Gold - A Typical Year-End Buying Opportunity

NewGold's Rainy River will change rags to riches.

Yukon's gold discovery of 2017.

B.C.'s Golden Triangle smoking hot in 2017.

Garibaldi soars 3,500% and Jaxon 500%.

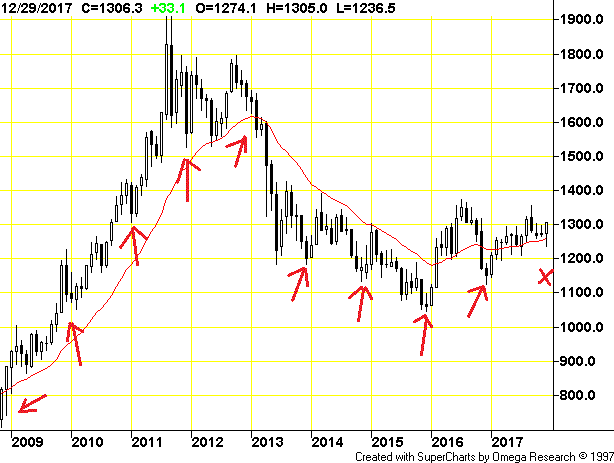

In my last comments on September 15th, gold (GLD) hit my $1360 target and I was contemplating the possibility of a break above $1375. I believed at that time, the best chance for this was in September/October because after that we would enter the typical year end period of gold weakness. As it turned out gold made it no higher than my $1360 target and the year end weakness began to take hold.

I drag this same monthly chart out a few times during October to December each year and simply add on the most recent calendar year. Gold held up better than I expected this year as I believed we would bottom between $1200 and $1220. With the year at a close, I have updated my monthly chart and this year we can see that weakness was quite brief with just the tail of the December candle stick dipping down to about $1245.

I believe there are two main reasons for gold's relative strength at 2017 year end. There are a lot of froth and bubbles in capital markets with Bitcoin soaring, marijuana mania and all stock market indexes up strongly in 2017 without so much as a 5% correction. Some of this excess capital is finding its way into gold. We are entering the later stages of the economic cycle, and this is the 2nd reason. After the 2008 crash many economic pundits pointed out how weak the economic recovery was and how long it was taking, even as late as 2015/16. Trump's election victory brought new optimism and 2017 marked the year of solid economic strength in the U.S. and abroad. In the later stages of an economic cycle, inflation begins to rise along with higher interest rates and this is usually a good period for gold. The Fed is always behind the curve, raising rates too slowly and/or not enough.

I believe there are two main reasons for gold's relative strength at 2017 year end. There are a lot of froth and bubbles in capital markets with Bitcoin soaring, marijuana mania and all stock market indexes up strongly in 2017 without so much as a 5% correction. Some of this excess capital is finding its way into gold. We are entering the later stages of the economic cycle, and this is the 2nd reason. After the 2008 crash many economic pundits pointed out how weak the economic recovery was and how long it was taking, even as late as 2015/16. Trump's election victory brought new optimism and 2017 marked the year of solid economic strength in the U.S. and abroad. In the later stages of an economic cycle, inflation begins to rise along with higher interest rates and this is usually a good period for gold. The Fed is always behind the curve, raising rates too slowly and/or not enough.

In my September report, I also suggested taking part profits in Goldcorp Call options and taking profits in NewGold around $4.00. In general 2017 was not very exciting for the precious metal producers as they basically traded sideways all year. This is shown below on the Gold Bugs Index (HUI), which traded 2017 between 180 and 210 for the most part and ended the year a few points higher from where it started.

This is the time of year I like to add some gold producers to the portfolio, and I will start with NewGold (NGD)

In 2017, Rainy River was a 'Rodney Dangerfield' to NewGold as they got no respect for it and actually disrespect with regard to the cost overruns. That is now water under the bridge and finally we are reaching the point where Rainy River will be a huge contributor to NewGold's bottom line. I will begin with putting NewGold in its current perspective, and then will review the effect Rainy River will have.

New Gold's Q3 report revealed gold production of 82,027 ounces (including the Peak mines), below 2016 as higher production from the company's Mesquite mine, was offset by planned lower production at New Afton, the Peak mines and Cerro San Pedro. Cerro San Pedro's production decreased as the mine transitioned into residual leaching in June, 2016. Quarterly copper production of 26.0 million pounds and silver production of 300,000 ounces both remained in line with the third quarter of 2016. Basically growth has been stagnant the past year, making the large jump in production resulting from Rainy River a welcome development in my book.

Third quarter operating expense per gold ounce of $601 increased relative to the prior-year quarter due to a higher proportion of sales from Mesquite. The company delivered third quarter all-in sustaining costs from continuing operations of $610 per ounce, including total cash costs from continuing operations of $204 per ounce. All-in sustaining costs from all operations were $792 per ounce, including total cash costs from all operations of $339 per ounce. NewGold's costs are in the lower quartile among their peers but the stress on their financial performance has been the development costs for Rainy River and the overrun costs on the same. Project spending at Rainy River during the third quarter totaled $130 million with estimated remaining development capital of approximately $100 million, including project working capital post commercial production. As shown below in slide 12 of their presentation, development costs are coming to an end and will be replaced with strong cash flow from production.

On October 19th NewGold announced that Rainy River Mine achieved commercial production, approximately two weeks ahead of schedule. Its first gold pour was on October 6, 2017. The processing rate averaged 15,200 tonnes per day, or 72% of the 21,000 tonnes per day nameplate capacity. New Gold defines commercial production as exceeding 60% of nameplate capacity over a 30-day period. Importantly, for the period October 1-18, 2017, the processing rate averaged 19,000 tonnes per day, or 90% of nameplate capacity.

In Q3 New Gold reiterated its guidance for full-year gold production of 380,000 to 430,000 ounces (includes Peak Mines). NewGold recently sold their Peak Mines in Australia for $58 million and their El Morro project in Chile earlier in the year to focus more funds on their new Rainy River project. The new focus is a good move and if we subtract Peak Mines production and add in Rainy River the strong production growth becomes obvious.

Peak mines will produce about 80,000 ounces gold in 2017 with about 13 million pounds of copper. Rainy River's feasibility projects average annual gold production of 243,000 ounces with 429,000 ounces of silver. The average grade mined will be 1.44 g/t for the first 9 years compared to 1.12 g/t over the life of mine so 250,000 ounces per year is a safe number to use. This means net growth with new Rainy River production and Peak mines being sold will be about 170,000 ounces per year. With current production around 400,000 ounces this equates to 42.5% production growth.

I believe NewGold's new stream lined operations with 90% of gold reserves in Canada will enhance performance. The Peak Mines was a high cost producer with all-in sustaining costs of $988 per ounce for the first 9 months of 2017 and $1,739 in Q3. This will be replaced by lower all-in sustaining costs at Rainy River projected to be $765 per ounce for the life of mine. Their three main mines in Canada will provide a solid foundation for growth.

New Afton with 11 years mine life

Rainy River with 14 years

Blackwater with 17 years

Mesquite in USA has 5 years left

Cerro San Pedro in Mexico is near end of life

The production growth profile with Rainy River coming on stream is very significant. I believe as production targets are met over the coming quarters, the stock will be re-rated.

Since the stock got hammered the end of January on what should now be the last Rainy River disappointment, there has been a trend of higher lows. Since that $2.50 bottom the performance has been substantially better than the sideways market we have seen in most gold producers. I see some mild resistance around $3.50 and expect we could test recent highs around $4.25 in the first half of 2018.

Since the stock got hammered the end of January on what should now be the last Rainy River disappointment, there has been a trend of higher lows. Since that $2.50 bottom the performance has been substantially better than the sideways market we have seen in most gold producers. I see some mild resistance around $3.50 and expect we could test recent highs around $4.25 in the first half of 2018.

While 2017 seen mostly sideways trading for the gold producers, the junior explorers have seen a very exciting year with many juniors increasing in price several 100% and even over 1,000%

Yukon Discovery of 2017 - Zonte Metals (OTC:EREPF)

The Yukon is seeing a modern day gold rush with 5 major miners jumping in and several junior exploration companies with large exploration budgets. Kinross Gold (KGC) was the first of the major gold miners to make a move into the Yukon when it gobbled up White Gold. The current Yukon gold rush really gained traction with Goldcorp Inc.'s (GG) C$520 million buyout of Kaminak Gold Corp. in 2016. Since then, Agnico Eagle Mines Ltd.(AEM), Newmont Mining Corp. (NEM) and Barrick Gold Corp. (ABX) have all picked up gold properties in the territory. Late summer in 2017 the Canadian government weighed in with $360 million in road infrastructure to access the Yukon's minerals, called the Yukon Resource Gateway project.

Peter Tallman of Klondike Gold probably said it best - in the Yukon, 20 million ounces of gold has come from gravels but zero from the bed rock. Yukon is the largest unexplained geochemical gold anomaly on the planet. It all adds up to the Yukon is seeing its busiest year since 2011.

Scott Casselman, head of mineral services with the Yukon Geological Survey (YGS), says: "What we've seen this year is a noticeable uptick in the amount of investment in mineral exploration in the territory.

We're probably looking at about double what it was last year. We're looking at almost $100 million in exploration expenditures and I think the number was about $20 million in development expenditures, for a total of $120 million this year. That compares to $57 million in 2016."

The most influential players in recent years to help trigger this rush would be Shawn Ryan who is credited with finding and developing the White Gold district, among others. Ryan has dealt most of his Yukon holdings and in 2016 moved to NFLD for gold prospecting. Next could be Rob McLeod of the famous McLeod mining family. His Underworld Resources was the Yukon project that was sold to Kinross Gold, and again Shawn Ryan was involved here.

There has been many other great prospectors in the Yukon, but I might as well mention John McConnell who has led Victoria Gold (OTCPK:VITFF) since 2011. Their Eagle deposit has been advanced to 4 million ounces measured and indicated, has gone to feasibility and fully permitted. It is likely to be the Yukon's first and largest hard rock gold mine.

Victoria Gold Shares out:517 million market cap US$181 million

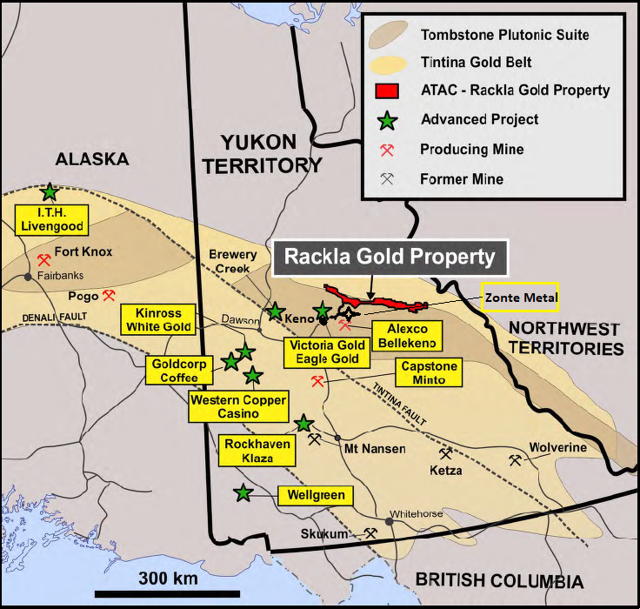

Victoria does not have a major partner, but Kinross Gold owns 11% of the company and their Eagle deposit at Dublin Gulch is advancing to the production phase. The PEA is complete, it is fully permitted and in an area with good infrastructure, roads and power. It is next door to the historic Keno mine that seen many years of silver production (approx. 240 million ounces). The map below is from Atac Resources and the Alexco/Bellekeno claims are the old Keno mine. You can see Victoria Gold just above Keno, a very small town.

Atac Resources (OTCPK:ATADF) shares out 140M, market cap US$65 million

Atac has some advanced properties and a partnership with Barrick Gold of approximately C$63.3 million. This includes a private placement of C$8.3 million (completed), and a two-staged, C$55 million exploration earn-in option to acquire 70% of the Orion Project, which is the middle portion of the Rackla Property in the map above. In 2017 Atac drilled 29 holes in three zones for a total of about 11,214 meters.

They reported some very good results at the end of November on their Orisis project that included 25.91 meters of 5.44 g/t gold. On October 23rd results from 12 drill holes on their Rackla gold property revealed a very good intersect of 51.82 meters containing 5.66 g/t gold. The stock reacted well to results at the end of August, but drifted down from there and ended the year up about +40%.

Goldstrike Resources (OTC:APRAF) Shares out 184M, market cap US$32 million

Goldstrike has done a deal with Newmont that will provide a C$53 million investment to advance their Plateau project, Yukon. Newmont can earn a 51% interest in the first phase and up to a 75% interest. Newmont is planning a 10,000 meter drill program for 2018.

Goldstrike successfully completed 1,032 m of diamond drilling in the nine shallow exploratory holes that constituted the 2017 drill program at their Luck Strike property. News on November 20th announced a discovery drill hole (DDLS-17-09) that intersected a broad zone of near-surface gold mineralization at the Monte Carlo zone grading 5.36 g/t gold over 22 meters, including 18.79 g/t gold over 5.72 meters. The stock was up some the end of August but ended the year flat.

Klondike Gold (OTC:KDKGF) shares out 93.2M, market cap US$26million

The most advanced project is their Eldorado at 13,545 hectares and has road access. In 2017 they drilled a total of 70 diamond drill holes equal to 8,620 meters drilled. Early results were lower grade, such as news on September 28th with 53.25 meters of 0.7 g/t gold. Assay results are pending for all 33 holes drilled in phase 3 (September to October).

Klondike is run by Peter Tallman who highlighted the 20 million ounces mined from alluvial sources in the Yukon that I noted above. However he got a hand slap from IROC and the company issued a press release August 21, retracting many statements. It came across to me as quite a negative press release, but the stock moved up anyway. However that ended up being the top for the year when the stock was up about 200% and has now ended the year up about 80%. Not too shabby!

Triumph Gold (OTCQB:TIGCF) Shares out 60.1M, market cap US$14.5 million

Triumph is advancing their 200 sq. kilometer Freegold Mountain project that has road access and is just above Rockhaven's Klaza project on the above map. Triumph completed 35 drill holes for 12,904 meters in 2017 and have released results for about 20 of these holes so far. Hole RVD17-13 hit 57 meters of 1.72 g/t gold equivalent and news October 19th revealed an intersect of 245 meters of 0.322 g/t gold with 0.112% copper.

Goldcorp acquired a 19.9% stake in the company with a C$6.272 financing on March 2nd 2017 and since then the stock drifted down before rallying to a high around C$0.50 in early September. The stock dropped since then and has not responded to recent drill results. Probably because of general year end weakness in the sector and for the most part drill intersects are lower grade. Freegold does have an indicated resource of 1.3M ounces at 0.544 g/t (lower grade than Victoria Gold)

Rockhaven Resources (OTC:RKHNF) Shares out 153.7M

Rockhaven raised little money in 2017 and did not do any work on their Klaza project in the Yukon, so I won't include them in discovery for 2017.

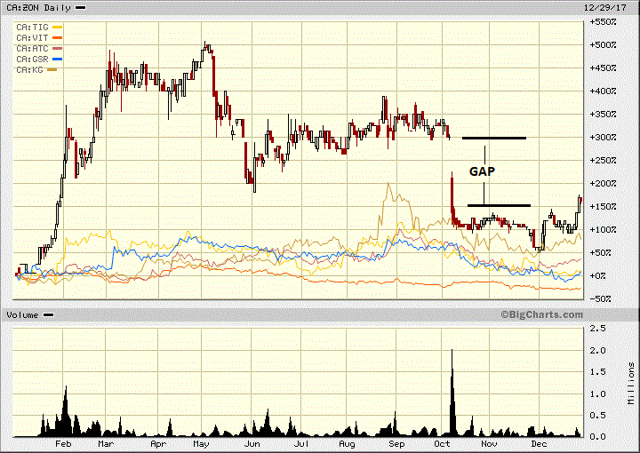

Zonte Metals (OTC:EREPF) shares out: 42 million, market cap US$6.7 million

Zonte made the discovery of the year based on their stock performance and although the company has other projects, their McConnells Jest project adjacent to Victoria Gold's Dublin Gulch was the only project they did much work on in 2017. The stock jumped in price and volume when they announced the acquisition of the McConnells Jest project in January and remained strong during the summer with early exploration results.

The stock ended the year up about 170% despite the sell off on drill results in October. That is far above the next contender, Klondike Gold, which was up about 80% on the year and not too shabby either. Zonte only completed a small drill program of 5 drill holes for 1,027 meters, testing three targets called Two Four, Hill and Pink Mountain. Despite very limited exploration that barely scratched the surface, Zonte made a discovery in the Two Four zone with the two holes drilled there.

The best intersects in Hole MJ-04 were 20.45 meters of 0.72 g/t gold and 20.28 meters of 0.69 g/t gold with that intersect bottoming in mineralization at 142.5 meters. MJ-03 was drilled from the same location in the opposite direction and looks to me that it was on the outside of the zone with a low grade intersect of 106.78 meters of 0.18 g/t gold. The McConnells Jest project is a close comparison to the adjacent Dublin Gulch pluton at Victoria's Eagle Gold project and the two intersects in MJ-04 came back with a slightly higher grade than Victoria's 123 million tonne reserve at 0.67 g/t gold.

I believe Zonte is the only Yukon explorer worth buying now in what is considered the off season because:

First the market misunderstood or had too high expectation on October's drill results and such a steep sell off was not warranted.

Second, the market value at a very low $6.7 million is less than half the value of the next cheapest Yukon explorer.

Third, their Wings project in NFLD is drill ready and Shawn Ryan's (Yukon fame) Torq Resources (OTCQX:TRBMF) has staked right up to the Wings boundary. Torq is still early phase exploration yet is valued 5 times higher than Zonte.

Fourth, on November 15th Zonte acquired the Cross Hills copper project with copper being the strongest performing metal in 2017.

Fifth, Zonte has disputed claims over the middle of AngloGold's (AU)/B2Gold's (BTG) 5 million ounce Gramalote deposit in Columbia. June 26th it was announced the court suspended AngloGold's (the operator) claims on the disputed ground. A similar case was Galway that had fractional claims over Ventana's 3.5 million ounce La Bodega project, Columbia and Galway settled for about C$300 million in 2012.

Lastly, the stock has broken out on the chart and is likely to fill the gap between C$0.20 and C$0.32

B.C.'s Golden Triangle hottest exploration play in 2017.

I have not watched all the Golden Triangle plays like I have in the Yukon, but I own Jaxon Mining (OTC:JXMNF) that did very well and Garibaldi Resources (OTC:GGIFF) which was probably the top performing exploration play in 2017. This map from Garibaldi shows how crowded and intense this play is. Jaxon Mining was a new entry in 2017 and on this map would be near the bottom area.

If you did not know or had any doubts how hot this area was in 2017, this chart on Garibaldi, comparing with Jaxon will probably change your mind. Garibaldi was up around 3,500% during the peak in the play while Jaxon was only up 500%. I also included Eskay Mining and Colorado Resources near Garibaldi and Tudor to the south. Those three were pretty boring this year.

What was quite amazing is that Garibaldi shot up on speculation and drill hole descriptions. The stock hit its highest level in October before the first four drill hole results were reported on Novermber 20th. I was quite convinced the stock would sell off on news so I suggested taking profits a couple times and had sold about 3/4 of my position by end of October. Who needs drill results if you can make profits like this before hand, but just the same I plan to hold my remaining position long term and see what unfolds.

I believe the stock became so speculative because drill results from Silver Standard in the 1960s revealed high grade nickel with copper, such as 37.8 meters of 1.3% nickel including 2.74 meters of 5.9% nickel with 1.7% copper. Then Garibaldi released their exploration results and VTEM surveys on July 18th that showed strong anomalies below and to the east of the historic Silver Standard drilling. The market was speculating that the old Silver Standard drilling just scratched the outside of the better targets.

Garibaldi announced a C$6 million financing in September at 82 cents per unit and Eric Sprott took down $2,502,970 in the first tranche and this added more credibility to the story. Eric Sprott bought $5 million in the next financing at C$3.15 per unit increasing his holding to 11.7% of the company.

Garibaldi did an excellent job promoting and hyping drill hole descriptions before any drill results and received its share of criticism, especially on the poor job done on the press release of the first four drill holes on November 20th. There was not enough detailed information to make much of the drill results and the company down played them, preferring to hype visual results of hole number 14 instead.

The first good results came on December 6th with drill hole EL-17-09 (hole 9) hitting 9.9 meters of 7.3% nickle with 3.3% copper. Then on December 8th they released results of the previously hyped drill hole EL-17-14 and it hit an impressive 16.75 meters of 8.3% nickel with 4.2% copper. Although these are some very high grade intersects, at this point there is no good evidence or other drill data that shows this has any size to be mineable. You can see the zones outlined in red are small with just two drill intersects. It appears there is not much potential to expand at depth or in two of four directions so these might end up to be small pods. There is potential at targets A, B and C, but unless they are bigger or can be connected, we just don't know until much more drilling is completed. What might be most promising is a deeper target labeled the 'Q Anomaly' that might be the source of these zones closer to surface. I suspect Garibaldi might test this later in 2018.

The above chart does not show price and I would only considering buying Garibaldi stock on weakness around C$2.00.

Jaxon Mining has a very appealing project with their 28,000 hectare, 100% owned Hazelton property about 50 kilometers north of Smithers B.C. Jaxon also expanded their 100% Wishbone property in the Golden Triangle to almost 20,000 hectares. On September 3rd they announced the acquisition of the old Cronin mine and it is believed to be the southern extension of their Hazelton project. Cronin has an old 1972 historic resource with grades of 428 g/t silver, 7.11% lead and 8.12% zinc. Jaxon built a very nice property portfolio in the Golden Triangle in late 2016 and throughout 2017.

The focus this year was an in depth first phase exploration program at Hazelton property that revealed some exceptionally high grades on surface. Channel samples up to five meters wide over a 700 meter extent showed many assays running 140 to 780 g/t Silver with one at 1,006 g/t. They also included zinc running 5% to 22%. Some of the historic work like trench 742 south, yielded historical values of up to 2,171 g/t silver, 3.89 g/t gold, 18.6% zinc and 39.5% lead in grab samples. The 550 trench, yielded historical values of 937 g/t Ag, 2.78 g/t Au, 4.31% Zn and 3.83% Pb

On September 19th Jaxon announced some extreme high grades with a float sample grading 8,952 g/t silver (highest value this season), along with 2.64 g/t gold, 3.57 per cent zinc, 7.89 per cent lead and greater than 5 per cent antimony. An important rhyolite sample graded 1,221 g/t silver, 1.80 g/t gold, 4.34 per cent zinc, 5.05 per cent lead and 4.53 per cent antimony.

High grade on surface is widespread and some exposures look as though they may connect underground. The potential on this property is very unique and attractive, such that it attracted a strategic investment from Dr. Yington Guo of the Zijin Midas Exploration Fund. This is a subsidiary of Hong Kong listed Zijin Mining Group which ranks as the largest gold producer in the world by revenue. Zijin Midas also participated in a 2nd financing at 32 cents per unit. On June 26th John King Burns joined as chairman and lead director. Mr. Burns is former chairman and founder of Northern Orion, which was subsequently acquired by Yamana Gold in a $1-billion transaction.

Jaxon completed ground induced polarization (IP) surveys that indicate several shallow chargeability anomalies underlying Jaxon's Max target at the Hazelton property. With all the ground work completed this season they finished up December 7th 2017 with 12 drill holes for 2,281 meters on the Max target. First results were expected late December but with labs busy it is obvious now that it will be January.

There has been no speculation built into the stock price considering drill results are around the corner. The chart below is the C$ price and it shows the stock near support around 22 cents. This Max target has very good potential of producing some good drill results that could pop the stock a lot higher. Since the price is near support, buying here could be a very good speculation.

Disclosure: I am/we are long NGD, GLD, EREPF, GGIFF, JXMNF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Jaxon Minerals is a paid advertiser at playstocks.net

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.