Gold and Silver Massacre to Continue? / Commodities / Gold and Silver 2021

Again, today’s report will be way shorter than usual, andfocus only on select charts so as to drive position details of all the fivepublications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

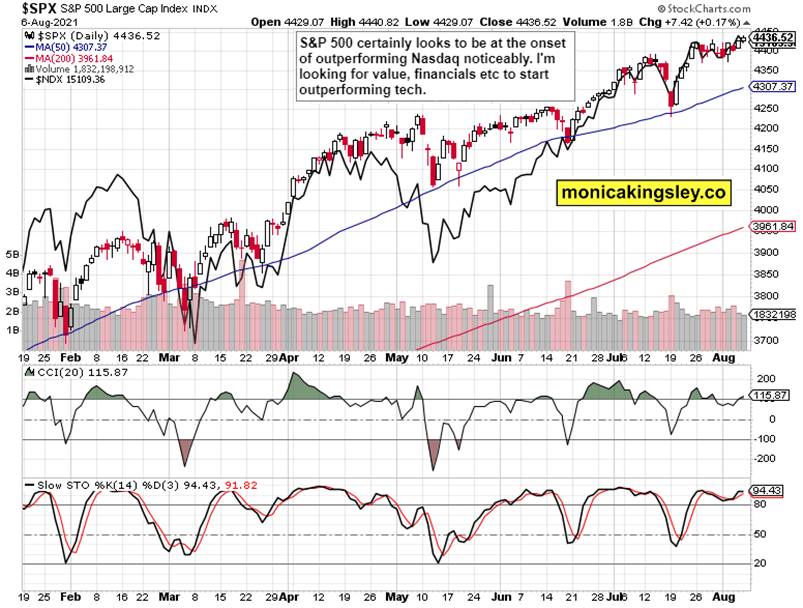

S&P 500 and Nasdaq Outlook

The tightly tracking each other indices – S&P 500 andNasdaq – are likely to part ways to a degree soon. As Treasury yields made adouble bottom, look for more tech to give way to cyclicals as they come back.Inflation, reopening trades and interest-rate sensitive spreads (e.g.financials over utilities) should start doing better.

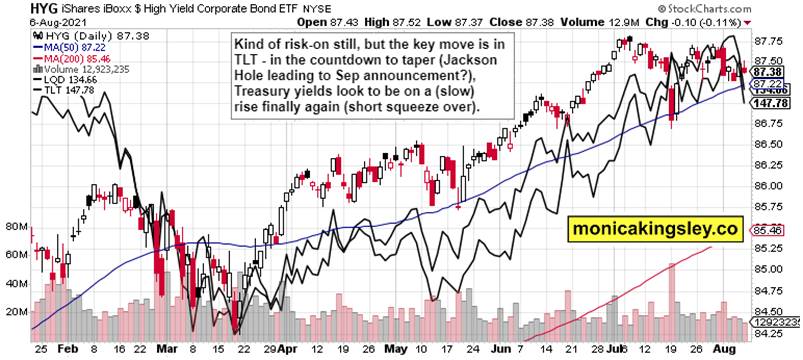

Credit Markets

Gold, Silver and Miners

Grim price action in the metals, and more be yet to come(looking at overnight price action, in all likehood we‘re done with shakeouts)– gold and silver usually do better once the waiting for taper is over. TheBernanke experience is the right one to compare taper prospects to, but the Fedwill have a much harder time mopping up the excess liquidity than it did in2018 – commercial bank credit creation isn‘t still there to make up for lostcentral bank purchases. Gold is getting inordinarily scared even as inflationisn‘t showing signs of retreating and real rates remain deeply negative – onlyinflation expectations have been jawboned. As neither miners to gold ratio norTIPS signal panic, the only question is when the metals would stabilize andwhether a fresh washout would occur or not. My view is that we‘re way closer tothe pain‘s end than to its June beginning.

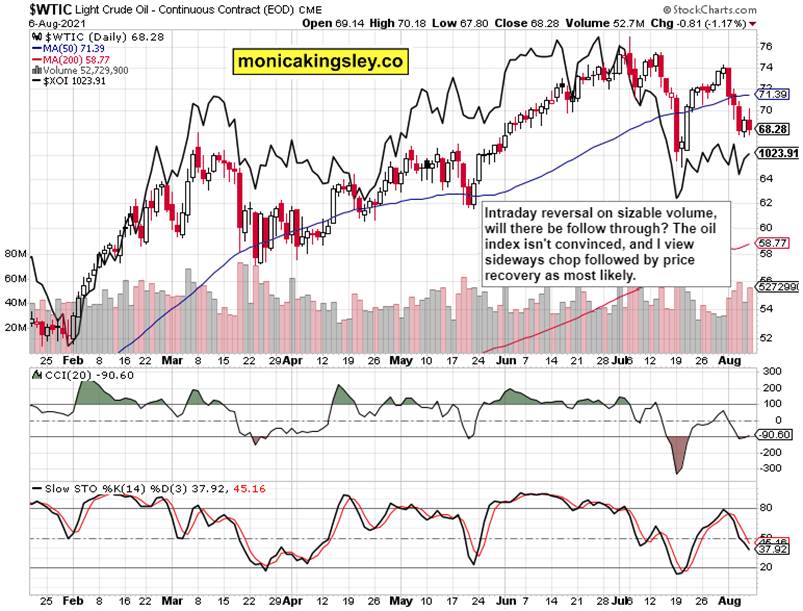

Crude Oil

Oil staged another reversal, and it was intraday to thedownside. How credible is that? Again trading within the $60-$80 range, I‘m ofthe opinion that prices are interesting to the buyers here, as black gold gotcaught in the taper fears selloff just as gold with silver or copper did. Oildemand may be also coming under pressure through all the restrictions eventhough APT doesn‘t signal its sharply rising odds (yet).

Copper

Copper retreated frompromising upswing, but its indicators are slowly turning positive. While it hasmirrored the yields compression (signs of weakening growth / growth worries),it looks ready to gradually come back to life and play catch up with thecommodity index.

Bitcoin and Ethereum

Resolute downswing rejection of Sunday‘s retracement inboth Ethereum and Bitcoin – the bulls are on the march still. Cryptos haveturned the corner very evidently indeed. With so much bearish sentiment out there, the dips might be short-lasting andshallow.

Summary

In place of summary today, please see the above chartdescriptions for my take.

Thank youfor having read today‘s free analysis, which is available in full here at myhomesite. There, you can subscribe to the free Monica‘sInsider Club , which features real-timetrade calls and intraday updates for all the five publications: Stock TradingSignals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals andBitcoin Trading Signals.

Thank you,

MonicaKingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research andinformation represent analyses and opinions of Monica Kingsley that are basedon available and latest data. Despite careful research and best efforts, it mayprove wrong and be subject to change with or without notice. Monica Kingsleydoes not guarantee the accuracy or thoroughness of the data or informationreported. Her content serves educational purposes and should not be relied uponas advice or construed as providing recommendations of any kind. Futures,stocks and options are financial instruments not suitable for every investor.Please be advised that you invest at your own risk. Monica Kingsley is not aRegistered Securities Advisor. By reading her writings, you agree that she willnot be held responsible or liable for any decisions you make. Investing,trading and speculating in financial markets may involve high risk of loss.Monica Kingsley may have a short or long position in any securities, includingthose mentioned in her writings, and may make additional purchases and/or salesof those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.