Gold Returns Above $1,800. Has It Bottomed Out? / Commodities / Gold & Silver 2020

The price of gold returned to above $1,800. Is the correction over?

The price of gold returned to above $1,800. Is the correction over?

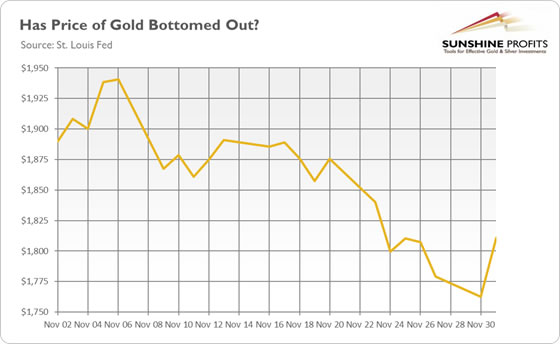

As the chart below shows, the price of gold rebounded, jumping from $1,763 to $1,811 on Tuesday (December 1) and increased further on Wednesday. As a reminder, the price of gold corrected more than 6 percent in November and almost 15 percent from its peak in August. Now, the key question is whether the worst is behind the gold bulls.

Well, it’s too early to declare it with certainty, but it’s possible. Or we are very close to the bottom – at least, if history is any guide. After all, in the past few years, gold used to reach the local bottom either in November or December. So, recently, there has been seasonal weakness between September and December in the gold market, with November being a tough period for the yellow metal.

Hence, the hopes about revival in the gold market could be justified. After all, the price of gold has been in a correction for about four months now. And the recent news about the vaccines – I refer here to the fact that yesterday (December 2), the UK approved the Pfizer-BioNTech vaccine for use as the first country in the world and said that it will be rolled beginning next week – have not sent gold prices down. So, it could be the case that the endgame for the pandemic has already been priced into the price of gold .

Of course, gold can decline even further in the short-term. Wild fluctuations are possible on a daily basis. However, the fundamental outlook remains positive for the precious metal, no matter what the case is with gold’s technical performance. You see, regardless of when the vaccines against the coronavirus are distributed around the world and when the pandemic comes to an ultimate end, the global economy will not recover anytime soon. Actually, we are likely to stay under the “new normal”.

Implications for Gold Under a New Normal

What do I mean by the “new normal”? First of all, interest rates will stay low for longer. We will fall into the debt trap , so the Fed’s ultra-easy monetary policy is not likely to be normalized anytime soon. Indeed, as Powell has recently said in his testimony to Congress ,

The rise in new COVID-19 cases, both here and abroad, is concerning and could prove challenging for the next few months. A full economic recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities. Recent news on the vaccine front is very positive for the medium term. For now, significant challenges and uncertainties remain, including timing, production and distribution, and efficacy across different groups. It remains difficult to assess the timing and scope of the economic implications of these developments with any degree of confidence.

In consequence, the real interest rates should stay near zero for years. Actually, if inflation accelerates – and this risk has increased after the pandemic – the real rates can decline even further. The ultra-low bond yields will decrease the opportunity costs of holding the precious metals, thus increasing the demand for gold .

Oh, by the way, the public debt is going to expand. The fiscal packages should be finally delivered by US policymakers, which will add to the ballooning indebtedness, exerting downward pressure both on the interest rates and the US dollar. You see, the greenback may still be the prettiest amongt the ugly fiat currency sisters, but its charm has recently been diminished because of the Fed’s interest rate cuts and spikes in America’s fiscal deficits . It seems to be positive news for gold, the ultimate safe haven asset , in the long-run.

Thank you for reading today’s free analysis. We hope youenjoyed it. If so, we would like to invite you to sign up for our free goldnewsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all ourpremium gold services, including our Gold & Silver Trading Alerts. Signup today!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.