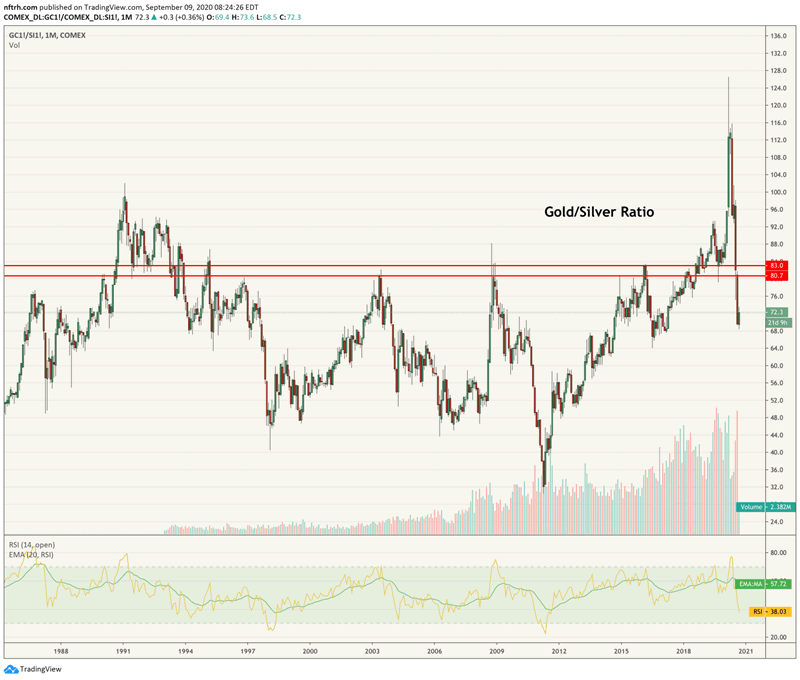

But on the big picture the Gold/Silver ratio toined alright. It toined down and lost a major support area. That is a signal that the balls out inflation the Fed is cooking up has taken root to a degree. If the macro-inflation play is to continue, which I think it will, the Gold/Silver ratio should hold below 80-83. But a rise to that area, probably coinciding with USD to 96, could see a fairly decent interim disturbance for the markets before the inflation really gets going.

That assumes that daily Gold/Silver ratio above gets on its horse, follows its RSI divergence and rides with its fellow above in the near-term.

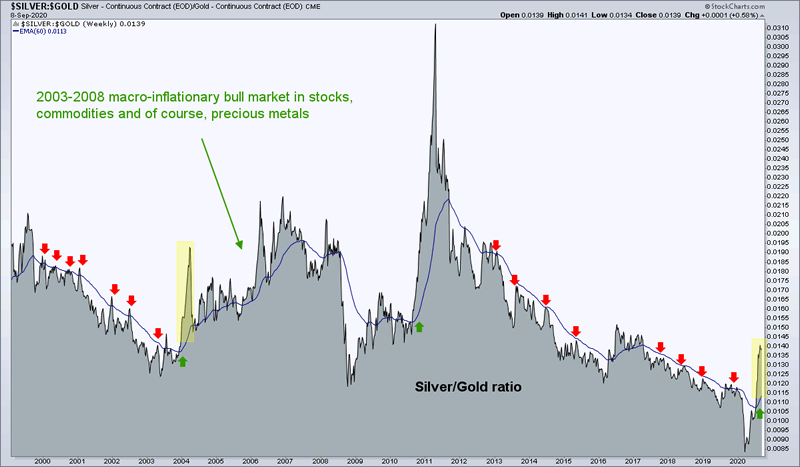

But on the bigger picture the Silver/Gold ratio has already made an inflationary-macro positive signal by doing this. There was a reason we watched silver vs. gold earlier in 2020 and this is that reason. In the 2003-2008 example there was an impulsive spike upward like today, a harsh pullback and then it was inflationary risk-on for several years.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.