Gold Price GameStop Stock Connection? It's an Emotions Game / Commodities / Gold and Silver 2021

There are many factors affecting goldprices on a daily basis, but… how can GameStop stock be one of them?

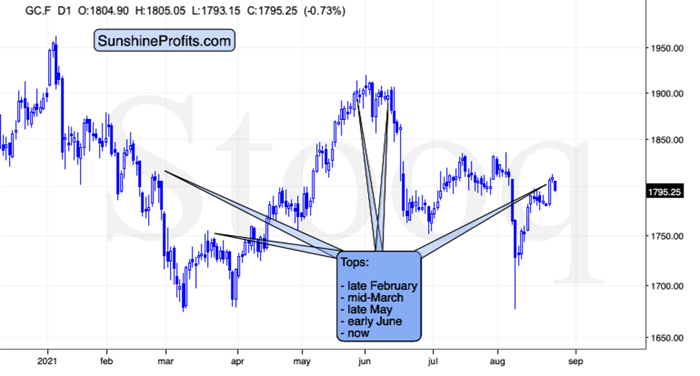

Given today’s pre-market slide in gold,it seems that the triangle-vertex-based turning point worked once again.Declines are likely next.

In yesterday’sanalysis, I explained why the situation remains very similar to whathappened in 2013, and that remains up-to-date. On top of that, two interestingthings happened yesterday: one quite obvious and one less obvious.

White MetalOutperformance

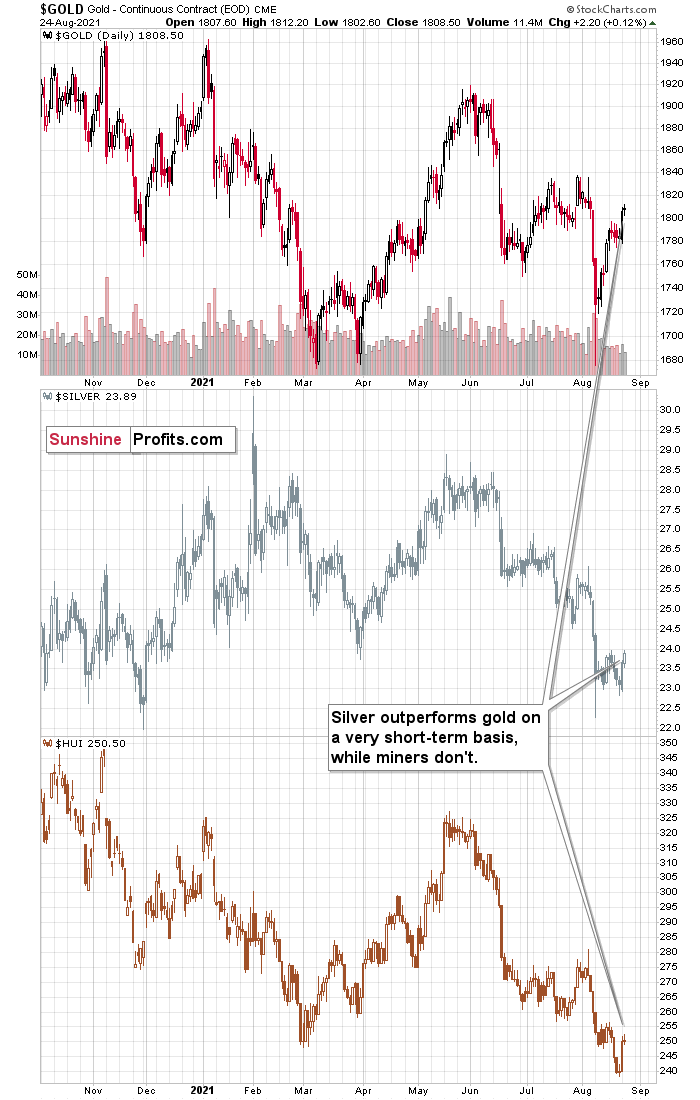

The more obvious one was that silver outperformed gold on ashort-term basis.

While miners and gold were almost flat yesterday, silver’s dailyupswing was notable. Nothing to write home about, but it was visibly biggerthan what we saw in gold and miners. These moments – when silver outperforms ona very short-term basis – tend to take place right before the prices of theprecious metals and mining stocks decline.

Remember the early-August breakout insilver that turned out to be a fakeout? Silver broke above new highs whilegold didn’t, so it outperformed on a very short-term basis. And just as lowerprices followed then, lower prices are likely to follow soon (not necessarilyimmediately, though).

Have You Heard AboutGameStop?

The less obvious indication of a turnaround in gold came from the…GameStop stock price.

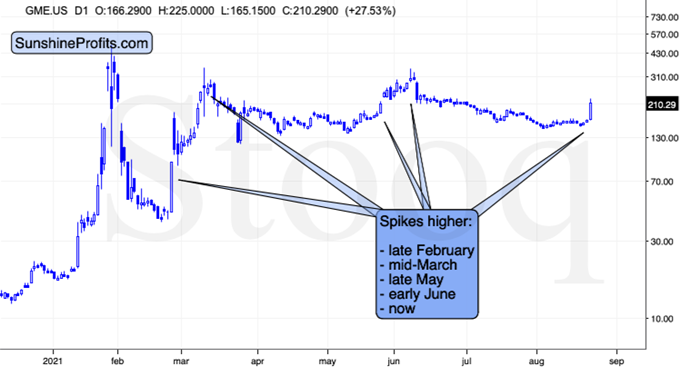

Yesterday’s sizable price spike is something that we saw severaltimes this year. I’m not taking into account the January rally, as it was aspecific forum-activity-based upswing that seems to be of one-of-a-kind nature.Except for yesterday’s price spike, there were also four other similar spikes.Let’s check if there was any kind of regularity on the gold market at the sametime.

It turns out that in all four cases when the GameStop stock pricespiked, gold was topping. Does it make any sense, and can one, therefore, counton this being repeated?

Actually, it does make sense. The assets are not really directlyrelated, but they are related in terms of people’s emotions. The GameStop tradewas quite an emotional one, people were jumping on board based on fear ofmissing out regardless of anything else. And nothing really changed since thattime. The current valuations of the stock seem to be based on the sameemotional aspect along with people’s ability to finance the purchases, perhapsbased on leveraged stimulus-based funds. Consequently, the price spikes inGameStop might be a barometer for a specific type of emotionally driven purchases.And if the market is emotional in one specific way, it could impact more (all?)assets in one way or another. In the caseof gold, it seems that when emotions (as indicated by GameStop stock)spiked, gold was topping.

Actually, it could be the case that the reason why silveroutperforms gold on ashort-term basis is related to the above. Silver is asmaller market, and it’s much more popular among individual investors than amonginstitutions. No wonder that emotions play a part here, as the former aregenerally more emotional than the latter.

Having said that, let’s take a look at gold.

The yellow metal moved lower today, close to itstriangle-vertex-based reversal. Consequently, the top might be in based on justthat indication, and there are plenty more coming from other markets.

The USD Index, for example.

The Dollar’s Behavior

Yesterday, I commented on the above chartin the following way:

TheUSD Index invalidated the breakout to new 2021 highs, but it didn't invalidatethe previous inverse head-and-shoulders pattern, so the downside seems verylimited.

There’s a rising short-termsupport line based on the June and July lows that currently “says” that the USDIndex is unlikely to fall below ~92.75. At the moment of writing these words, the USD Indexis trading at about 93.07, so it’s very close to above-mentioned level.

Andeven if the USDX declines below it, there’s support at about 92.5 provided bythe neck level of the previously confirmed inverse head-and-shoulders pattern.This means that the USDX is unlikely to decline below this level, and this inturn means that the downside seems to be limited to about 0.6 index point.That’s not a lot.

Rememberwhen the USD Index previously invalidated the breakout above the inverseH&S pattern? I wrote then that it could decline to the nearest supportlevel provided – then – by the 38.2% Fibonacci retracement. Now the nearestsupport is provided by the rising support line at about 92.75.

Thisdoesn’t mean that gold will necessarily rally from here or that the rally willbe substantial. On the lower part of the above chart, you can see that goldmoved to its declining resistance line, which means that it could decline rightaway.

The USD Index didn’t move to theabove-mentioned rising support line, but it was very close to it. The USD Indexhas been relatively flat so far today, but gold is already down, so it seemsthat even if the USD Index bottoms slightly lower, it might not take gold tonew short-term highs.

All in all, it seems that the preciousmetals sector is ready for another sizable decline.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.