Gold Shines as the Economic Outlook Darkens / Commodities / Gold & Silver 2023

While looser monetary policy may seembullish in the short term, the medium-term ramifications could upend the yellowmetal.

Recession PessimismAhead

The ‘bad news is good news’ tradecontinues to dominate the financial markets, as weaker economic data isperceived as bullish for risk assets. In a nutshell: if the Fed pivots and endsQT, all of investors’ problems will disappear. However, while the narrativehas helped gold, an ominous economic backdrop should result in muchlower prices in the months ahead.

For example, S&P Global released itsU.S. Composite PMI on Nov. 24. And while the overall data was somewhat mixed,the last piece of the recession puzzle has begun to take shape. An excerptread:

“U.S.companies lowered their workforce numbers during November for the first time inalmost three-and-a-half years. Although only fractional, employment tippedinto contractionary territory following the first drop in service sectorheadcounts since June 2020. Manufacturers, meanwhile, recorded back-to-backdeclines in staffing numbers.

“Businesses commonly mentioned thatrelatively muted demand conditions and elevated cost pressures had led tolay-offs. Other companies noted that hiring freezes were in place amid pressureon margins.”

Thus, while we warned repeatedly thathigher long-term interest rates were poised to erode consumer demand, aslowdown in the U.S. labor market should continue for the foreseeable future.And as that occurs, investors’ pivot optimism should turn to recessionpessimism.

Remember, rate cuts have beenhistorically bearish, as they typically occur alongside severe economic contractions.And with the crowd pricing in a perfect soft landing, a major surprise shouldunfold, which is highly bearish for silver,gold and mining stocks.

More Red Flags

Despite investors’ belief that the Fedwill pull off the perfect landing (it never does), boom and bust cycles haveplayed out plenty of times throughout history. And with the ominous data hidingin plain sight, it’s likely only a matter of time before investors’ confidenceturns to doubt.

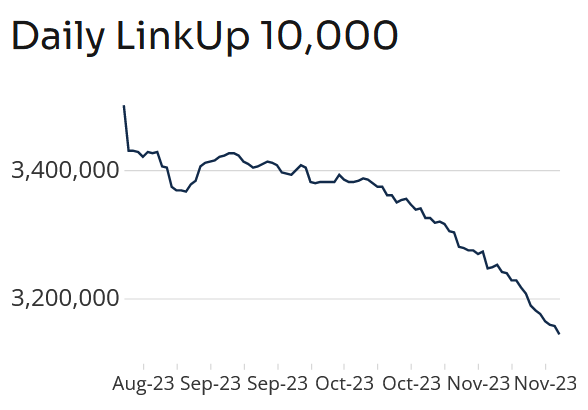

LinkUp’s employment index tracks thehiring intentions of the 10,000 largest employers with the most U.S. jobopenings. And with the metric suffering a serious slide, it’s no wonder crude oil hascome under pressure.

Please see below:

To explain, the blue line above tracksLinkUp’s employment index over the last 100 days. If you analyze the sharpdeceleration, you can see that hiringintentions collapsed as long-term interest rates soared. Moreover,while the crowd continues to celebrate the drawdown (pivot hopes), a continuedcrash should lead to a Minsky Moment in 2024.

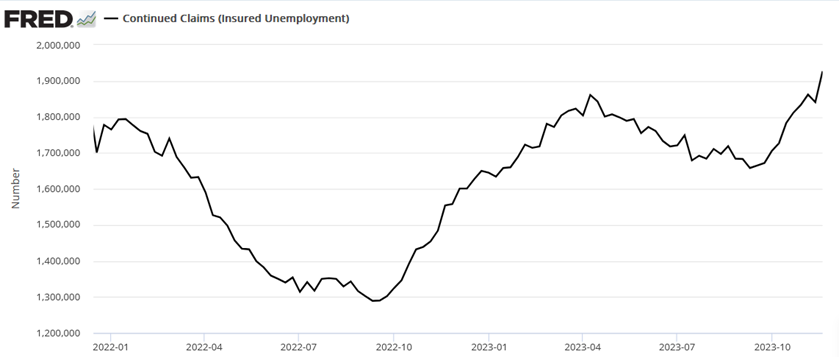

As further evidence, continuedunemployment claims have risen materially, which adds further fuel to thebearish thesis. The metric measures the number of Americans who have filed forunemployment more than once.

Please see below:

To explain, the sharp rise on the rightside of the chart highlights how continuedunemployment claims have surpassed their 2022 and 2023 highs. And again,it’s no coincidence the recent surge occurred alongside the rise in long-terminterest rates. As a result, the fundamentals continue to unfold as expected,and a recession should be the next catalyst that hammers risk assets and uplifts theUSD Index.

Finally, with U.S. mortgage ratesfollowing Treasury yields higher, the housing market remains highlyunaffordable for most buyers. And with pending home sales in crash mode, demandremains another casualty of the Fed’s inflation fight.

Overall, the ‘bad news is good news’narrative has been a boon for the S&P 500.Yet, risk assets are known to place hope before reality, which often leads to sharpreversals when the latter prevails. Consequently, we believe the real drama isyet to come, and mining stocks should suffer profoundly if (when) a recessionarrives.

To avoid missing important inflectionpoints, subscribeto our premium Gold Trading Alert. Our expert technical analysis hasallowed us to profitably trade in and out of positions on several occasions andhas resulted in an 11-trade winning streak. And with future volatility poisedto create even more prosperous opportunities, there has never been a bettertime to become a member.

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.