Gold, Silver, Precious Metals Slide Re-starts / Commodities / Gold & Silver 2023

As the concern with geopoliticspeaked, so did gold price. Silver and mining follow. Are you prepared for thelikely outcome?

Gold Peaks and Slides

In my yesterday’sanalysis, I wrote the following about gold:

Goldmade a few attempts to move above the all-important $2,000 level and the risingresistance lines, and it failed all of them. The strong short-term momentum isgone, just as the fear of the unknown regarding the situation on the MiddleEast. To clarify – the situation remains unclear and critical, but the fear /concern already peaked (based on Google Trends data).

Ipreviously wrote that gold was likely to peak up to two weeks after the concernpeaked, and that period is over. Gold did indeed move slightly higher after theconcern peaked – just like what we saw in 2022 after the analogous fear/concernregarding the Russian invasion also peaked. The history is very likely torhyme, and this rhyme implies much lower gold prices in the following weeks.The fact the momentum is gone confirms the above.

The fact that the gold price moved lowerduring yesterday’s session simply confirmed that this is indeed what’s going onright now. The upward concern-based momentum is gone, and the price can now getback to its medium-term trend, which is down. Some gold analysts might argue that the trend in gold is not down but that it’s horizontal, andthere’s some truth to it – while looking at gold price alone. However, addingsilver and mining stocks to the mix and looking at the situation in the entireprecious metals market reveals that the trend is actually down.

It’sthe same kind of situation that we saw last year in early March after theRussian invasion started and the concern peaked. Gold then declined over $400from its top in the following months.

Remember when gold soared due to Greenspan-inducedextremely low interest rates? Now, it’s the opposite – rates are high (alsoreal rates), and the gold price is likely to finally reflect that.

Silver pricedeclined, too, confirming the direction ofgold’s move. The same goes for mining stocks.

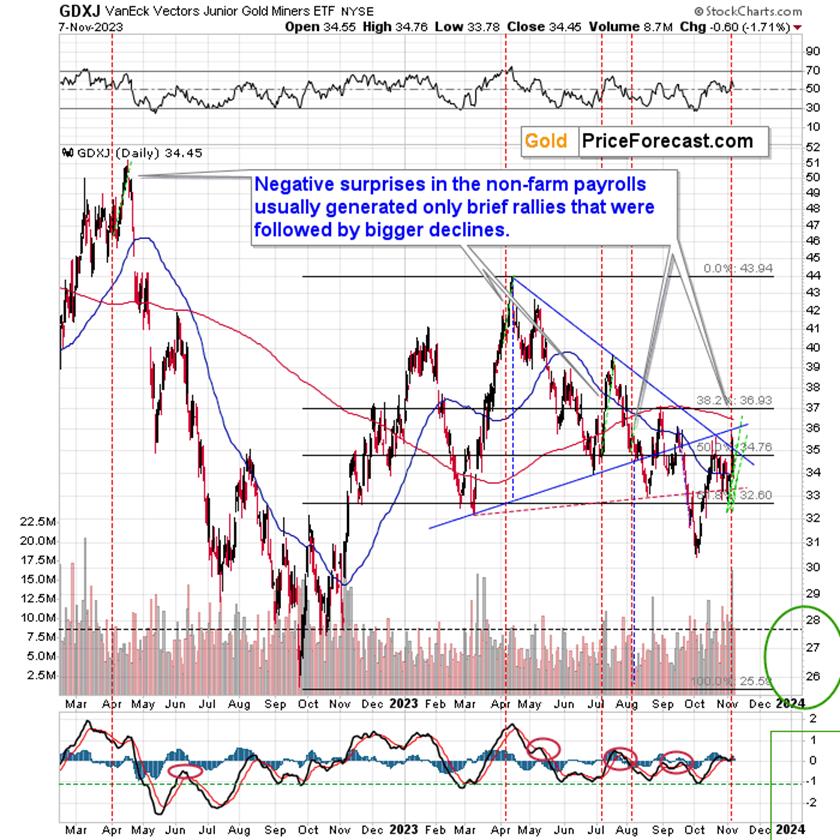

The above 1-hour GDXJ ETF chart showsjust that the tiny breakout above the October highs was quickly invalidated,which on its own served as a sell signal.

This chart additionally shows how similarthis double-top is to what we saw in the recent past – in early June and in mid-September.Re-tests of previous highs are not uncommon for junior miners, and the factthat we saw it once again is – simply put – normal. That’s not a bullishgame-changer, it’s a regular topping pattern.

Whether it’s triggered by “real traders”or algorithmictrading tools doesn’t really matter – the latter increased theimportance of the very short-term price moves in recent years, but overall, thepatterns remain intact – double tops are often followed by bigger declines,regardless of what caused them to form.

Miners Show Signs ofDecline

Interestingly, junior miners declinedyesterday even though the general stock market moved higher.

This is important because on Friday,miners soared along with stocks. They no longer want to follow stocks’ lead,which means that whether stocks are topping here or not doesn’t matter thatmuch. Miners are likely to decline, anyway.

And… Are stocks topping here? That’squite possible, as they already corrected visibly after reaching my previousdownside target, and RSI moved visibly above 50, which was when thosecorrective upswings oftentimes ended in the past.

Besides, it was not only junior minersthat declined despite stocks’ strength.

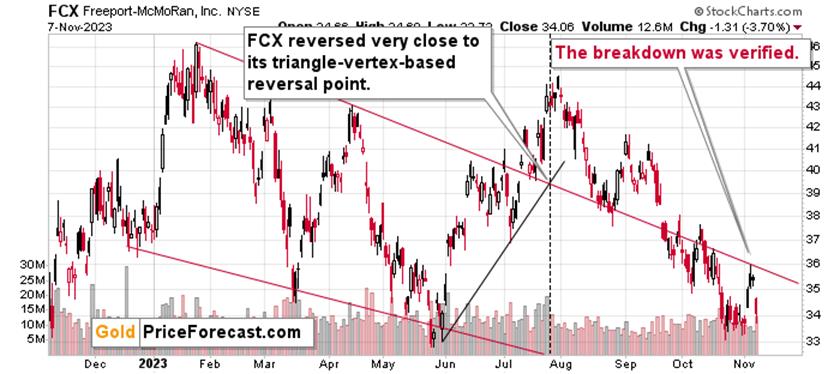

FCX, one of the biggest gold and copperproducers, also declined heavily after (once again) verifying the breakdownbelow the declining resistance line.

This is a bearish signal for the stockmarket as declines in commodities and commodity stocks herald weaker demand inthe future. The profits on our short positions in FCX and GDXJ increasedyesterday, and they are likely to increase further.

Consequently, mining stocks are likely toslide due to both declining gold values and declining stock prices.

On a final note, please keep in mind thatFriday’s rally was triggered by below-expected nonfarm payroll statistics.

I marked the previous analogous surpriseswith vertical orange lines and I marked the follow-up rallies with green.Copying them to the current situation revealed that what was likely to happenbased on this surprise has probably already happened, and the medium-termdowntrend can now resume. In fact, it appears to have already resumed.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.