Gold's Century - While stocks dominated headlines, gold quietly performed / Commodities / Gold & Silver 2019

“For twelve consecutive years, gold was up every single year whether there were inflation fears, deflation fears; strong dollar, weak dollar; political stability, political instability. It didn’t matter – strong oil, weak oil. . . Gold went up for twelve years. . . When gold embarks upon its next move, I believe that you will see that long wave take gold relatively quickly, but it will be measured in years, up to a $3000 to $5000 target that I believe is fundamentally justified based on the facts we have today.” –– Thomas Kaplan, Electrum Group (Bloomberg’s Peer to Peer Conversations with David Rubinstein)

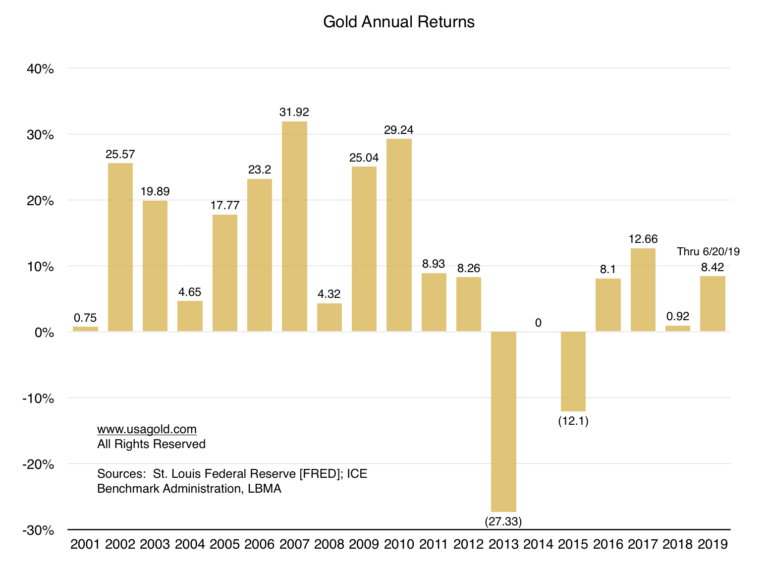

1. Gold has produced positive returns in 16 of the last 19 years.

2. Gold’s average annual return compounded since 2001 is 9.38%.

3. Gold’s appreciation thus far in 2019 (through 6/20/19) is 8.42%.

4. Gold has been a portfolio stalwart. A $100,000 investment in gold in January 2001 would be worth about $350,000 today. At gold’s peak in 2011, it would have been worth about $475,000.

5. Gold does not have a political preference – something to keep in mind as we approach another presidential election year. Its ascent has occurred during the terms of four presidents – two Democrats (Bill Clinton and Barack Obama) and two Republicans (George Bush and Donald Trump). Its largest gain – 31.92% in 2007 – came under a Republican (Bush). It’s second largest gain – 29.24% in 2009 – came under a Democrat (Obama).

6. Gold is not swayed by who leads the Federal Reserve. Its ascent has occurred during the terms of four different Fed chairmen with four distinctly different styles and approaches to monetary policy – Alan Greenspan, Ben Bernanke, Janet Yellen and Jerome Powell – and under a variety of economic circumstances and events.

7. Contrary to popular belief, gold does not need inflation to appreciate in value. In 2001 the average inflation rate was 2.8%. In 2018, it was 2.4%. Between those bookend years, the inflation rate exceeded 3% only three times. Its lowest reading was 0.1% in 2015. In short, some of gold’s best years were the result not of inflation but disinflation – a stubborn circumstance that has carried over to the present.

8. Gold’s price history is only loosely connected to that of the dollar. In January 2001, the U.S. Dollar Index stood at 113.39. It now stands at a little over 96 for a decline of 18% during the period. The price of gold on the other hand rose 3.5 times. The disconnect between the two statistics undermines the long-held belief that there is a strong negative correlation between the two savings instruments.

9. The 21st century has been gold’s century, not the stock market’s. In January 2001, the Dow Jones Industrial Average stood near 16,000. It is now bumping up against the 27,000 mark for a gain of roughly 69%. By contrast, gold is up 350% over the same period (from roughly $400 to $1400 per ounce). While stocks dominated headlines, gold quietly performed.

The question becomes whether or not an investment that has performed so well in the past is likely to perform equally well in the future. Though nothing in the world of finance and economics is certain, we rest the bullish case for gold on the understanding that none of the economic and financial system problems that created a positive price environment for gold over the last nearly nineteen years have been removed from consideration. In fact, a case could be made that they have only intensified – and dangerously so.

Thus, we return where we began for an answer – to the well-conceived forecast from Electrum Group’s Thomas Kaplan at the top of the page. (The interview is highly recommended.) Perhaps a decade hence, we will post another chart at USAGOLD similar to the one you now see at the top of the page. At $5000, by the way, the appreciation from the current $1400 price would amount to roughly 350%. Thomas Kaplan, we add in conclusion, began his investment career with $10,000. He is now a billionaire. Gold was priced at $1280 per ounce at the time of the Bloomberg interview.

A word on USAGOLD – USAGOLD ranks among the most reputable gold companies in the United States. Founded in the 1970s and still family-owned, it is one of the oldest and most respected names in the gold industry. USAGOLD has always attracted a certain type of investor – one looking for a high degree of reliability and market insight coupled with a professional client (rather than customer) approach to precious metals ownership. We are large enough to provide the advantages of scale, but not so large that we do not have time for you. (We invite your visit to the Better Business Bureau website to review our five-star, zero-complaint record. The report includes a large number of verified customer reviews.)

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.