Gold Price's Rally is Normal, but Is It Really Bullish? / Commodities / Gold & Silver 2024

Gold price rallied this week, and thisgot many heads turning. Rightfully so?

Let’s check the details and see whatreally happened.

Having said that, let’s take a look atgold’s rally.

Gold moved above its April 2023 high.Again.

HistoricalPatterns: A Look Back

This is the fourth time that ithappened if we don’t count the tiny early-January attempts.

All those moves have been invalidated,and the gold price fell in the aftermath.

Why would this time be any different? Isthe USD Index moving much lower here? No, that seems particularly unlikely.

So, yes, the current attempt to movehigher is likely to be invalidated as well, but the above chart is not the onlyreason for it.

Enter the sentiment context.

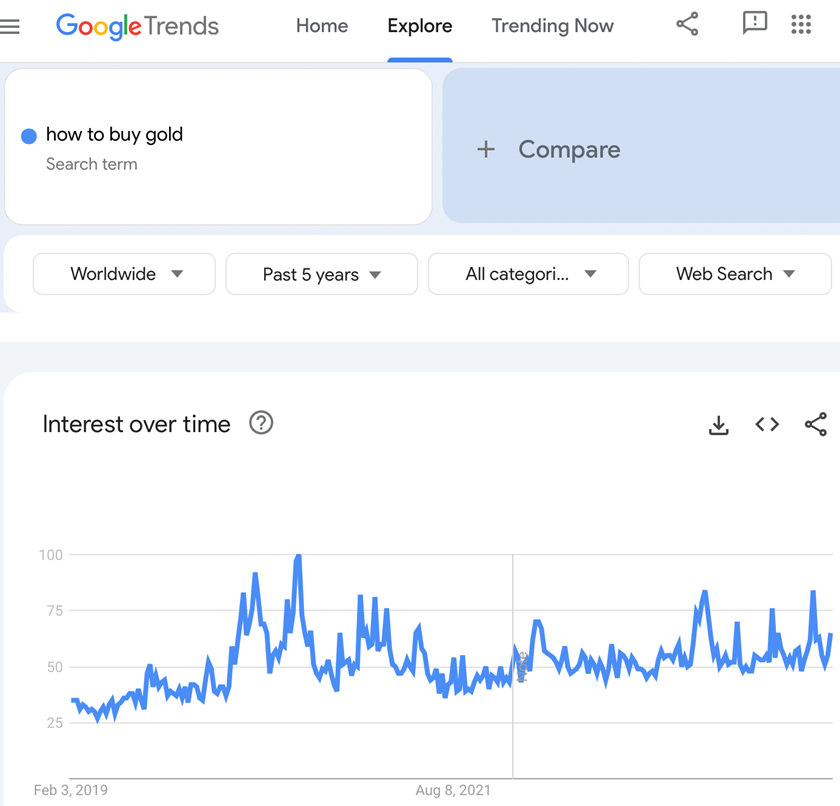

Asyou can see on the above Google Trends screenshot, the searches for “how to buygold” soared in the recent weeks, and it’s not the first time that it happened.

Makesone wonder… What happened to gold price in those other cases?

Afterall, whatever circumstances triggered this jump in the interest in the topic,they are taking place all over again. I don’t mean the state the world is in –I mean the sentiment among gold investors. By estimating the latter, we canalso estimate what’s likely to happen to the price, because… The history tendsto rhyme, and people’s emotional reactions to what the market is doing remainmore or less the same, regardless of the details of the fundamental situation.

So,what happened to gold price on those occasions?

Imarked the peaks in interest in the “how to buy gold” phrase with blue, dashedlines and in three out of four cases those were the MAJOR tops. Ones that werefollowed by hundreds-of-dollar declines in the price of gold.

Theonly remaining case was when it was still the end of a short-term rally and the start of apause (that took gold about $100 lower, anyway). This time was trulyexceptional, though, because it was right after the covid-scare bottom – it wasnot a regular course of action.

So,I’d say that in all “regular” cases, the huge increase ininterest in buying gold translated into huge declines in the following months.After all, people tend to buy at the tops – that’s exactly what this sentimentanalysis proves.

The IMMEDIATE aftermath, though, was notnecessarily bearish. It was the case in mid-2020 and in 2022, but in early 2023, we saw an initial decline and then another move up, during whichgold tested its sentiment-peak price top. And THAT was the final top. It took several weeks between the initial and final top.

What we see now is just like what we sawin early 2023. Gold dipped after the peak in sentiment, and then it moved uponce again. Mining stocks underperformed back then by not moving to new highwhile gold did, and miners are underperforming once again as well.

With this context, it’s clearer thatgold’s attempt to move above its April 2023 high is going to be unsuccessful.

And… Do you remember about gold’spowerful weekly reversals?

I wrote about them yesterday in my goldprice forecast for February 2024, but it won’t hurt to write aboutthem again, as the implications are so important.

A Powerful Signal

In short, weekly reversals are verypowerful events. Seeing them after a rally implies a reversal and the start ofa big downswing. The decline might not be apparent at first, as the price mightmove back and forth, but eventually, it slides. We saw that kind of performancein early 2022. Gold price topped, then it moved back and forth, and then itdeclined – hundreds of dollars.

We saw the same thing recently… So, willgold really be able to stay above its April 2023 high? I doubt it.

This excessive move higher – and itslikely invalidation – create a great trading opportunity and given where stocksand the USD Index are (and how weak miners are), those might be the final daysto take advantage of it.

As always, I will keep my subscribers –informed.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.