Gold Miners: Celebration Time / Commodities / Gold and Silver 2021

Another day, another decline in juniorminers – and another increase in profits from short positions in them.Shouldn’t we expect a rebound though?

Well, no. The rebound already happened inlate July and early August, and what we see now is the trend being resumed.Consequently, even if it wasn’t for all the long-term analogies to the2012-2013 declines in gold and goldstocks (HUI Index), one should expect the current short-term decline to be significantlybigger than the counter-trend upswing which ended earlier this month. At thistime, the move lower is just somewhat bigger than the preceding rally. Thus,it’s not excessive and can easily continue.

However, let’s keep in mind that periodsof very high volatility usually need to be followed by periods of relativelylow volatility. That’s when investors verify if the “new reality” – the pricelevels after the decline – are justified or not. If the market votes “no”, weget huge rebounds and breakdowns’ invalidations. So far this week, the markets have been voting “yes”.

Consequently, the current back-and-forthtrading is perfectly normal, and it’s in tune with what I wrote in the previousdays – even in the case of the details. While the precious metals are taking abreather, the gold mining stocks continue to decline, but in a steadier manner.That’s what happened earlier this year (in February and in late-June /early-July 2021) and during the 2013 slide.

While a steady decline might not get asmany heads turning as big daily slides, it also serves a very importantpurpose. You see, the mining stocks (GDX includes both: gold stocks and silverstocks) are now verifying the breakdown below the neck level of the headand shoulders pattern. Once this breakdown is verified (just one more dailyclose is needed), miners will be likely to fall much lower, as the targetresulting from this formation is based on the size of its head. In this case,it implies a move to about $28.

In the case of the juniorgold miners, the situation is even more bearish, as they just moved belowthe previous yearly lows, and they are confirming the breakdown.

Please note how the junior miners losttheir momentum right after declining on relatively big volume. In yesterday’sanalysis (Aug. 10), I commented on junior miners’ breakdown in the followingway:

Thismove was not yet confirmed, but with the significant volume on which it tookplace, it looks quite believable. Therefore, itwouldn’t be surprising to see a few days of consolidation before senior minersmove much lower.

As I wrote earlier today, gold and silverwere not doing much yesterday (and in today’s pre-market trading at the momentof writing these words), but it’s a perfectly normal phenomenon.

In fact, if gold moves back to thepreviously broken lows at about $1,750, it won’t invalidate the bearishnarrative.

TheMost Powerful Tool – Self-Similarity

Gold has a triangle-vertex-based reversalclose to the end of the next week, which means that it could continue to consolidateor move a bit higher in the next several days, and then slide once again.Please note that this would make the current decline very similar in terms ofits pace to the decline that we saw in June. While the moves don’t have to beidentical, the goldprice quite often moves in similar patterns – I’ve seen this many times inthe past decade (and beyond). For example, please note how similar theshort-term declines that we saw between August 2020 and December 2020 were.

And while gold is consolidating afterbreaking below its June lows, the GDX is doing so after breaking below the necklevel of the head-and-shoulders pattern and the GDXJ is trading sideways afterbreaking to new yearly lows, silver is also consolidating after a breakdown tonew yearly lows.

Unless silver manages to soar back abovethe March lows shortly (and it seems unlikely that it does), it will be likelyto fall profoundly once again soon.

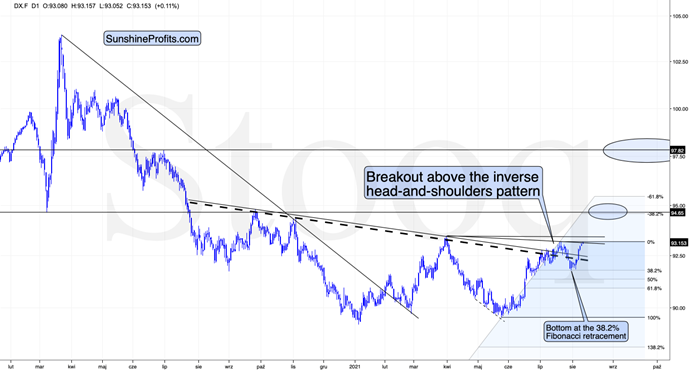

The inverse of the above is likely theUSD Index, which is verifying its second attempt to break above its inversehead-and-shoulders pattern.

The August 2020 highs are the nextshort-term resistance for the USD Index, but I don’t expect it to declinesignificantly from there. Instead, it seems to me that the USDX will rally toalmost 98 based on the inverse H&S pattern, and then it might consolidate.

So, while the USD Index and the precious metalsmarket might consolidate for a few days (or even up to two weeks), they arelikely to continue their most recent sizable moves shortly thereafter.Consequently, while I can’t make any promises with regard to the performance ofany asset, it seems that the profits on the short positions in junior minersare going to increase substantially in the coming weeks.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.