Gold Setting Up For A Reversal Higher

Gold is at the bottom of it's trading range.

GLD gaps below it's 200 day MA for 4th time.

Gold stocks ignoring the recent drop in Gold prices.

US$ Index entering resistance area.

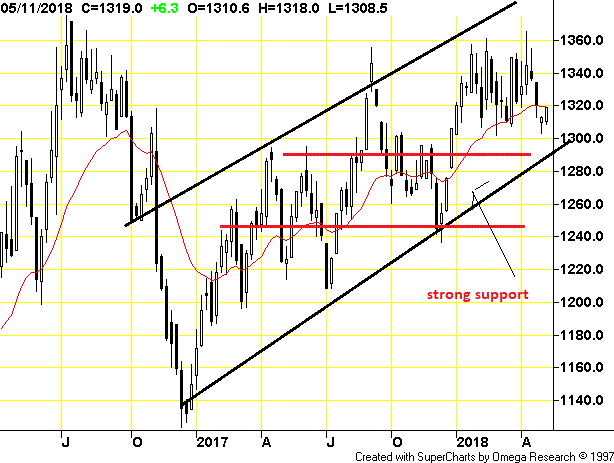

Whenever Gold (GLD) prices move down, it seems to provoke fears of further weakness. Most of the talking heads on the squawk box are negative Gold and pushing their equity holdings and funds. It is disappointing that Gold has lost it's upward momentum, but I believe the current weakness is a great bottom fish opportunity. Comex Gold is currently about $1290 so around the bottom of it's trading range and trend line where it also has strong support between $1250 and $1290.

Another interesting chart that shows bottom potential is of GLD and the 200 day MA. Since GLD moved above the 200 day MA over a year ago, the last 3 times it gaped down below the 200 Day MA, it bottomed and turned around within 1 - 2 weeks and a substantial rally followed. Looks like a repeat on the way.

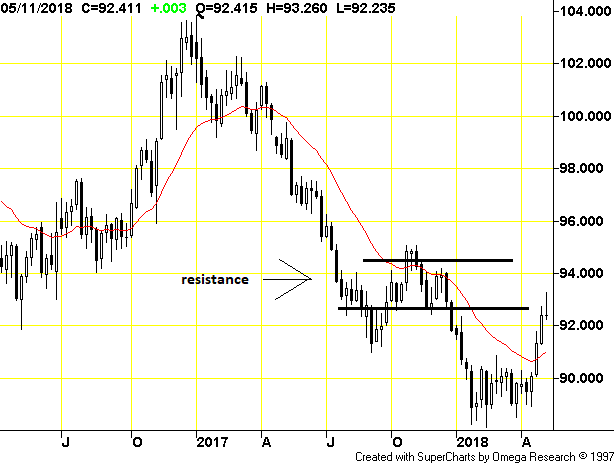

There has been much talk about a stronger US dollar pressuring the Gold price and that is a factor. Today the US dollar index is about 93.6 and when you have a look at this weekly chart it is entering resistance between 93 and 95. Odds are it will retreat and not break this resistance, at least not on the first attempt.

My favorite Gold stock index to follow is the HUI and as you see below, despite Gold moving to lows for the year, the index is still above the March low. Gold stocks are not taking the weakness in Gold very seriously, perhaps because it is temporary.

Next is a chart of the TSXV index, a good representation of juniors. My last comment was the doji star reversal pattern in early April that meant a bottom was probably in. I also suggested a retest of that bottom could occur in May. The move down to 770 area was a retest and again the new Gold lows are not showing up in these stocks either.

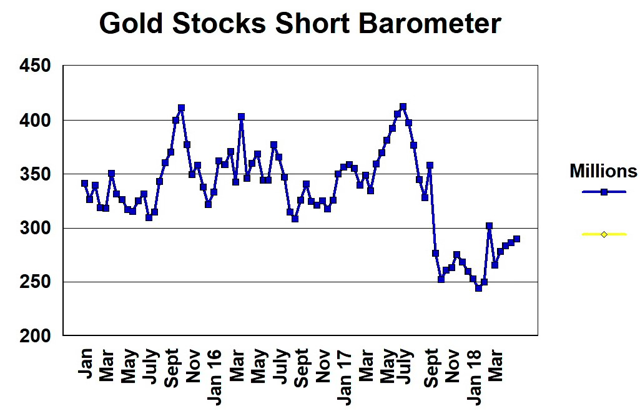

The Playstocks Gold stock short barometer at May 1st is still near record lows. It appears short players still do not see much downside in Gold stocks.

Everything I watch and follow is telling me that we are in a bottoming process and this is a buying opportunity. Sure there could be more downside, but the odds strongly suggest it would be very limited.

One could buy GLD and for senior/mid tier gold stocks, such as:

Alamos Gold (AGI)

Semaflo (OTCPK:SEMFF)

Kinross (KGC)

Disclosure: I am/we are long GLD, AGI, KGC, SEMFF, GEBRF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Ron Struthers and get email alerts