Gold And Silver Up, Down, Sideways, Up / Commodities / Gold & Silver 2020

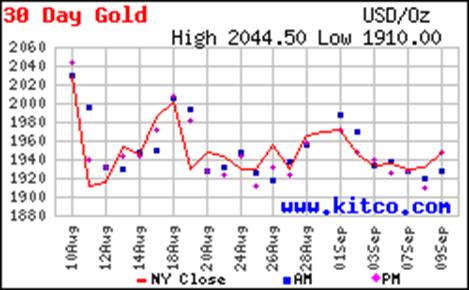

Inmid-march, just as the coronavirus was gaining momentum, the price of goldbegan to rise. After trading sidewaysfrom 2015 to 2019, gold rose from a low of $1,471 in mid-March to $2,069 onAugust 6th, a spectacular 40% rise in five months.

Duringthat same period, silver rose from $11.94 to $29.14 on August 6th,an even more spectacular 114% increase.

Threedays later, on August 9th, as gold and silver continued to tradeclose to their respective highs, I wrote, …In August 2020, gold and silverare both rising even as central bankers still hope to slow their ascent.Whether gold and silver will continue to ascend or be forced lower as they werein 2011 when central bankers flooded markets with gold bullion offered atnegative interest rates remains to be seen.

The nextday gold and silver prices plunged with central bankers reminding speculatorsand investors that they would battle to the death to keep their profitablefranchise of credit and debt afloat; a 325-year old franchise whose demise is nowwithin sight.

CENTRALBANKING: THE PROBLEMS THEREOF

Much asmedieval priests wrote in Latin to keep the general public ignorant of the truemeaning of the scriptures, central bankers utilize mathematical equations toobfuscate the inner-workings of their obscenely profitable ponzi-scheme ofcredit and debt.

Forexample, from Wikipedia entry, Mathematicaleconomics:

…VonNeumann's model of an expanding economy considered the matrix pencil A - λ B with nonnegative matrices A and B;von Neumann sought probability vectors p and q and a positive number λ thatwould solve the complementarity equation

pT (A - λ B) q = 0,

Also:

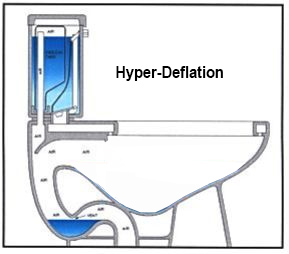

I believethat central banking and its present problems are more easily understood when atoilet represents the economy, instead of obtuse mathematical formulae.

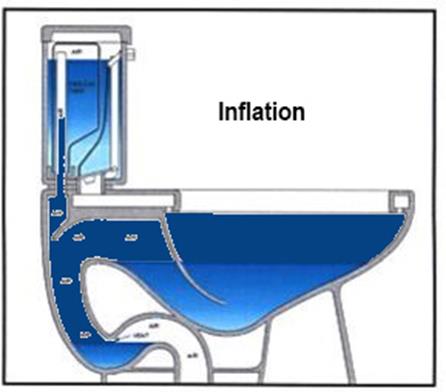

Usually,when the toilet, i.e. economy, does not work, jiggling the handle, i.e. raisingor lowering interest rates, is sufficient to restore balance.

If thewater level rises in the toilet, it indicates too much money (circulatingcredit and debt) is being printed causing inflation.

If toomuch money continues to be printed, inflation is followed by hyper-inflationwhere the toilet overflows, prices explode upwards and money loses all value.

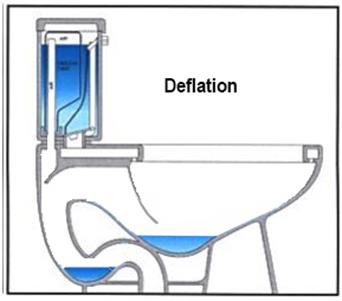

However, if the water level is too low, it indicates deflation where moneyis no longer circulating as before. This often happens after speculativebubbles collapse, debts default and credit is scarce.

In a severe deflation, it becomes necessary to pour in water, i.e.quantitative easing, in order for the toilet to function, i.e. flush.

Quantitative Easing

Hyper-deflation is an even more extreme state when the water in thetoilet completely drains and the toilet can no longer be flushed.

In 2020,we are in a severe deflation where central banks are printing more and more andeven more money to replace that being rapidly lost. Whether this ends inhyper-deflation or hyper-inflation is not yet known. Soon, it will be.

OnSunday, September 13, I will be answering questions on a livestream Q&A at4 pm (USA ET). The URL for theevent is https://youtu.be/QTYY0CcDiX8

Buy gold,buy silver, have faith.

By Darryl Robert Schoon

www.drschoon.com

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.