Gold And Freight Rates Point To An Industrial Metals Rally

Gold tends to lead the industrial metals sector at intermediate-term bottoms.

Regardless of whether or not GYX makes a new low within the next couple of months, the performance of the gold market suggests that the industrial metals sector will commence an intermediate-term rally before the end of this year.

The Baltic Dry Index is also predicting an industrial metals rally.

Editor's note: Originally published at tsi-blog.com on August 20, 2019.

[This post is a modified excerpt from a recent TSI commentary]

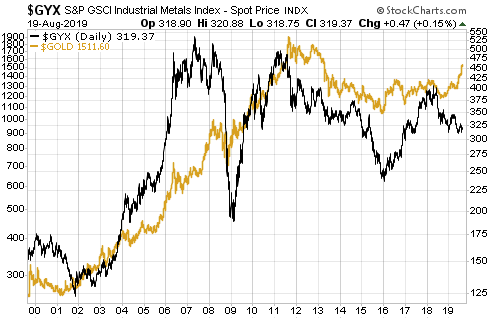

Gold tends to lead the industrial metals sector at intermediate-term bottoms, i.e., the US$ gold price tends to make an intermediate-term bottom and commence a multi-quarter (or multi-year) upward trend in advance of the Industrial Metals Index (GYX). Evidence of this can be found on the following chart comparison of the US$ gold price and GYX. Specific examples are:

a) The gold price reversed upward in April of 2001 and GYX did the same in November of that year.

b) The gold price reversed upward in October-November of 2008 and GYX did the same in February-March of 2009.

c) The gold price reversed upward in December of 2015 and GYX followed suit in January of 2016.

Gold's most recent intermediate-term bottom was in August 2018. It has since trended upward, and over the past two months, the trend has accelerated. GYX, however, continued to make lower lows until June of 2019. It's too early to tell if GYX's June-2019 low was the intermediate-term variety, but regardless of whether or not it makes a new low within the next couple of months, the performance of the gold market suggests that the industrial metals sector will commence an intermediate-term rally before the end of this year.

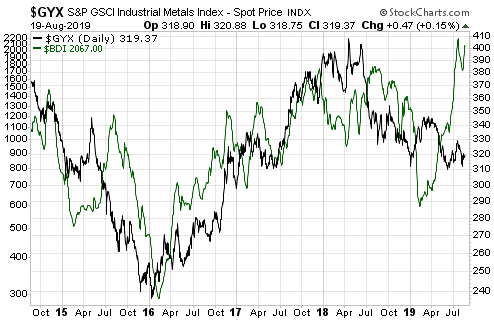

The Baltic Dry Index (BDI) is also predicting an industrial metals rally.

The BDI is an index of dry bulk shipping rates. I generally don't use it as an economic or a financial market indicator, because it is influenced as much by changes in the supply of shipping capacity as by changes in the global demand for commodities. However, intermediate-term trends in the BDI often match intermediate-term trends in the Industrial Metals Index (GYX). Also, large short-term divergences between the BDI and GYX tend to be important, with one or the other subsequently making a big catch-up move in quick time.

As illustrated by the following chart, a large divergence has opened up over the past four months due to the BDI rocketing up to a 5-year high while GYX languishes near a 2-year low. This divergence could be closed by either a dramatic plunge in the BDI or a substantial rally in the industrial metals sector. I suspect it will be the latter.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Follow Steven Saville and get email alerts