Gold and Silver Expose Stock Market's Phony Gains / Commodities / Gold & Silver 2024

Wall Street is ecstatic after the Dow Jones Industrial Average(DJIA) hit 40,000 for the first time ever. The nominal record makes for plentyof pithy headlines.

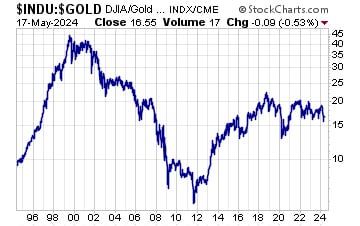

The Dow is indeed racing higher in terms of depreciating U.S.fiat dollars. But what about in terms of real money – gold and silver?

The headline news not being reported in the mainstream financialmedia is that the stock market benchmark just fell – yes, fell – to a two-yearlow in real terms.

It may seem hard to believe that the stock market is losingvalue at the same time as its gains are being widely celebrated, but the chartsdon’t lie.

The DJIA:gold ratio peaked all the way back in 1999.

It’s been 25 years since stocks have made new highs in terms ofgold.

The DJIA is also starting to lag behind silver. The Dow:silverratio suffered a significant breakdown last Friday – the very day the Dowclosed above 40,000!

A stealth bear market in stocks appears to be underway.

Few investors are aware of it. Their brokerage accountstatements still show gains being registered. But those gains exist only interms of phony, funny money.

Stefan Gleason isPresident of Money Metals Exchange, the national precious metals company named 2015"Dealer of the Year" in the United States by an independent globalratings group. A graduate of the University of Florida, Gleason is a seasonedbusiness leader, investor, political strategist, and grassroots activist.Gleason has frequently appeared on national television networks such as CNN, FoxNews,and CNBC, and his writings have appeared in hundreds of publications such asthe Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2024 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.